Pairs Trading

Buying one index and selling another carries less risk than just buying or selling one index position outright

Turn on CNBC, Bloomberg, tastytrade or any other financial media outlet and a host or commentator will soon mention “the market.” Depending on the outlet, those well-coiffed personalities could be referring to any of the four major equity indices. In the U.S. they would be the S&P 500, Dow Jones Industrial Average, Russell 2000 or Nasdaq 100. Each of those indices represents a different portion of the equities market, but they all tend to move together. As of this writing, any pair of these indices has a six-month price correlation greater than 0.80, meaning they move in similar directions.

These indices move closely because many of them hold the same stocks! Roughly 80% of the stocks in the Nasdaq are also in the S&P 500. Additionally, 100% of the stocks in the Dow are held in the S&P 500. The overlap results in the indices moving in similar ways, hence the strong price correlations.

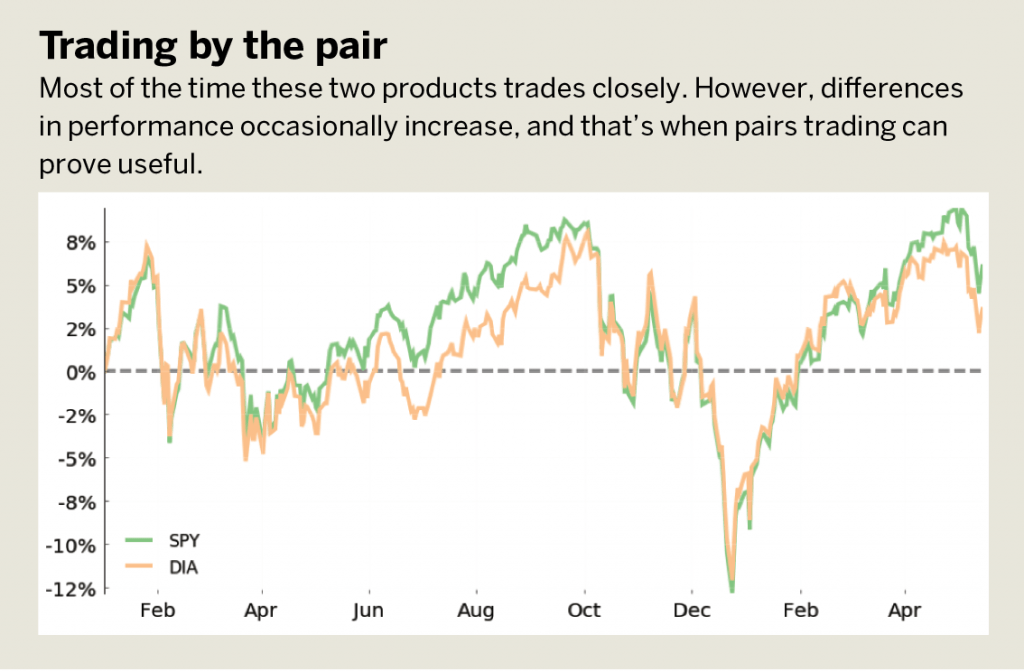

Take a look at “Trading by the pair” (below), which depicts the percentage change of ETFs (exchange-traded funds) representing the S&P 500 and the Dow since 2018. Note that most of the time the two products trade very closely. However, differences in performance between them occasionally increase. Pairs trading is a professional strategy that capitalizes on extreme divergences between highly correlated products.

Unlike trading the price or volatility of a single underlying, a pairs trade exploits the relationship between two underlyings by selling the leading stock and buying the lagging stock. Pairs trading carries less risk than just buying or selling one underlying outright because losses in one position are often offset by gains in the other position in the correlated pair.

Structuring a pairs trade

The first step in structuring a pairs trade is finding two highly correlated assets. Some examples include gold and silver, the British pound and the euro, and the S&P 500 and the Dow. SPY and DIA are great candidates for a pairs trade because their six-month price correlation is 0.93, a strong positive correlation. A strong correlation means two assets move similarly and thus reversions (to the mean) in performance are likely.

The next step is to determine an entry point. The best entry points generally occur when the assets have an extreme divergence in performance. Over the last two years, SPY and DIA had an average performance difference of 0.8%. Today, their performance difference has widened to 2.47% as SPY has outperformed DIA. This presents an opportunity to sell SPY and buy DIA.

After finding a potential trade, it’s critical to calculate how many shares of each product to buy or sell. This is computed by comparing the notional amounts for each asset. For an ETF, the notional amount is simply its price. Currently, SPY is priced at $285 and DIA is priced at $256 thus the notional adjusted ratio is 1 to 1. Assume, for example, a pairs trade with ABC and XYZ. If ABC was $50 and XYZ was $100, traders would need two shares of ABC for every one share of XYZ.

After determining the notional ratio it’s time to trade. Execution is easy. Because SPY outperforms DIA, sell SPY and buy DIA in a ratio of 1 to 1. This trade profits from mean reversion between these two highly correlated ETFs.

With a basic understanding of options, this trade can expand to include a theta (time decay) component. Because one share is equivalent to one delta, traders could sell 50 shares of SPY and sell one at-the-money put in DIA or sell 30 shares of SPY and sell one 30 delta put in DIA, or any other delta combination, so the ratio is 1 to 1.

Pairs trades are placed as a single order to avoid “leg risk,” which happens when investors have one half of a pairs trade on, and that stock or ETF is going against the investor without the other half of the pair to offset the loss. The same is true when exiting a pairs trade, and they also should be closed as a single order. That removes the outright directional exposure of just buying DIA or selling SPY and adds portfolio diversification.

Pairs trading can present challenges and isn’t a beginner’s strategy. But it adds flexibility and trading choices to a portfolio, and it’s worth learning about.

Michael Gough, a self-taught coder who became an options trader, serves as co-host of tastytrade’s Research Specials Live.