Stop Profits

Yes. It’s a thing. Traders can limit the potential for large losses while maintaining, and even improving, profitability.

What’s more important: trade entry or trade exit? As experienced traders know, both are integral to a trader’s profits!

Stop Losses, the Basic Tactics article in this issue, tests the viability of incorporating stop losses into short option trades to limit large losses. This management strategy successfully reduces large losses; but it also reduces the profitability and win rate of short puts. Can traders do anything to limit the potential for large losses while maintaining or improving profitability?

How about a stop profit management strategy—the opposite of a stop loss? Instead of closing trades based on a loss amount, it closes trades at a pre-defined profit level.

Options traders can use this strategy seamlessly because max profits are defined at trade entry. A put option sold for $500 can never make more than $500, thus a profit-taking strategy can be set as a percentage of the potential max profit. For example, a 50% stop profit on a put sold for $500 would execute when the profit is $250.

Using the back-testing framework from “Stop Losses,” let’s compare the performance of holding the short puts to expiration, incorporating a 1x stop loss and managing at 50% of the potential max profit. The back-testing framework is as follows:

- Data Date: 2005 through 2019

- Underlying Asset: SPY

- Approximate Option Delta: 50 (At-the-Money)

- Approximate Days to Expiration: 30

- Managed Short Puts at 50% Potential Max Profit

- Number of Occurrences: 3,400

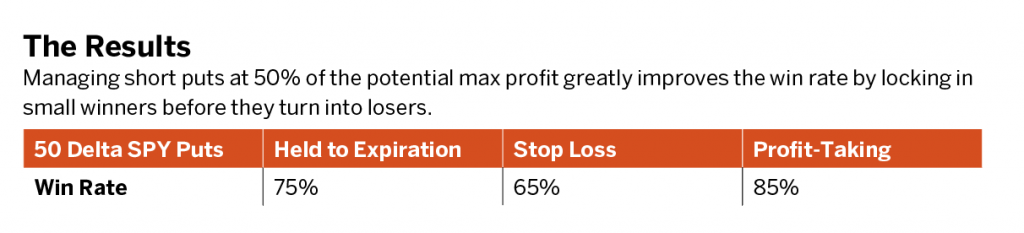

As seen in “The Results,” below, managing short puts at 50% of the potential max profit greatly improves the win rate by locking in small winners before they turn into losers. But trading isn’t all about win rates. Win rates can be misleading if large losses wipe out the gains of small winners. It’s important to also consider profitability. One way to measure profitability is annualized return on capital (ROC). Annualized ROC explains how much return a trader can expect to make for a given amount of capital deployed and normalizes based on differences in trade duration.

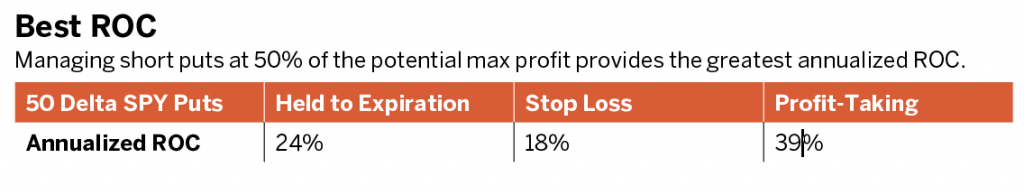

As seen in “Best ROC,” below, managing short puts at 50% of the potential max profit provides the greatest annualized ROC. Wait a minute, some may suggest. How can the strategy that “leaves money on the table” provide the greatest ROC? Managing at 50% of the potential max profit yields the greatest ROC because of the high number of winning trades and the reduced trade duration, which prevents profitable trades from turning unprofitable before expiration.

Because stop losses prevent large losers and profit taking increases annualized ROC, is it viable to incorporate both management strategies?

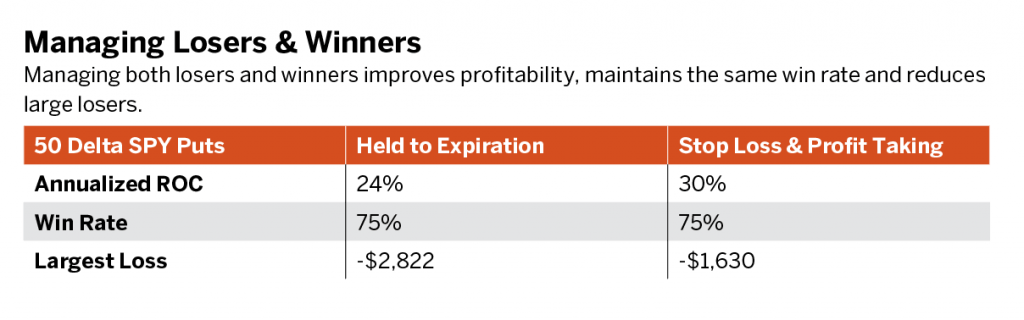

The table “Managing Losers & Winners,” below, combines stop losses and the profit-taking results in the best performance and compares them to holding short puts to expiration. Managing both losers and winners improves profitability, maintains the same win rate and reduces large losers. Although seemingly counterintuitive, taking money off the table improves profits and reduces risk.

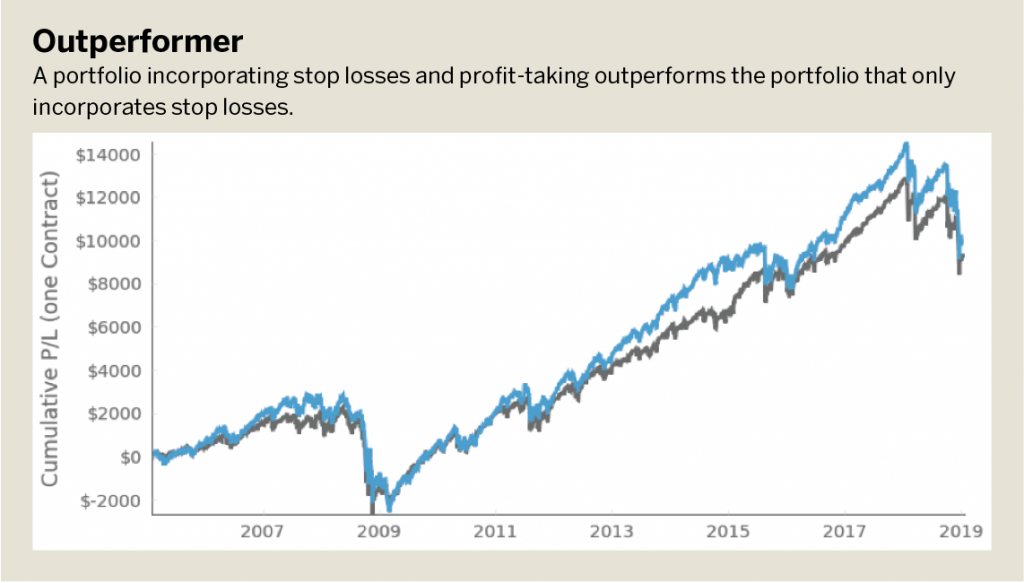

Profitable trading demands attention to both entry and exit. The cumulative results of a portfolio employing these strategies can be seen in “Outperformer,” below, which shows that the portfolio incorporating stop losses and profit taking outperforms the portfolio that only incorporates stop losses. Although contradictory to the conventional financial advice of letting profits run, an active profit-taking strategy in conjunction with stop losses greatly improve a portfolio’s risk and return profile.

Kai Zeng, an active derivatives trader for more than 10 years, works as a data scientist and derivatives strategist at tasytrade.

Michael Gough, a self-taught coder who became an options trader, serves as co-host of tastytrade’s Research Specials Live.