Three Keys to Successful Directional Trading

The management of directional risk is key when trading the financial markets

Accurately predicting price direction in the financial markets isn’t an easy proposition, especially in short-term situations. In fact, numerous market studies suggest that picking direction correctly in the near term has about a 50-50 likelihood of success.

That’s why many market participants choose to trade volatility using options. Reams of evidence prove that volatility is mean-reverting, which dictates that elevated volatility tends to decline over time, while depressed volatility tends to increase over time.

The above doesn’t mean directional trading should be ignored altogether. Depending on one’s unique strategic approach and risk profile, there can be instances when directional trading makes sense. One can’t overlook the fact that options positions also contain a degree of directional risk.

Directional risk also needs to be managed at the portfolio level, which is another reason investors and traders need to hone their mastery of this discipline.

Readers seeking to learn more about directional trading are therefore encouraged to review a new episode of Best Practices on the tastytrade financial network. The show highlights a variety of ideas and tactics traders can use when evaluating potential directional positions, and when risk-managing their overall portfolios.

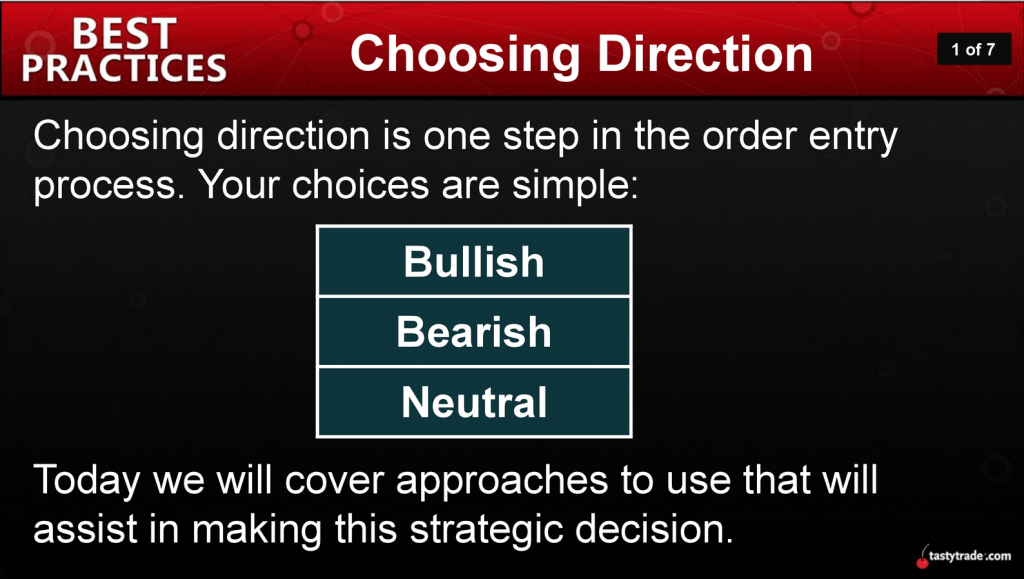

As most are already aware, there are three choices when it comes to directional trading: bullish (long), bearish (short) and neutral (flat). The question, therefore, is how a trader goes about choosing which one is best for a given position, or for the portfolio.

Let’s first examine directional risk at the position level.

On Best Practices, the hosts outline three philosophical levels as it relates to building an assumption (i.e. creating a trading/investing idea) for a directionally focused idea:

- Market Awareness

- Statistical Analysis

- Contrarian or Follower?

Regarding the above, the best advantage investors and traders can give themselves when trading directionally is to build market familiarity and awareness. By following the markets, market participants can understand why things move in a certain way and how different markets are connected.

The second point above, statistical analysis, speaks to the value of understanding and following metrics in the market beyond simple price action. Depending on one’s strategic approach, that might involve an understanding of technical analysis, fundamental analysis or volatility. Ideally, it would be all of those and more.

Mastering these disciplines allows traders to track and understand a larger pool of available market data, which helps make more informed trading/investing decisions.

Another important question relates to whether a directional position is contrarian in nature or whether it is momentum-related. For example, a contrarian position might involve buying into weakness or selling into strength, whereas a market-following position usually involves buying into strength and selling into weakness.

tastytrade has previously conducted market studies on “price extremes” and possible approaches to trading such situations. Readers seeking to review this data in detail should watch Market Measures: Directional Trading and Price Extremes.

But beyond deploying and managing individual positions, investors and traders also need to serve as risk managers of their portfolios. A big element to this role is identifying the overall directional exposure of a given portfolio and adjusting as necessary to fit one’s outlook and risk tolerance.

When managing directional exposure at the directional level, it’s important to consider the high-level components of the portfolio, and then try to formulate a directional bias (long, short, neutral) based on one’s outlook on the market and risk profile.

For example, an options trader holding a heavy inventory of short volatility might adopt a short directional bias as a hedge against a systemic market correction.

On the other hand, an investor holding a portfolio of long stocks might feel comfortable with that directional position during times of relative complacency in the markets. However, if uncertainty and associated risks are perceived to be rising, that same investor might decide to add a short stock index hedge against their portfolio to defend against a possible correction.

One useful technique for measuring the directional risk of a given portfolio is beta-weighting. Readers can review that concept in more detail by watching Market Measures: Beta-Weighting and Portfolio Hedging.

All of the topics highlighted in this post have been covered extensively by the tastytrade network and can be reviewed further by using the following links:

- Best Practices: Choosing Direction

- Market Measures: Directional Trading and Price Extremes

- Market Measures: Beta-Weighting and Portfolio Hedging

- From Theory to Practice: Directional Trading, Building an Assumption

- Futures Symposium: Trading Direction

Choosing Direction

Choosing direction is one step in the order entry process. Your choices are simple: Bullish, Bearish or Neutral. The process of determining this can be mechanical following some of the steps Tom and Tony present today.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.