The Magic Number You Need to Know When Pairs Trading

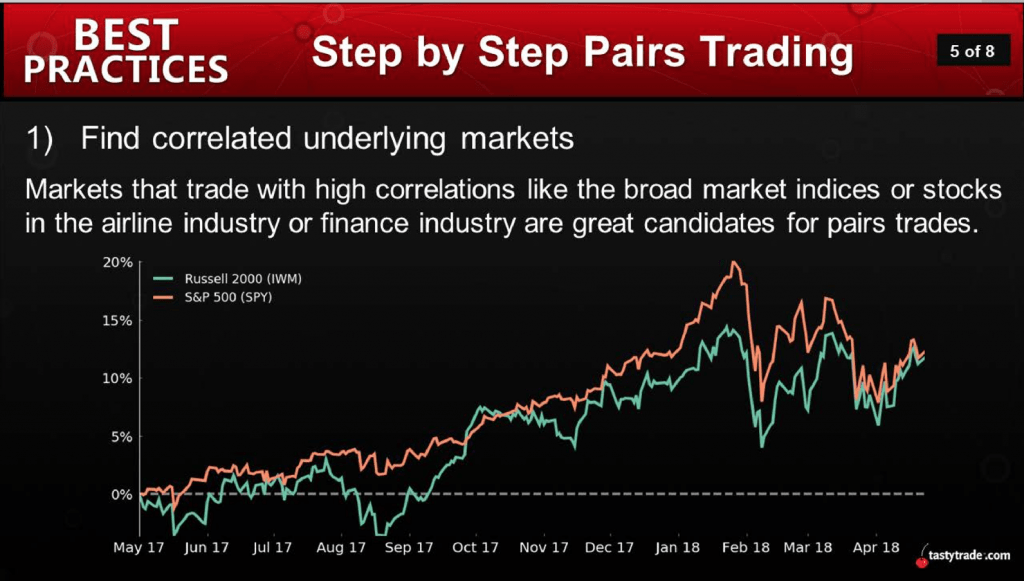

As most traders are well aware, the pairs approach is founded on strong historical correlations that exist between the two underlyings being considered for a position, as shown below:

Pairs trades typically become attractive when the relationship between two closely correlated underlyings moves away from historical norms, generally referred to as a divergence.

In terms of position construction, a pairs trade is built by simultaneously trading two instruments with the expectation that the differential between their respective prices will widen or narrow. Therefore, two legs are deployed: a short leg and a long leg.

Trading a spread using a pair such as this is typically said to be “market neutral” because with a high degree of correlation and a similar amount of risk deployed on both sides of the trade, the position is theoretically more sensitive to movements in each respective underlying, as opposed to the broader market. That means systematic risk is perceived to be a reduced factor.

For example, gold and silver share a well-known positive correlation that hovers historically right around 0.89. If a trader were to identify a divergence in the gold-silver price relationship, then they would get long one versus getting short the other.

If the broader financial markets made a big move in either direction after that position was established, the pairs trade would theoretically be more insulated from systematic risk, because the historical correlation would indicate gold and silver should move in the same direction—meaning each leg of the trade would offset the other.

On the other hand, the intent of a spread trade is to profit when the relationship between the two underlyings reverts back to historical norms. For example, a pairs trader might see an opportunity if gold were to suddenly spike without a correlative move in silver.

Given that gold and silver typically move together about 90% of the time, a pairs trader might decide to deploy a trade that would profit as the trading relationship between the two reverts to historical norms.

The gold-silver pair is so famous that it even has its own ratio named after it: the Gold/Silver Ratio—something that readers may want to learn more about when scheduling allows.

Based on the above, there are three typical reasons that traders choose to consider a pairs trade:

Points two and three are generally self-explanatory, but point one may need a little additional context, which was why it was covered recently on an episode of Market Measures on the tastytrade financial network.

In this episode, the hosts expand on the topic of correlation as it relates to pairs trading, and specifically why a strong correlation (above 0.80) is preferred when weighing such positions.

The key point made on the show, illustrated through tastytrade research, is that two underlyings with historical correlations lower than 0.80 may take longer to revert to “normal,” as compared to underlyings with a stronger historical association.

This is important because while pairs are said to be market neutral, they aren’t risk-less.

If a trader were to deploy a pairs trade that profits from a potential convergence, they are also exposed to the risk that they further diverge. In the latter case, the trader will need to be able to withstand capital losses until the price relationship potentially turns in their favor.

By focusing on underlyings with very strong historical correlations (above 0.80), traders give themselves the best possible chance for a relatively “quick” reversion to the normal historical trading relationship, at least as compared to price divergences in underlyings that have demonstrated a weaker long-term correlation.

Due to the complexity of this topic, readers may want to review the complete episode of Market Measures focusing on pairs trading correlations when scheduling allows.

Additional information on this topic can also be found by reviewing this previous installment of Best Practices: Step-by-Step Pairs Trading.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.