Trades

Playful Summer Stocks

|

Last week we included a sweet graphic. May, June, and July tend to have the lowest monthly VIX average prices. Everything tends to shut down during the summer, but recreational stocks are up; NCLH, CLL, UAL, & AAL are all up over 25% YTD, SPY is up 12.6%.

The full dataset can be found here.

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Data Science at tastytrade; James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade; and John Kicklighter, Chief Strategist at DailyFx with an expertise in fundamental analysis and market themes.

Cherry Picks

-

12 of the Most Boring Stocks

|Traders are not a monolithic group. Some have a high risk tolerance, while others are more risk averse. Those with higher risk tolerance would probably prefer to trade TSLA, while… -

Yields and Historical Volatilities

|Yields Below, check out the 2-, 5-,10-, 20-, and the 30-year Treasury yield to maturity. To see how the yields have changed, look at the different color lines. The 30-year… -

Sizing Futures and Holiday Movement

|Futures sizes? We got the hook up for you! Don’t trade without knowing the true size. That said, futures are extremely capital efficient. Black Swan Black Fridays Most traders anticipated… -

Straddle Up

|When you’re expecting a big price move but aren’t certain of the direction Implied volatility is one of the most useful metrics to consider when looking at a stock’s movement.… -

Index Breakdowns and Implied Volatilities

|The S&P 500’s Expected Move From now until the end of the year the S&P 500 is projected to move somewhere around ±6%. This is the theoretical expected price range… -

Tom Sosnoff’s Current Outlook, Trade Ideas and Crypto Moves

|Tom Sosnoff’s Portfolio and Potential Trade Ideas We asked Tom his current outlook on various markets right now, here’s what he had to say: Short: Nasdaq-100, Chip stocks, Bonds Neutral:… -

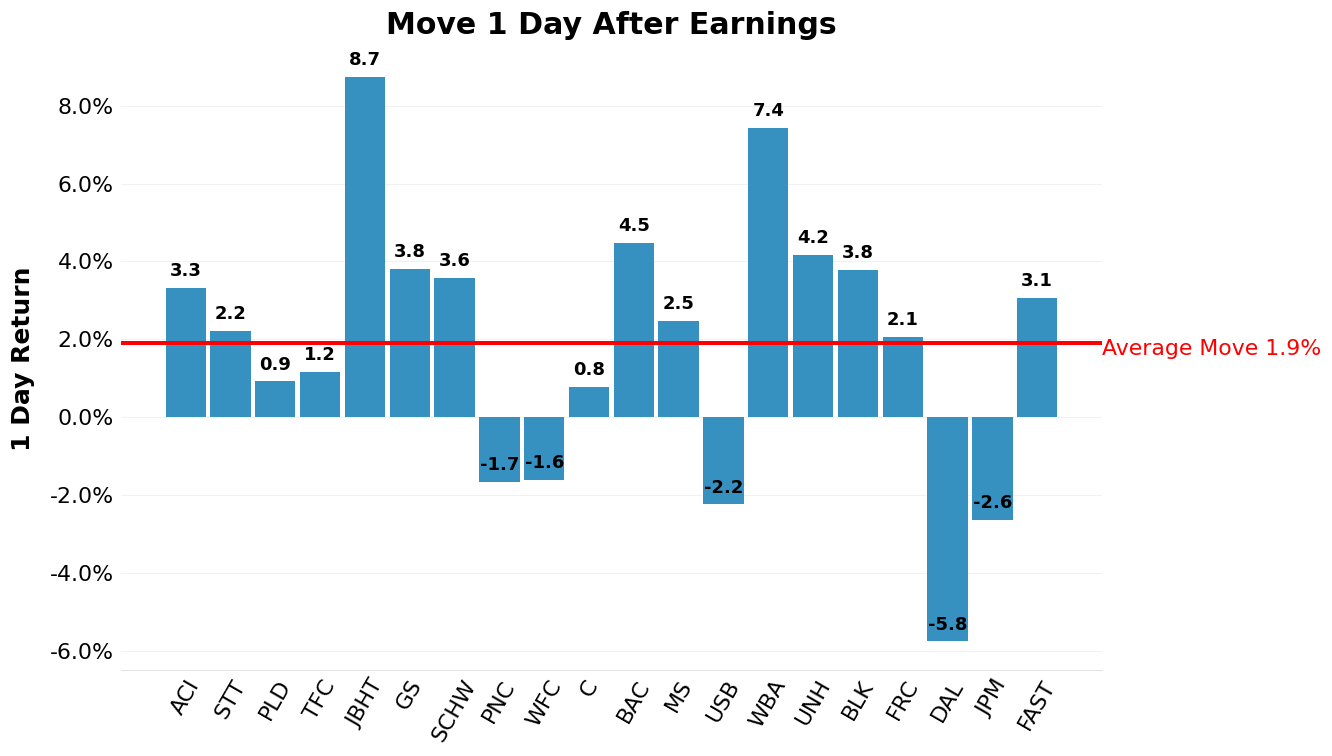

Recent Earnings Moves and a Cheaper Gold Alternative

|Earning season so far Fifty-one percent of symbols were positive after the release of recent earnings. Below are the stocks with the biggest shocks this season. Looking for a lower… -

Asymmetric Leverage, Plus the Current IV & IVR Landscape

|Asymmetric Leverage If you lose 50% in a trade, you’ll need a 100% return on the next trade, just to breakeven. Here is the math: Required Gain to Breakeven =… -

Where the Action Is

|Understanding volatility helps traders manage risk. Here’s how sectors and indexes compare for their tendency to move in price. Volatility is synonymous with the probability of movement. Consistently volatile sectors,… -

Problems with BITO, the ProShares Bitcoin ETF

|BITO is not a suitable long-term investment The ProShares Bitcoin ETF (BITO) started trading today. According to the prospectus, it does not invest directly in bitcoin. Instead it uses the… -

Kickoff to Q4 Earnings Season

|Earnings: Daily Breakdown Earning Season “officially” begins with the big banks. Expect to see the bulk of earnings at the end of this month and beginning of next. One way… -

Recent Volatile ETFs and 2021’s Current Winning and Losing Stocks

|Most and Least Volatile Equity ETFs Below we sorted the sector and index ETFs from high to low for each week. Oil ETFs (not surprisingly) are consistently, week after week,… -

Metals, Yields, and Trades Ideas

|Metals Metals are moving. Perhaps this can be explained by metals becoming less attractive as Treasury Yields are increasing. Metals, after all, are non-interest bearing. This can be seen below… -

Sector ETF Slumps, Volatility Curve and Debt Instruments

|Monday Sector ETF Slumps With last Monday’s large sell off, the hardest hit sectors in the S&P 500 were Energy, Financials and Consumer Discretionary. Volatility Curve Below is a current… -

No Crypto? Consider These Proxies

|Cryptos have a weak relationship with the major equity indexes. Anything between -0.15 and 0.15 is considered to have no relationship. Digital currency’s correlation with the S&P 500 is 0.13,… -

Lookback: Introducing Options Backtesting by tastytrade

|Lookback is now live and open to everyone—you just need a tastytrade account. Perform Option Analysis, Backtest using historical data, expected trade simulation and projection using the Black-Scholes algo, plus… -

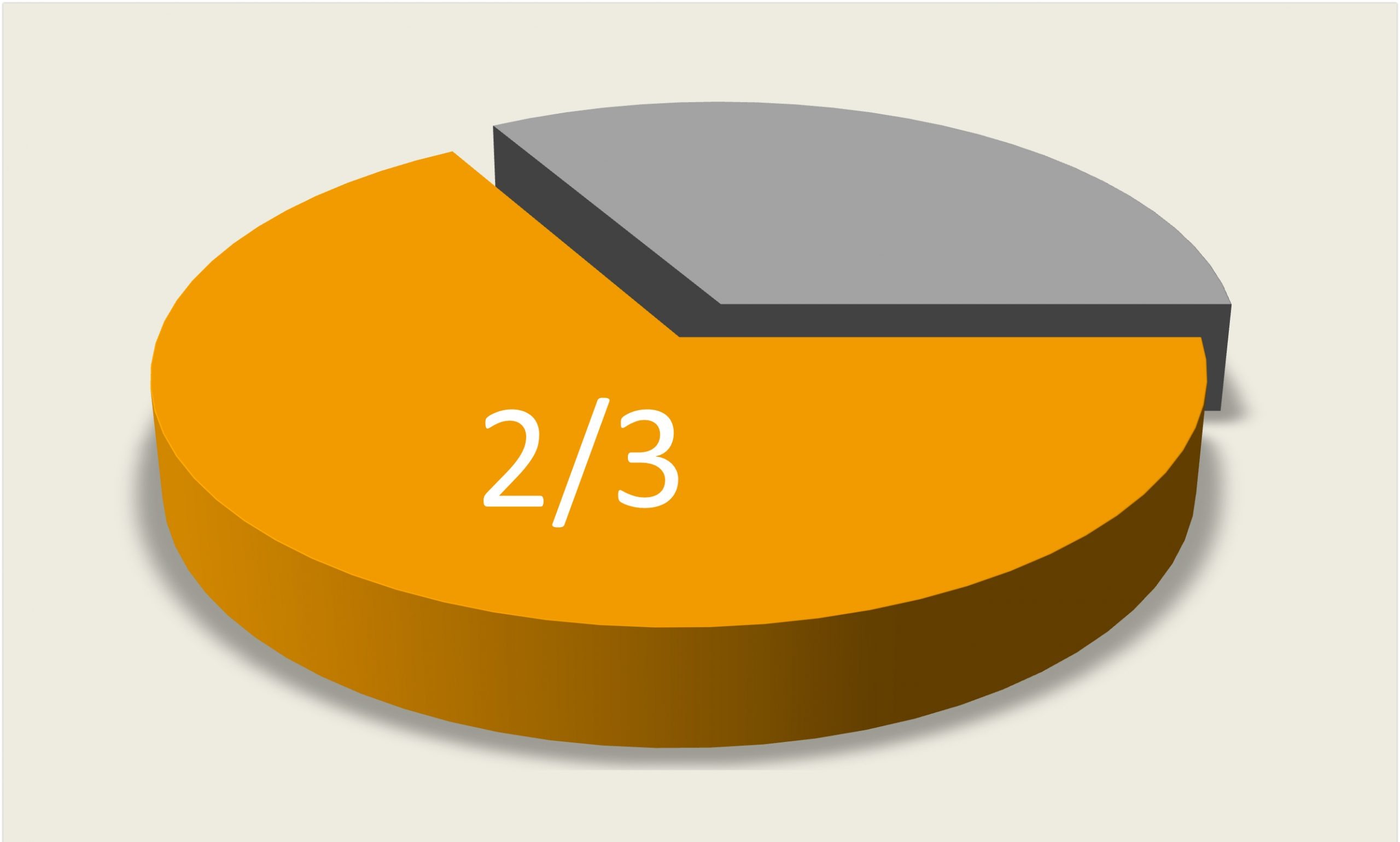

Two-Thirds In

|The S&P 500 rallied over 20% for the first 8 months of the year, the largest such rally for the first two thirds of the year since 1997. The historical… -

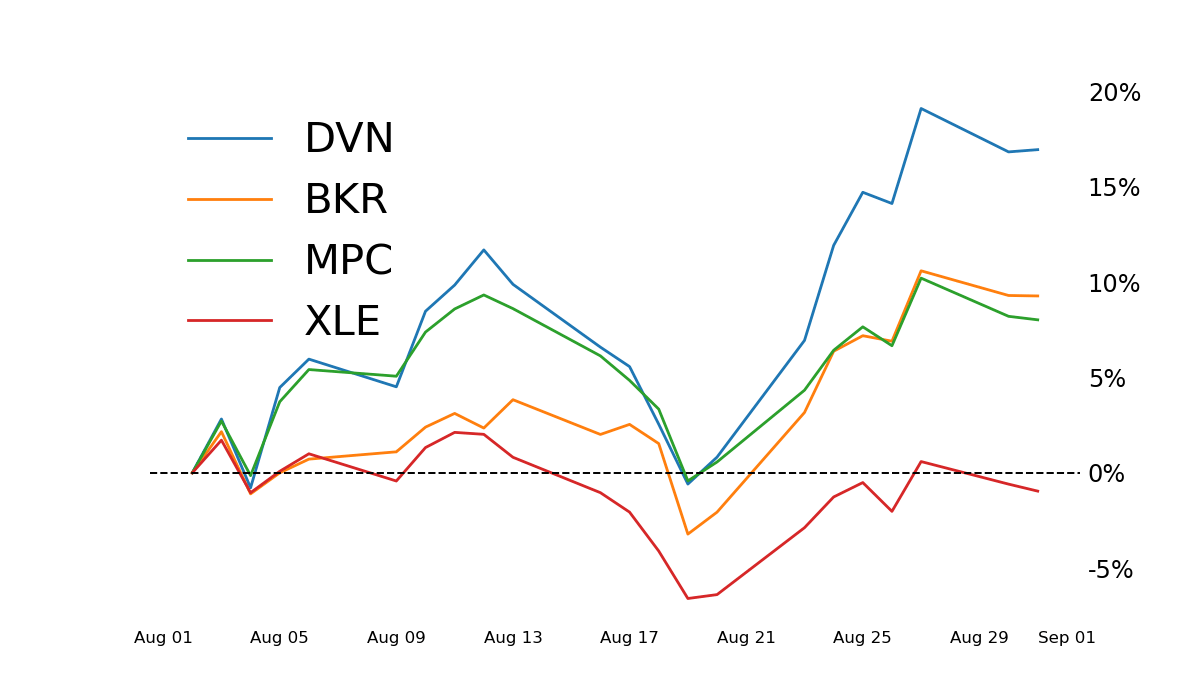

Stocks and ETFs to Trade Gold and Energy

|Gold Bug? Gold is down 8% over the past year; many gold stocks are down even more. For the Gold Miner ETFs, take a look at GDX and GDXJ. For… -

Recent Futures Ranges & Trade Ideas in Chinese Stocks

|Popular Futures Contracts: Intra-day, Median High-to-Low Ranges Per Month Check out Oil— huge moves in the month of August (see the Small Exchange’s /SMO contract for a 100 barrel alternative).… -

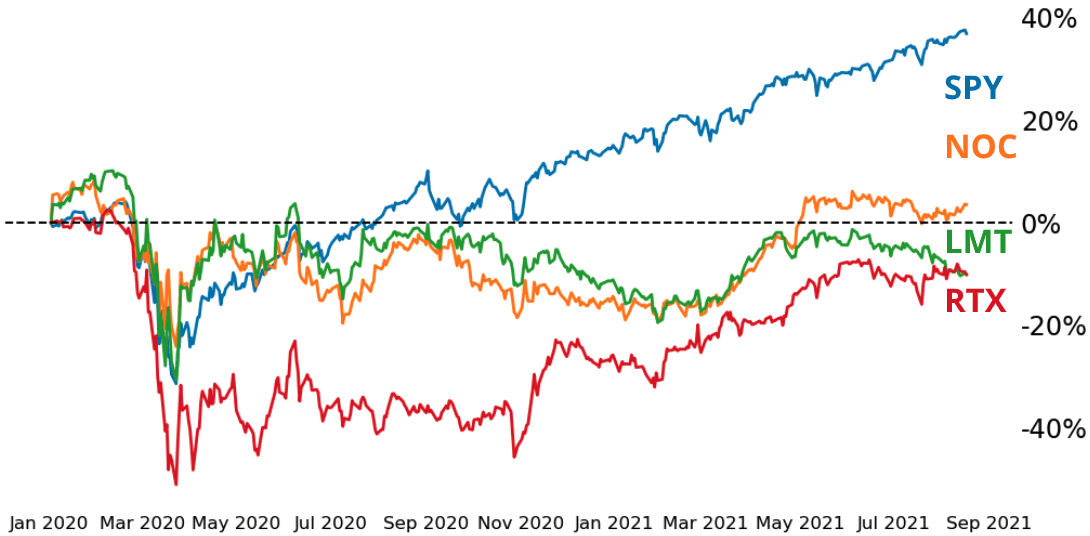

Earnings Impact and a Look at Defense Stocks

|Home Depot (HD) and Walmart (WMT) earnings were this morning. Lowe’s (LOW) and Target (TGT) is tomorrow. Download the full list here. Defense Stocks Three companies that are often synonymous…