Zeroing Out Those Utility Bills

With this hack, investors can make utility companies pay the family gas and electric tabs

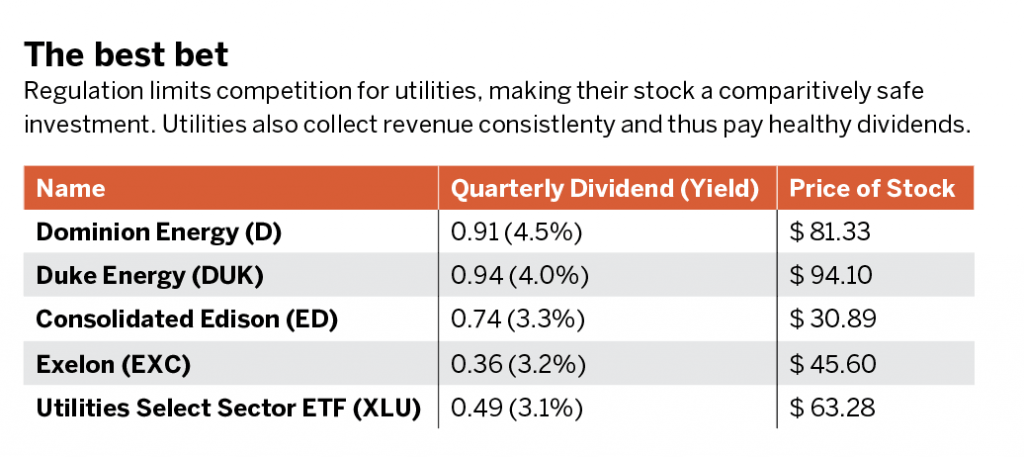

Traders consider utility stocks relatively safe investments—partly because regulation limits competition. Besides, the massive infrastructure required to produce gas or electricity is so expensive that it serves as another nearly insurmountable barrier to entry.

What’s more, revenues tend to remain consistent for utilities because consumers generally use about the same amount of power every year. With a stable income stream, utilities often pay higher-than-average dividends.

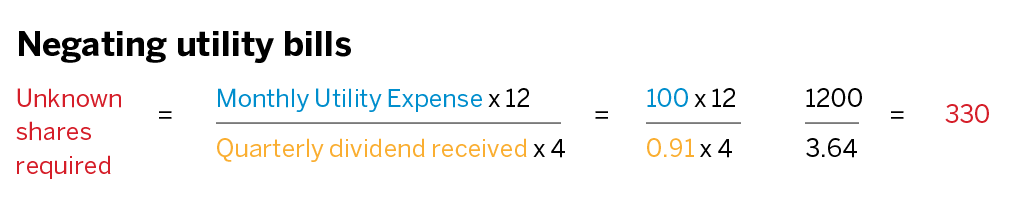

Take a look at the dividend yield of the utilities in The best bet (below). An investor could use them to offset household gas and electric bills. But how many shares would it take to cancel out a hypothetical $100 utility expense?

Well, consider the utility Dominion Energy (D). The quarterly dividend is $0.91 and, unsurprisingly, investors expect to receive it four times a year. To cover a $100 utility bill, an investor would need the dividends from 330 shares. Multiplying 330 shares by the share price of $81.33 means an investor would have to own nearly $27,000 worth of stock.

But options provide more opportunity while requiring less cash.

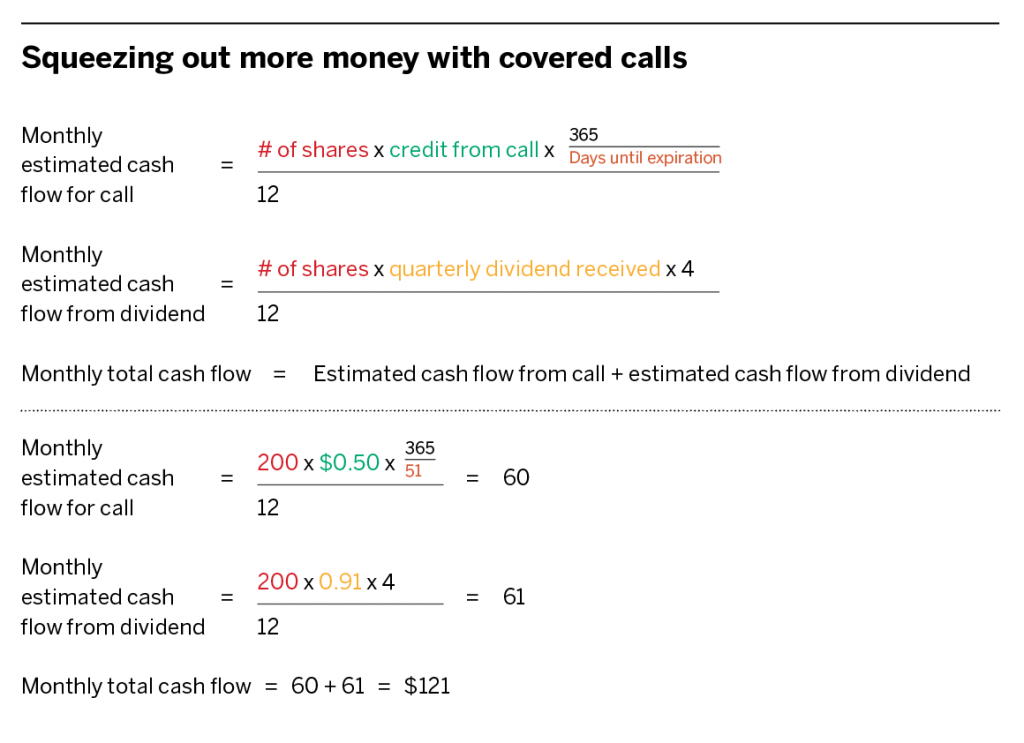

Here’s how: Instead of purchasing 330 shares, one could buy 200 shares and sell 85 calls against the stock held. That offers the advantage of still receiving the $0.91 per share quarterly dividend while also making money from the sale of the call.

Assume an investor would receive $0.50 per share by selling the November call, which is 51 days from expiration, while still receiving $0.91 for the dividend for each of the 200 shares held.

Instead of needing $27,000, the investor could use options and use one-third less and receive 20% more ($120 versus $100 per month).

Michael Rechenthin, Ph.D., (aka “Dr. Data”) heads research and data science at tastytrade.