Amazon’s Fires

The tech behemoth is taking a lot of heat. Here’s a contrarian analyst’s perspective.

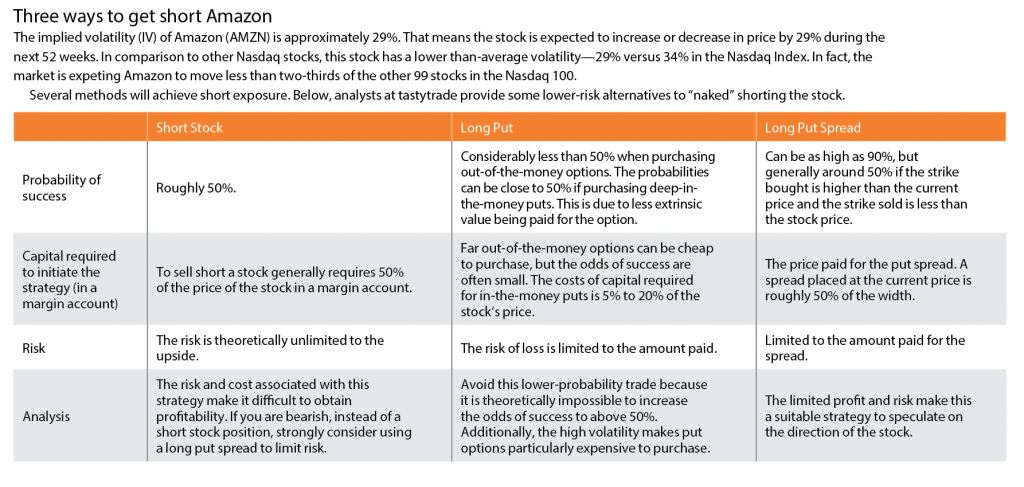

Amazon (AMZN) has had a tumultuous year. The stock traded as low as $1,500 the first week of January before breaking the $2,000 level in July and settling back into the $1,700s.

The company’s top managers, like many other Americans, are fretting about tariffs, and like their counterparts at other tech giants, Amazon execs are feeling uncomfortable about the looming specter of greater regulatory oversight.

Meanwhile, Amazon’s top treasurer is heading for the door after 15 years with the company. At the same time, the Whole Foods subsidiary, long known by the derisive sobriquet of “Whole Paycheck,” is cutting prices (again).

Federal agencies are declaring 4,000 products on Amazon sites unsafe, including 2,000 toys. Some claim that selling the products without warning labels constitutes mass deception.

At any moment, President Trump could renew his call for higher U.S. Postal Service shipping rates, which would damage Amazon’s business.

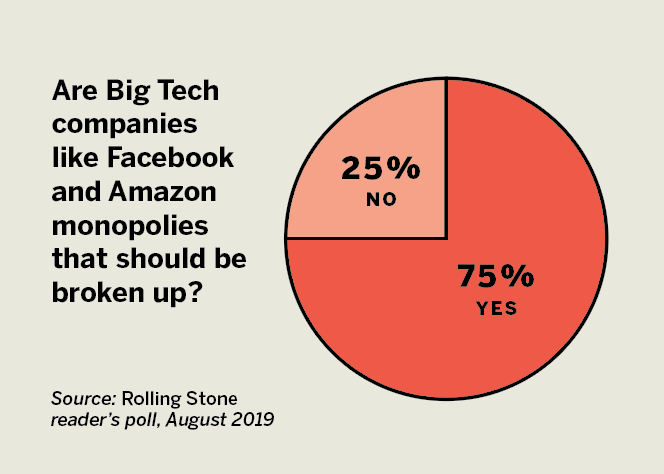

The Department of Justice has announced its Antitrust Division will review “whether and how market-leading online platforms have achieved market power and are engaging in practices that have reduced competition, stifled innovation or otherwise harmed consumers.” Amazon seems vulnerable because the DOJ will examine concerns about the company’s dominant market position and alleged monopolies in its online retail platform and cloud-computing business.

Do those travails simply amount to the daily quota of misery for such a large, powerful internet company? Some Wall Street analysts seem to think so. According to Nasdaq.com, the stock has 25 “Strong Buy” recommendations, two “Buys,” one “Hold,” and no “Underperform” or “Sell” ratings.

But New Constructs, an independent equity research firm powered by machine-learning, is advising investors to avoid Amazon and gives it an “Unattractive” rating—citing more downside risk than upside potential.

Despite Amazon’s attractive return on invested capital of 13% for the trailing 12 months and attractive price-to-economic book value, New Construct’s David Trainer and Sam McBride explain that they base their “Unattractive” rating for Amazon on the significant disconnect between the expected forward financial performance implied by its market price and the company’s historical performance.

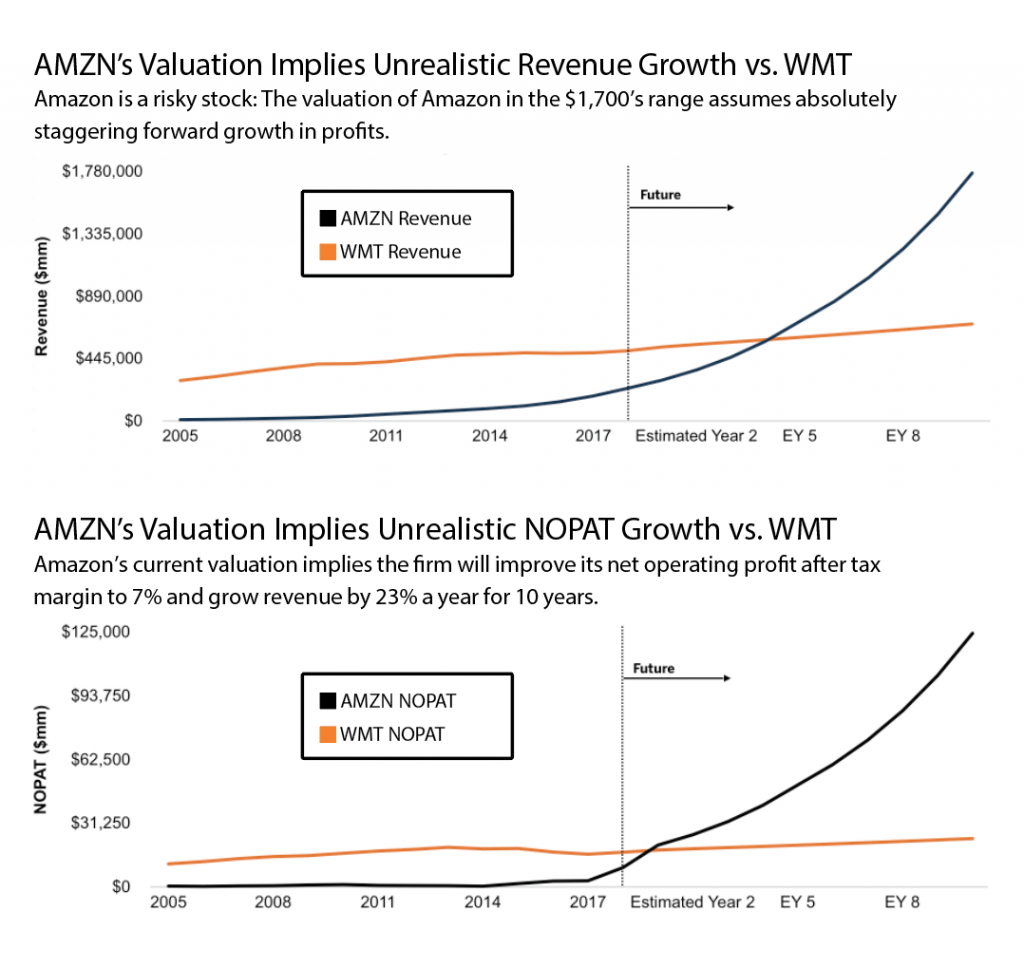

(For more on Amazon’s situation and prospects, see “AMZN’s Valuation Implies Unrealistic Revenue Growth versus WMT” and “AMZN’s Valuation Implies Unrealistic NOPAT Growth versus WMT,” below). —Ed McKinley

Amazon rated “unattractive”

Amazon isn’t a bad company, but its stock poses a big risk because the firm’s valuation in the $1,700’s range assumes absolutely staggering forward growth in profits.

Specifically, Amazon’s valuation implies it will improve its net operating profit after tax (NOPAT) margin to 7% (versus 5%, which was highest in company history) and grow revenue by 23% a year for 10 years.

That margin improvement and revenue growth would result in NOPAT growth of 29% compounded annually. In this scenario, Amazon earns over $1.8 trillion in revenue in Year 10, which is over three times the 2018 revenue of Walmart (WMT).

To own the stock at these levels means an investor would have to think that the company’s future cash flow growth will be significantly greater than the performance already baked into the stock price.

For context, compare Amazon’s valuation to Walmart’s current NOPAT and valuation. At approximately $12/share, the WMT price implies the firm will maintain its fiscal 2019 NOPAT margin (3%) and revenue and NOPAT will grow by just 3% compounded annually for 10 years.

—David Trainer & Sam McBride

Luckbox lookback

Glu Mobile: Bust

In July’s Electronic Gaming & Esports issue of luckbox, two analysts rated Glu Mobile (GLUU) as a stock to “Sell,” even though it had been steadily climbing in price that month.

In an article entitled Glu Mobile: Boom and Bust Cycle Continues, New Construct’s David Trainer and Sam McBride cited a litany of problems with the company, including a questionable business model, shareholder dilution and competitive weaknesses. They noted strong selling by insiders and advised following their lead.

It didn’t take long for events to prove Trainer and McBride correct. Despite announcing record bookings and a 6% increase in second-quarter revenue on Aug. 2, Glu Mobile’s stock plunged more than 36% on the game maker’s reduction in 2019 guidance. The stock has been trading in the low $4’s, ever since.