How to Trade a Bullish Outlook on Volatility

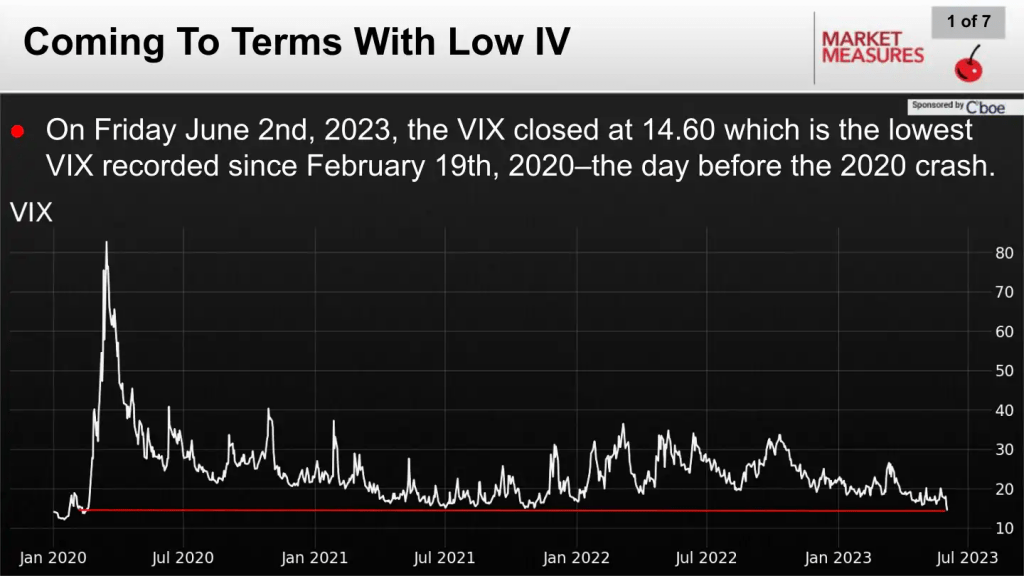

On June 2, the CBOE Volatility Index (VIX) dropped to its lowest level since February 2020, which may represent an opportunity for active market participants that are bullish on volatility.

On June 2, the CBOE Volatility Index (VIX) crossed below 15 for the first time since Feb. 19, 2020.

This event suggests that volatility in the financial markets has finally “normalized” in the wake of the COVID-19 pandemic.

However, the move may only be temporary, considering that the U.S. economy is still facing an elevated interest rates environment, an ongoing banking crisis, and a surge in corporate bankruptcies.

As of this moment, however, the suspension of the United States debt ceiling appears to have pushed the VIX below that key level of support at 15. The fact that volatility tends to dip in the stock market during summer may also be weighing on the infamous fear gauge.

Since peaking in March of 2020 at roughly 82, the VIX trended lower through 2020 and 2021. But volatility picked back up in 2022 amidst the bear market, which saw the Nasdaq Composite plummet by more than 30%.

Since the start of 2021, the VIX has ranged between roughly 15 and 36. Notably, the VIX hasn’t traded above 40 since Oct. 28 of 2020. And it only stayed there for one day.

Depending on one’s outlook and strategic approach, the recent multiyear low in the VIX may therefore represent an opportunity. And for investors and traders that are bullish on volatility, there are several different strategic approaches that can be utilized to express that outlook.

Expressing a Bullish Volatility Outlook Using Options Spreads

In the options world, long (owned) options typically benefit when volatility increases.

However, long options are also subject to theta decay—which means they steadily lose value as expiration approaches. That’s one reason that investors and traders bullish on volatility often choose to deploy a bullish volatility outlook using spreads, which offer some degree of protection from theta decay.

An options spread focusing on a bullish volatility bet can in turn be deployed in a couple of different ways. One can execute a spread in the same expiration cycle—such as a vertical spread. Or, one can execute a spread across expiration cycles, which is known as a calendar spread.

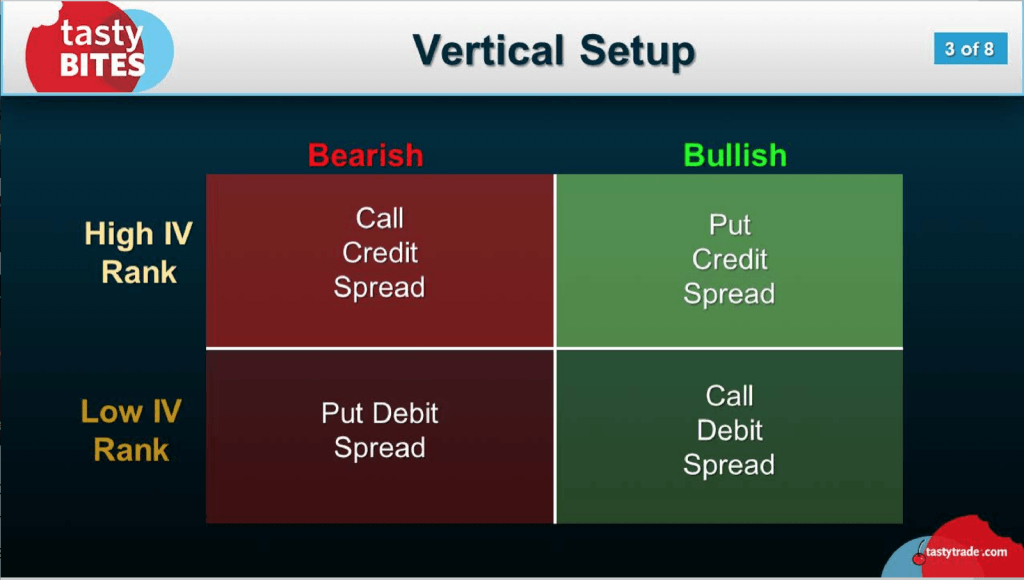

One convenient element of a vertical spread is that it can be used not only to deploy an outlook on volatility, but also direction.

For example, a long vertical call spread is executed by purchasing an at-the-money (ATM) call and selling an out-of-the-money (OTM) call in the same expiration period. This spread leans directionally bullish because it performs best when the stock moves toward the short strike of the OTM call.

Moreover, the long vertical call spread also theoretically benefits from an increase in implied volatility because the long ATM option is more sensitive to changes in volatility than the short OTM option.

Alternatively, one could execute a long vertical put spread, which is extremely similar to the long vertical call spread, except that it involves puts—and is therefore directionally bearish in nature.

To execute a long vertical put spread, one simply purchases an ATM put and sells an OTM put against it—both in the same expiration cycle. Like the long vertical call spread, this spread benefits from increased volatility because the long ATM put is more sensitive to changes in volatility than the short OTM put.

Of course, from a directional perspective, the long vertical put spread will perform optimally if the underlying stock drops toward the strike of the short OTM put.

As shown below, debit verticals are often utilized when implied volatility is depressed (aka low IV rank) because they respond well when volatility increases.

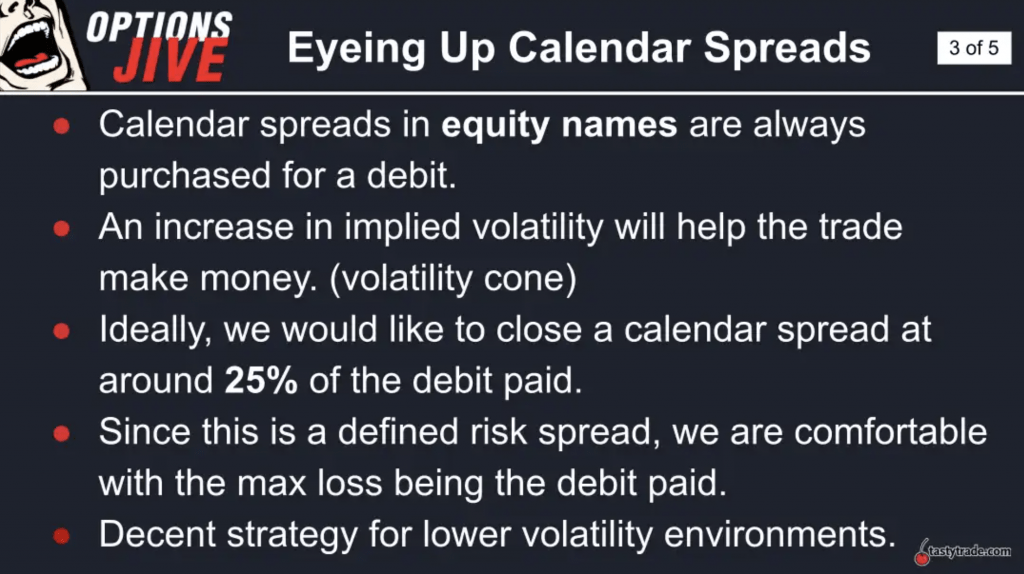

In addition to the aforementioned vertical spreads, investors and traders bullish on volatility can also utilize calendar spreads.

Calendar spreads involve taking a short option position in a near-term expiration period against a long option position in a further-out expiration period. For example, selling a put in the July expiration month and purchasing a put with the same strike in the September expiration month.

This is referred to as a long (or debit) calendar spread, because the out-month option will be more expensive than the shorter-term option, thus requiring the investor/trader to pay the difference in premium to establish the spread. This is referred to as a “debit” in the options world.

This position theoretically benefits from rising volatility because the longer-dated option is more sensitive to changes in volatility than the short-term option. Moreover, the short option will expire well ahead of the long option, which means the investor/trader will hold a long-only option after the expiration of the short near-month option.

That naked long position also theoretically benefits from an increase in volatility, should one occur.

For more context on the current volatility environment, readers can check out this new installment of Engineering the Trade on the tastylive financial network. For more details on the recent drop in VIX, this episode of Market Measures is also recommended.

To learn more about using options spreads in low-volatility environments, readers can check out this installment of Best Practices. As always, to follow everything moving the markets in 2023, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.