Single Stocks vs. ETFs

The term “single stock” doesn’t refer to a security that spends its free time swiping right and left on Tinder.

No, “single stock” as a concept evolved only after financial products that incorporated exposure to more than one stock were conceived—products like stock indexes, exchange-traded funds (ETFs), and mutual funds.

That means a single stock circa 1895 was simply known as a “stock,” because the first-ever stock index was the Dow Jones Industrial Average, which originated in 1896 and was conceived by Charles Dow and Edward Jones.

Because both single stocks (i.e. AAPL, GOOG, MSFT) and more diversified products, like stock indexes and ETFs, both have long and varied histories, there’s arguably a place for both types in the portfolio, depending on one’s unique trading approach and risk profile. This is especially true for options traders, because a similar position taken in each (single stock vs. ETF) can represent such a different risk-reward profile.

That’s not to say that a calendar spread executed using single stock options is fundamentally different than a calendar spread executed using ETF options. Instead, the differing risk dynamic relates to the behavior of the underlyings in terms of historical, implied and realized volatility, as well as the composition of the underlyings.

Traders seeking to learn more about the respective value propositions presented by trading single stocks versus ETFs will undoubtedly find a new episode of tasty BITES on the tastytrade financial network compelling.

The purpose of the show is to illustrate more clearly why the risks associated with options positions in each type of product are so different, and to highlight several key considerations that traders can keep in mind when weighing opportunities in either one.

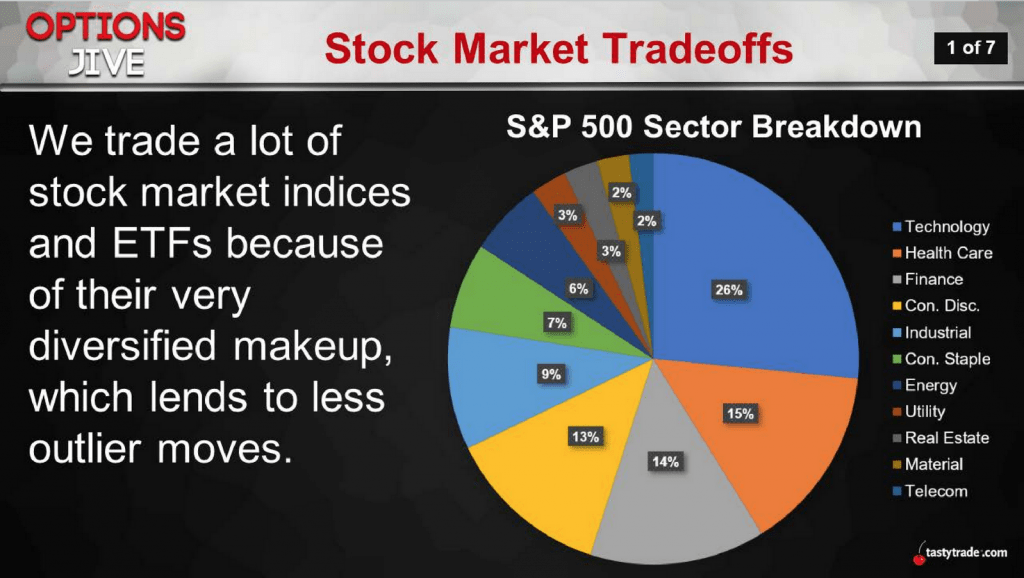

As one can see in the graphic below, ETFs such as SPY are diversified because they are exposed not only to multiple sectors of the market, but also to multiple companies from each sector. That means that if one company in the index runs into stock-specific trouble, the index as a whole usually doesn’t suffer to a great extent:

One popular way to combat the non-systematic (aka stock specific) risk inherent in single stocks is to target only underlying companies with larger market capitalizations. Theoretically, large companies are better insulated to withstand problems that may arise within a single business line of a well-diversified organization.

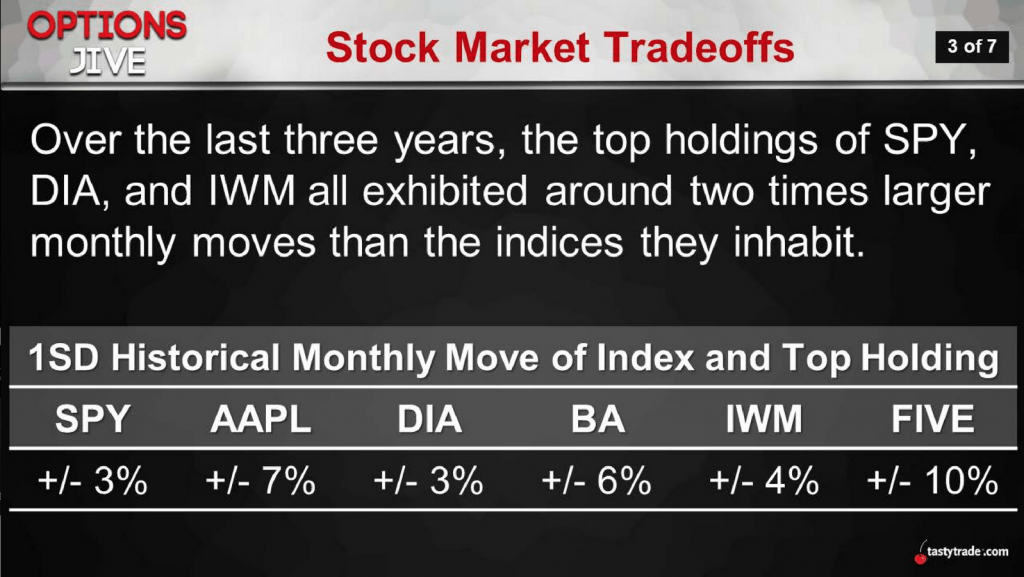

However, as indicated by research conducted by tastytrade, even large cap single stocks exhibit significantly larger monthly moves (i.e. more volatility) than the indexes they inhabit. As one can see in the slide below, the largest single stocks in SPY, DIA and IWM have all experienced about two times larger moves as compared to the indexes themselves over the last three years (on average):

While the chart above provides important perspective, one must not forget that risk versus reward is also priced “efficiently” in the market. That means that because single stocks move on average more than indexes/ETFs, the market price for volatility in single stocks is likewise “richer”—meaning implied volatility levels are higher to compensate for the additional movement/risk.

In sum, the above tells us that at any given time, there may be an attractive opportunity available in a single stock, an index, or an ETF—one can’t predict where a market mispricing may materialize. The wrinkle is that while each and every potential trading opportunity requires analysis and vetting, traders need to be especially vigilant when considering single stocks.

As discussed on tasty BITES, traders may want to incorporate some (or all) of the following tactics when weighing opportunities in single stocks:

- Ensure adequate liquidity

- Trade fewer contracts

- Be less aggressive when selecting strike(s)

- Consider defining risk (through spreads and wings)

To learn more about this topic, traders may want to review the new installment of tasty BITES in its entirety when scheduling allows. Likewise, a previous installment of Options Jive serves as a great complement to this information, while also providing additional insight.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.