False Prophets

The financial industry is ripe with personalities claiming to be experts on the financial markets. These individuals, or groups, spout their buy and sell opinions on securities, sectors, or geographic areas as if they’re coming from the mouth of God himself.

Conveniently, an accounting of such advice rarely occurs. And oftentimes, when such picks are highlighted, it’s only the “correct” ones that are put under the spotlight, as opposed to those that produced a negative P/L.

In order to analyze the utility of so-called expert picks, the research team at tastytrade recently conducted a review of one particular group’s chosen picks for calendar year 2019. In this examination, the expert picks were published by Fortune magazine and involved bullish individual stock positions.

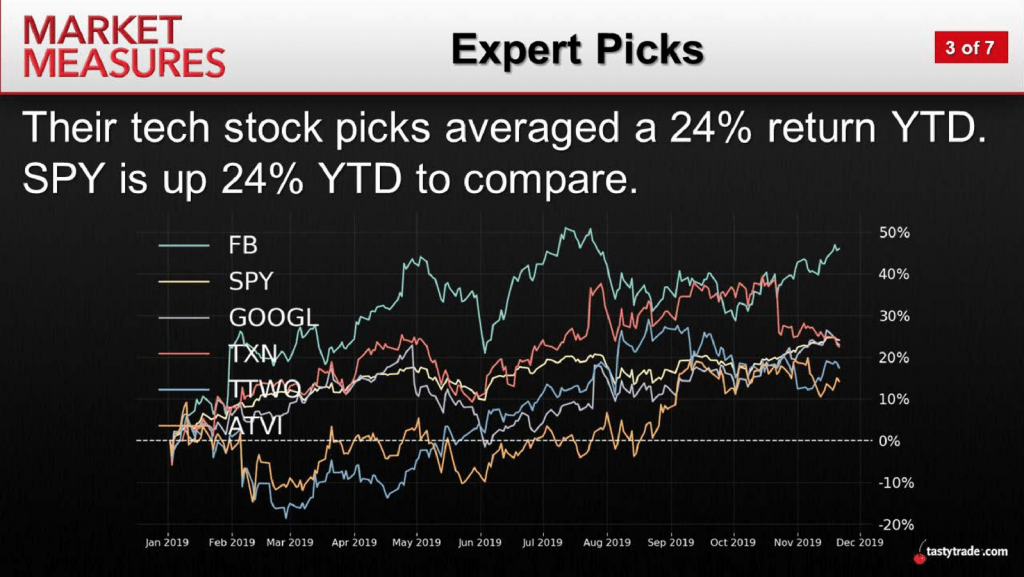

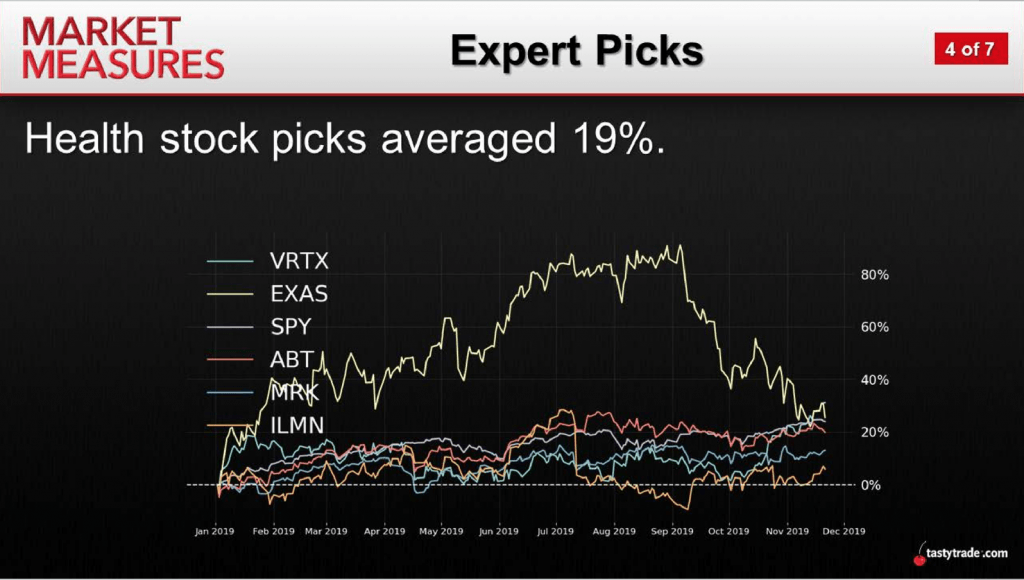

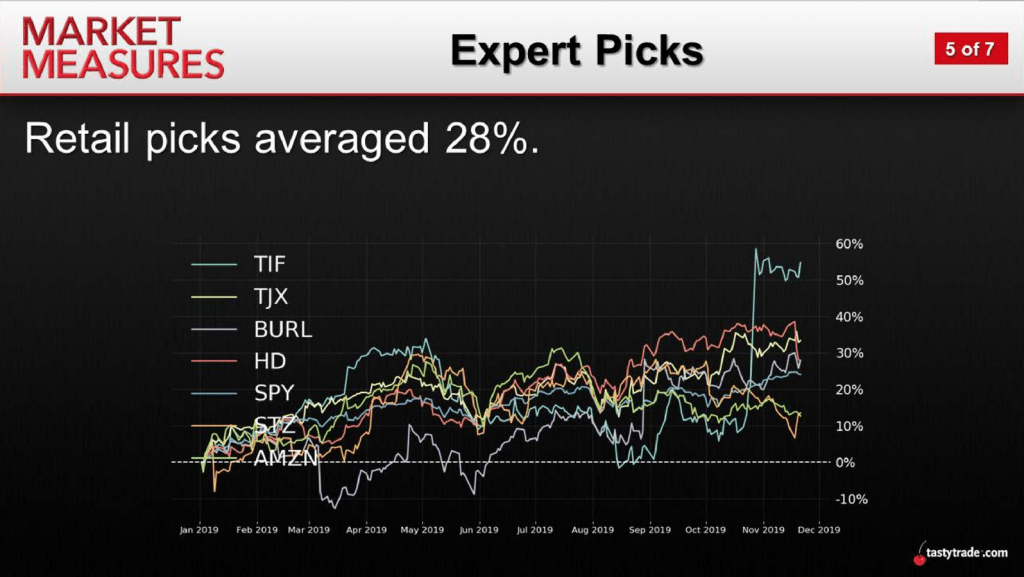

As one can see in the graphics below, the expert stock picks performed almost exactly on par with the average return in the SPY:

Adding together all of the stocks included in the recommendations by Fortune, the combined return through the end of November was interestingly identical to the year-to-date return of the SPY in 2019: 24%.

And while a 24% return is certainly nothing to sneeze at, most experts seek to outperform a market benchmark like the SPY. After all, there’s not a strong value proposition in burning the resources necessary to identify top picks when the net impact of all that effort mirrors identically the plain-vanilla strategy of simply going long SPY.

This is especially true when one considers that the relatively simple approach of selling short strangles in SPY has consistently outperformed a long position in SPY, according to previous research conducted by tastytrade.

While the experts responsible for the Fortune list may not have achieved their goal of outperforming SPY, they did arguably do better than well-known CNBC TV personality Jim Cramer.

In a 2015 study published by researchers at the Wharton School of the University of Pennsylvania, authors Jonathan Hartley and Matthew Olson tracked the performance of Cramer’s Action Alerts portfolio since its inception in 2001. This exhaustive examination revealed that the Cramer-directed portfolio cumulatively returned about 64.5% over roughly 15 years.

In comparison, Hartley and Olson found that during the same period, the S&P 500 produced a cumulative return of 70% (when adjusted for the reinvestment of dividends).

As with the tastytrade study, the Wharton conclusions revealed that all the sweat equity put into the Action Alerts portfolio was largely academic, given that a simple long position in SPY would have produced a larger return with an arguably lower degree of risk.

The above suggests that when an expert offers his or her opinion in the future, savvy investors and traders may be well served to take it with a grain of salt—especially given that a directional stock bet has at best a 50-50 probability of being correct.To learn more about probability of profit (POP), and how short options approaches have historically exhibited high POP, traders can review associated tastytrade research on this subject when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.