Paper Trading Just Got Better

A new free tool enables investors to see the future of their trades

tastytrade is offering investors a new free tool called Lookback that provides a risk-free environment to test options trading strategies.

New traders can use it as “paper trading” by queuing up a trading idea and seeing how it would have performed over time. Instead of learning by making mistakes—which can be costly—they learn from historical data on options and stocks that’s built right into the system.

More experienced traders can use the system to understand the risk associated with a strategy. They would learn, for example, exactly how Greeks react close to expiration of a butterfly, or the historical profitability of a short strangle using 30 delta short puts and calls versus a short strangle with 10 delta short puts and calls. They would find out what happens with 60-day expirations versus 20-day expirations.

A Lookback feature for both new and advanced traders helps them see a strategy’s profit zones all the way up to expiration. They hold and click the left mouse button to view the theoretical probability of a strategy being above or below a specific price level.

Traders can use the feature to obtain probabilities around “worst-case scenarios.” All were created using thousands of randomized simulations.

The tool also gives traders the ability to see the cumulative probability of reaching a specific profit at any time leading up to the expiration of the options.

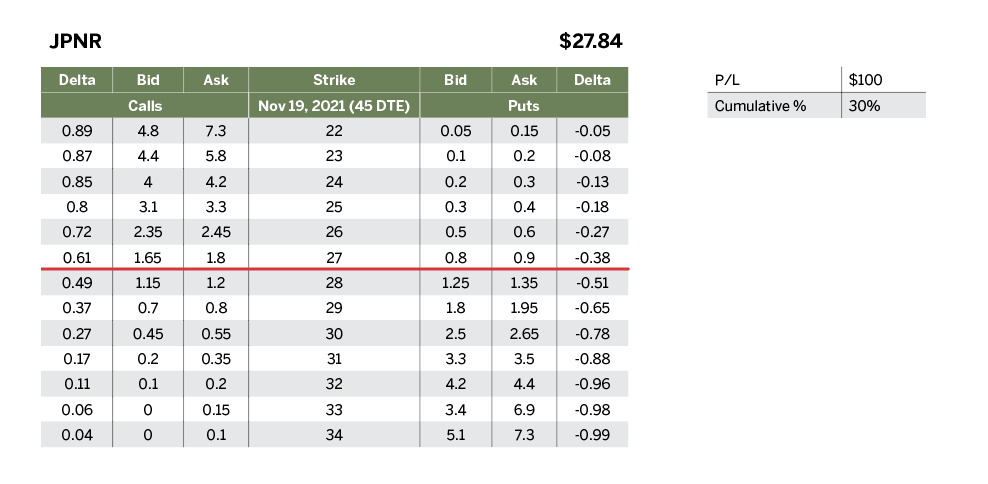

For example, purchasing a 29 long call expiring 45 days away in November may seem like a good idea to someone with an extremely bullish outlook on Juniper Networks (JNPR) at the last sale of 27.84. (See JNPR table, below.)

But Lookback (lookback.tastytrade.com) shows that’s likely to result in a loss of $75, which is the cost of the call. The probability of making $100+ by the end of the year is only 10%. It helps to add clarity around a trading approach.

With a slight adjustment, traders can buy a 28/30 call spread for the same amount and have a probability nearly three times as great of making $100. That’s still a low-probability trade but an interesting observation.

Michael Rechenthin, Ph.D., aka “Dr. Data” is the head of research & development at tastytrade.

@mrechenthin

More Lookback Do your own backtesting here