Trading Stock Splits

Stock splitting has returned in a big way.

In the last week, tech giants Apple (AAPL) and Tesla (TSLA) both announced their shares would undergo splits. And while those bandwagons were already overloaded, the announcements appear to have pulled in some new believers.

Apple’s shares have jumped about 24% since the stock split was announced, but at least part of that momentum has to be attributed to an encouraging earnings report from July 30.

Unlike Apple, Tesla announced its plans for a stock split on Aug. 11, well after Q2 earnings, and has rallied 18% in just a couple trading days.

Stock splits can cause a variety of reactions, depending upon the situation. But for extremely popular stocks, splits are often perceived as positive because they effectively lower the price per share, making them more accessible to a wider pool of market participants.

Stock splits are a form of “corporate action.” And while that term might sound about as sexy as “family minivan,” some of the most dramatic moves on Wall Street can be tied back to them.

Mergers and acquisitions are great examples of corporate actions, and such events can be tectonic in their impact on companies, the industry or even the market as a whole.

Corporate actions include any activity that causes a material change in an organization. That sounds vague because it is. More directly, corporate actions affect shareholders or bondholders—and often in dramatic fashion.

At its most basic level, stock splitting is about creating more shares. And if a company creates more shares, the value per share generally decreases. That’s the principle of supply and demand at work.

For existing shareholders, the stock split may seem inconsequential. Take the example of a two-for-one stock split, where shareholders receive two new shares for every old share they owned. That means post-split, twice as many shares are outstanding. Twice the shares equates to half the price.

Now, imagine a shareholder owns 100 shares in hypothetical stock XYZ, which is currently trading $10/share. The value of the investment equals $1,000 (100 x $10 = $1,000). If XYZ undergoes a two-for-one stock split, that same investor will now possess 200 shares post-split, worth $5 each. The value of the position remains the same post-split: $1,000 (200 x $5 = $1,000).

Most existing shareholders don’t care whether they own 100 shares or 200 shares, as long as the value of their investment remains the same.

As demonstrated by the big moves in Apple and Tesla in the wake of their respective split announcements, the influence on market participants considering an investment/trade in a split stock can be a lot more striking.

For example, the stock prices of Apple and Tesla were over $350 and $1,300 per share before the splits were announced, and now they’re even higher. Those prices seem high in absolute terms, especially for market participants accustomed to trading stocks between $10 and $100 per share.

In the post-split world, Apple stock will have dropped to around $115/share, while Tesla stock will have dropped to about $324/share, both of which are substantially lower amounts in absolute terms.

In Apple’s case, the company is executing a four-for-one stock split, while with Tesla’s it’s five-for-one.

In the previous example, a two-for-one stock split would cut the share price in half. For Apple, currently trading around $460, the post-split stock price would be $115 ($460/4 = $115). With Tesla, currently trading at $1,620, the post-split stock price would be $324 ($1,620/5 = $324).

Those are just examples because the split will hinge upon the stock price at the close of trading Aug. 30 because both stocks are set to split Aug. 31. Apple will divide its Aug 30 figure by four, and Tesla will divide its by five.

In a world dominated by dollars and cents, those reduced share prices make the stocks attractive to a wider range of investors and traders. That may explain why both have rallied lately—traders anticipate increases in demand after the split. In other words, “Get ‘em while they’re hot!”

Another example helps reinforce that line of thinking.

Berkshire Hathaway’s Class A (BRKA) is currently trading north of $300,000/share. That means 10 shares are worth a cool $3 million. That’s a lot of gravy, and it’s well beyond the means of many traders and investors, meaning the pool of market participants that can trade BRKA is limited.

Given how Apple and Tesla have performed in the wake of their “corporate actions,” it’s hard to imagine other companies won’t follow suit. Some potential candidates include: Adobe (ADBE), Alphabet (GOOGL), Amazon (AMZN), Chipotle (CMG), Costco (COST), Facebook (FB), Home Depot (HD), Microsoft (MSFT), Netflix (NFLX) and Nvidia (NVDA).

Note, however, that a stock split announcement does not guarantee a bullish movement. Not every stock can be Apple or Tesla, just like not every basketball player can be Michael Jordan. And it’s not always easy separating the stars from the chaff.

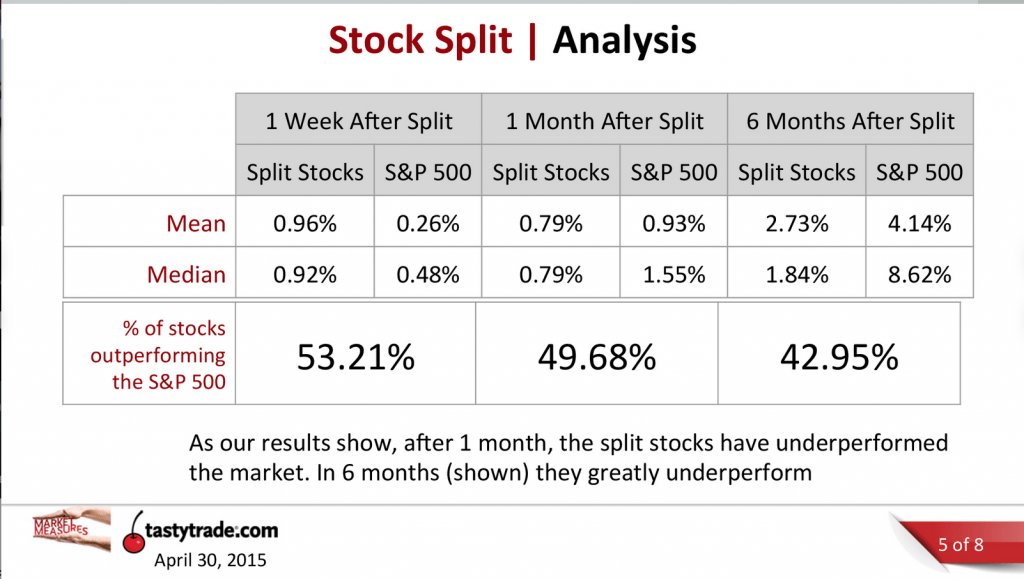

The tastytrade network has conducted extensive research on stock performance after splits, and the results weren’t always that encouraging, as shown below.

Stock splits, like any corporate action, aren’t necessarily conducive to a “one size fits all” approach.

In terms of the historical record, this will be the fifth split in Apple history and its first since 2014. Tesla is splitting for the first time. Amazon has split its stock three times, but the most recent was in 1998.

Readers can learn more about stock splitting, and how this type of corporate action has affected historical trading performance, by tuning into a previous episode of Market Measures on the tastytrade financial network.

“Sage Anderson” is a pseudonym for a contributor who has traded equity derivatives and managed volatility-based portfolios as a prop trading firm employee. He is not an employee of Luckbox, tastytrade or any affiliated company. Readers may direct questions about this blog post, or any other trading-related subject, to support@luckboxmagazine.com.