Trades

Playful Summer Stocks

|

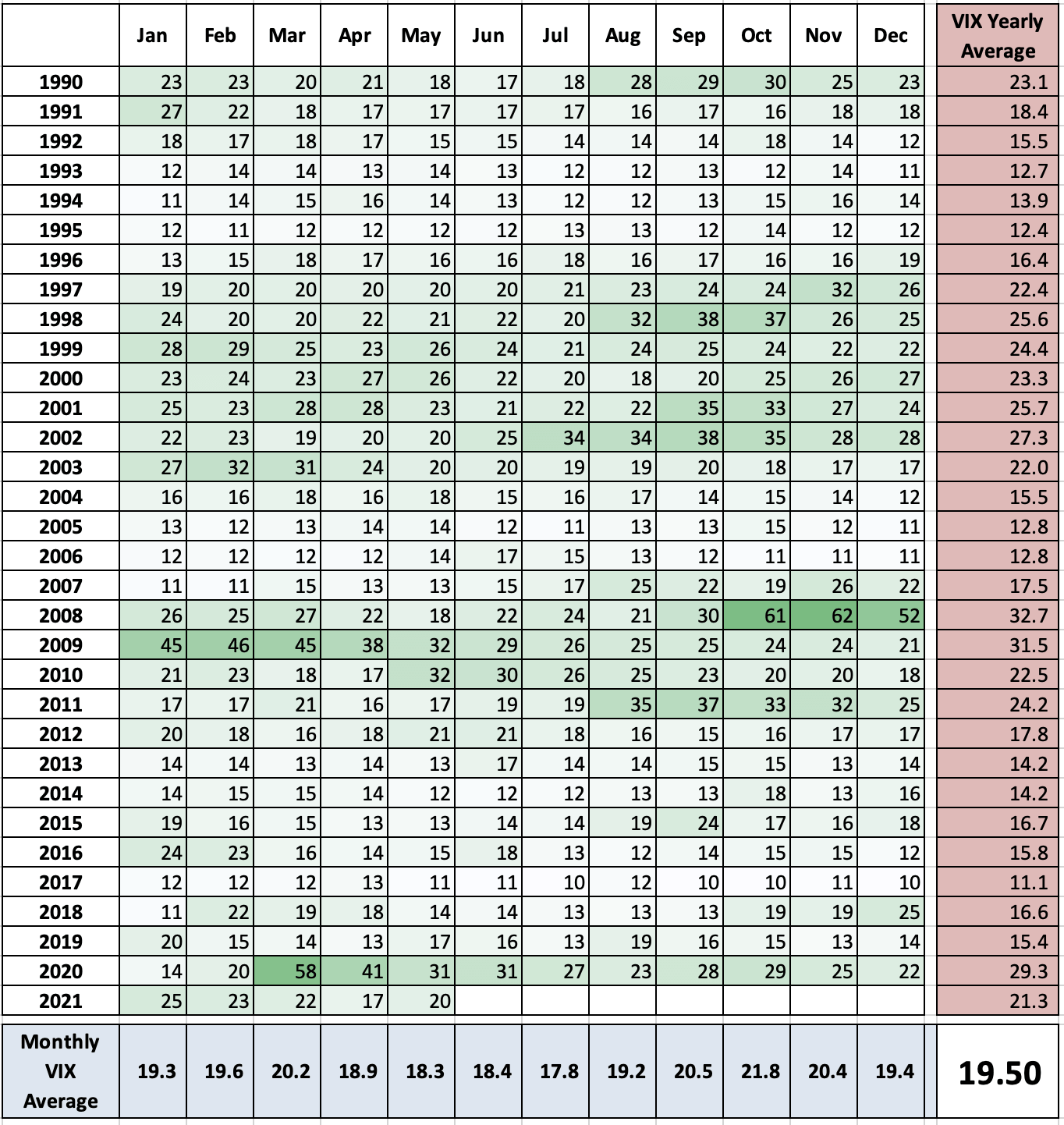

Last week we included a sweet graphic. May, June, and July tend to have the lowest monthly VIX average prices. Everything tends to shut down during the summer, but recreational stocks are up; NCLH, CLL, UAL, & AAL are all up over 25% YTD, SPY is up 12.6%.

The full dataset can be found here.

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Data Science at tastytrade; James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade; and John Kicklighter, Chief Strategist at DailyFx with an expertise in fundamental analysis and market themes.

Cherry Picks

-

Futures-to-ETF Cheat Sheet

|Here’s a handy guide to convert your favorite futures to ETFs! The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique… -

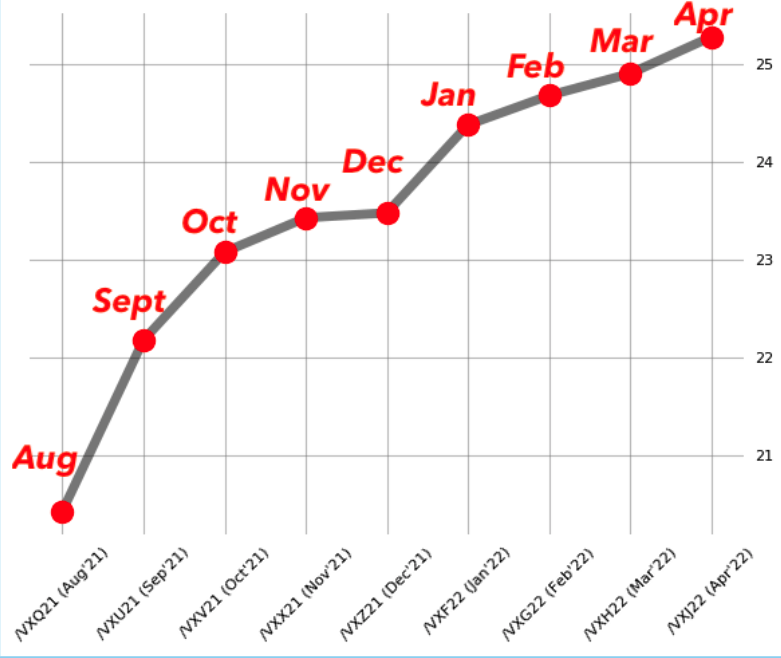

Volatility is Waning, Again

|The data below reflects Aug. 3 prices. Check out the VIX prices per month. At the bottom, we show the 5-, 10- and 30-year VIX averages. We are including this… -

Naked Puts for the Risk Averse

|In the Tactics section of this issue, an article entitled Three Ways to Play Long Odds offers three strategies for placing speculative trades. Here, readers will find an “anti-speculative” strategy… -

Diversification & Correlations

|Diversification is spreading money across multiple assets as opposed to just 1 or 2 (i.e. “don’t put all your eggs in one basket”). So how do you pick those assets?… -

The High Probability of Low Standard Deviation Option Strategies

|We wanted to see where the most theoretical opportunity for short-premium based strategies on the historical percentage of time that the stocks went “outside of the 1, 2 or 3… -

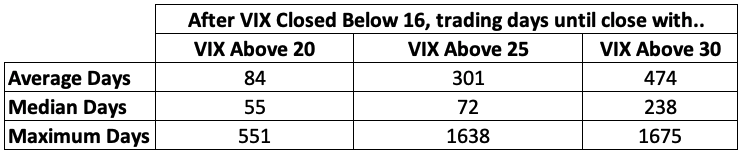

Is fear dead?

|The VIX (aka the “Fear Index”) dropped below 16 for the first time since before the pandemic. Judging from past performance, it may stay low for a while. Historically, when… -

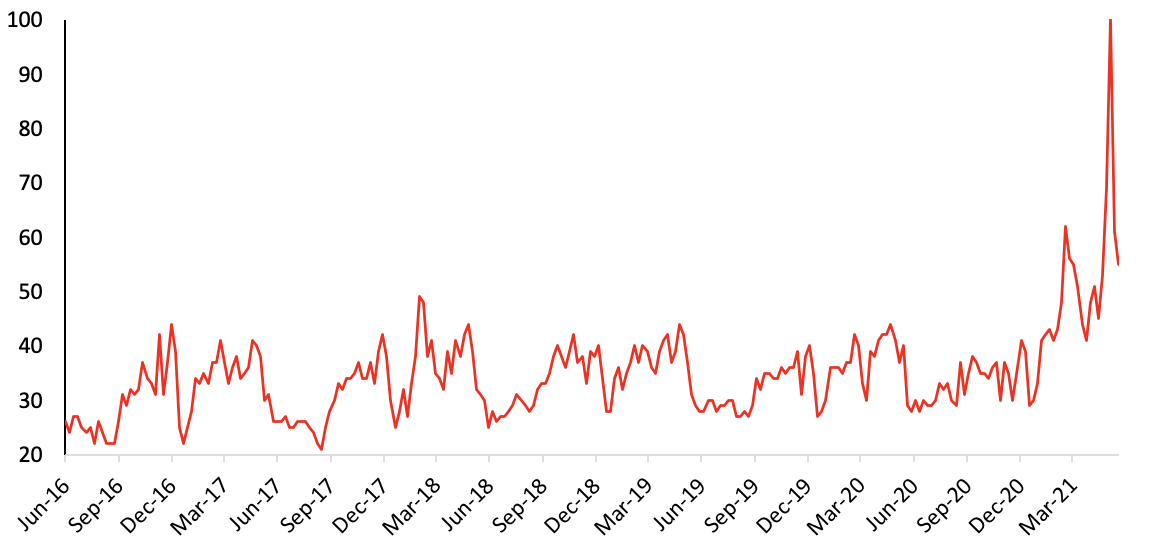

Cherry-picking Inflation

|Inflation is in the news a lot lately. Check out the Google Search spikes. Google Trend searches are measured 0-100 with 100 being the peak of searches for the measured… -

Summer Doldrums? There is a Trade For That

|Volatility tends to be low in the summer! May, June and July tend to have the lowest monthly VIX average prices. Traders and business tend to slow down in the… -

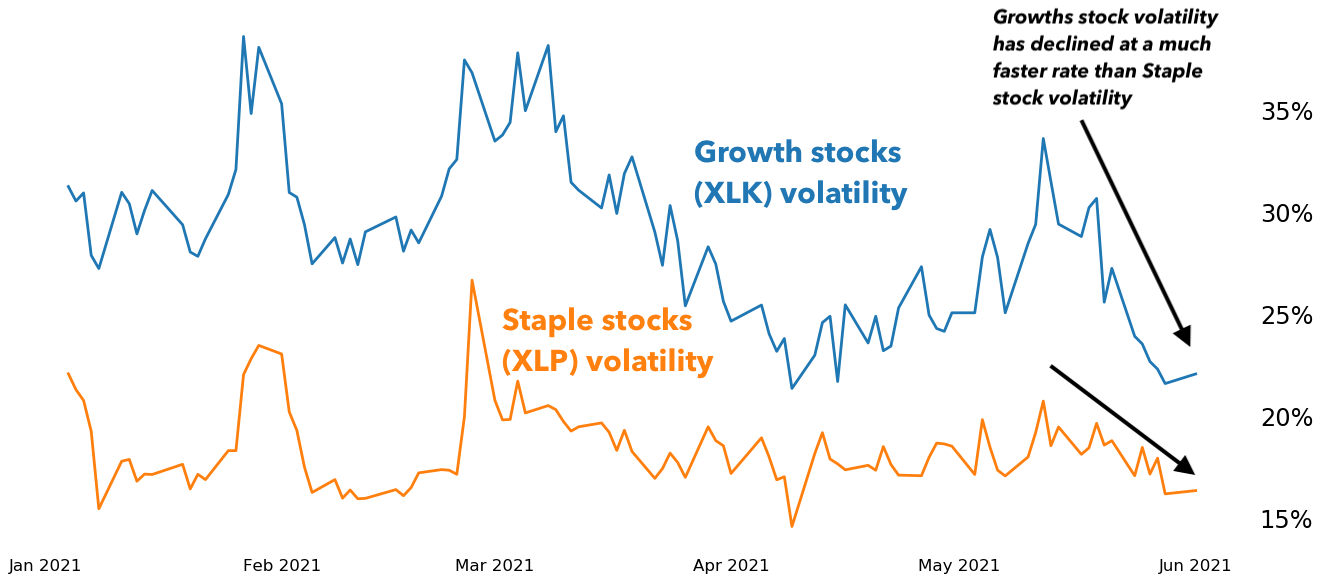

Hey Volatility, What are you implying?

|Implied Volatility readings across various liquid asset classes continue to deflate, generating much the same assumption that seems to be applied to the S&P 500-based VIX: ’“perhaps the summer doldrums… -

Crypto Scalping

|It is easy to purchase any of these coins on the tastyworks platform. Check out the daily “scalping range” of BTC/USD. A single coin has had a daily range of… -

Retail Options

|The list of retailers, right, is sorted from high to low with respect to volatility. Etsy has the highest volatility among the group, while Costco has the lowest. So how… -

For Moonshots, Avoid ETFs

|Sometimes traders strain to achieve a “moonshot.” They dream of picking a single stock that quickly moves from $1,000 to $100,000. But they shouldn’t expect that to happen with a… -

Options With Futures

|Why trade E-mini S&P 500 futures when Micro E-mini S&P 500 futures is also liquid and more appropriate for smaller accounts? Trading the /ES on the Chicago Mercantile Exchange (CME… -

Volatility “Sweet Spot”

|Securities are ranked on this page according to their forward-looking volatility from last year. Traders seeking safer investments—at least those expected to move less—might lean toward the exchange-traded funds (ETFs)… -

More Bang for Your Buck

|As a trading vehicle, nothing beats futures in terms of cost efficiency, liquidity and, for some, tax treatment. Take a look below. First, note the “Futures USD Notional,” which… -

All Your Options

|Have a directional assumption about a stock? With options, traders have a much larger range of possibilities than with stocks. Instead of being just “bullish” or “bearish,” options provide ways… -

Futures: Ticked Off

|Differing tick sizes and varying dollars per tick can make futures trading confusing. This handy crib sheet can help. Keep an eye on the “Median Day-to-Day Movement” column, and don’t… -

Digging Gold

|When the markets are in turmoil, money tends to flow out of stocks and into “safer” investments. The market’s definition of “safe” changes, but when stocks declined in March, money…