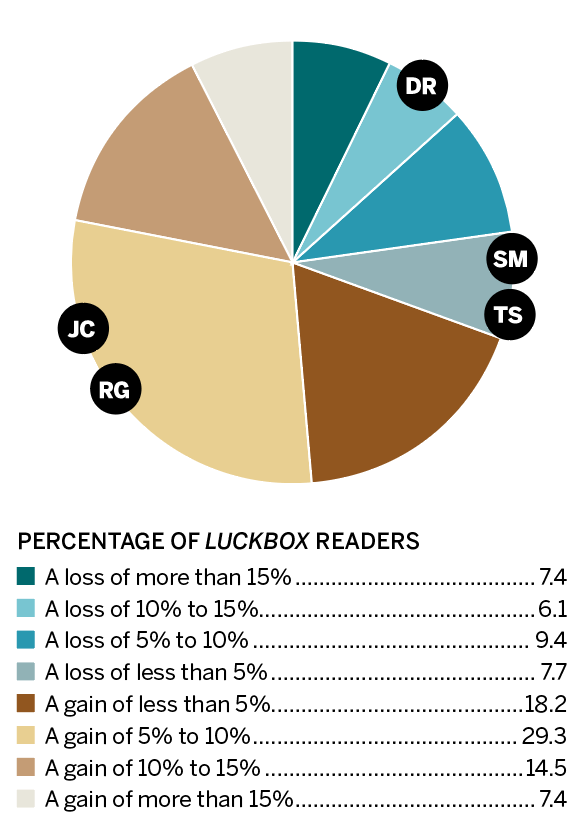

Luckbox Readers vs. Market Experts

The Luckbox Magazine editorial team uses surveys to gauge reader sentiments ahead of every new issue. This time, the same questions asked of readers were posed to a panel of financial experts. Here’s how the results compared.

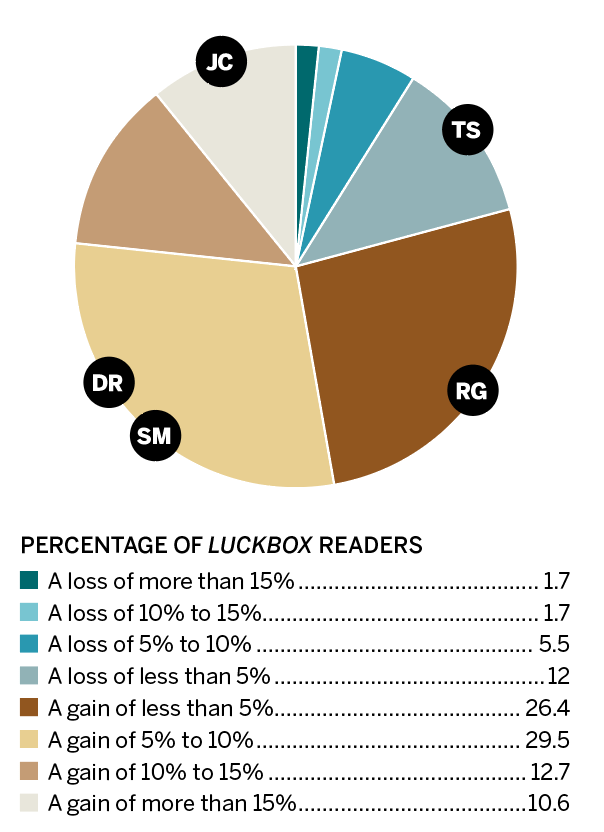

What will the returns on the S&P 500 be from its closing price on election eve (3,310) through closing on March 31, 2021?

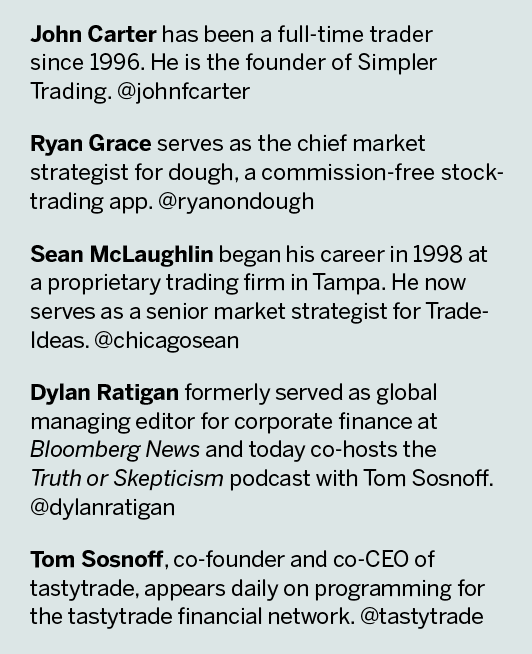

John Carter: A gain of 5% to 10%

It looks as though our government will be gridlocked. And when politicians can’t do anything, that’s good for everyone. It also means fewer surprises. Markets hate surprises.

Ryan Grace: A gain of 5% to 10%

While we need more clarity on the Biden administration’s policy initiatives, the path of least resistance for stocks is higher. The economic recovery is underway, there are expectations of additional fiscal stimulus and monetary policy should remain supportive.

Sean McLaughlin: A loss of less than 5%

While the trend follower in me wants to pay attention only to price, which seems to be pointing higher, the mean-reversionist in me sees all the economic headwinds related to COVID-19 and has a hard time being bullish.

Tom Sosnoff: A loss of less than 5%. Buy the rumor (election) and the results.

Dylan Ratigan: A loss of 10% to 15%. Tax increases.

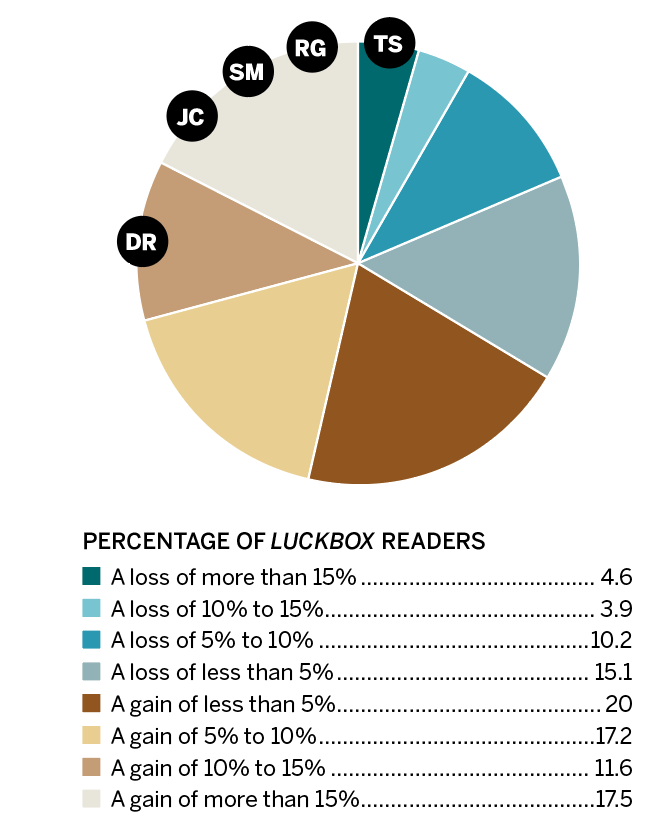

What will the returns on Gold be from its closing price on election eve ($1,897) through closing on March 31, 2021?

John Carter: A gain of more than 15%

I like gold both technically and fundamentally. I read somewhere that there are two ways to end a credit boom. One is you take away the credit. The Fed tried that with QT and nobody could handle it. The other way is to debase the currency. The only way out of our current mess is to inflate our way out of it. Technically and fundamentally, I’m looking for gold to make new highs into 2021.

Sean McLaughlin: A gain of 5% to 10%

Forming a pretty impressive base for another launch, and more stimulus should help keep a bid under gold.

Dylan Ratigan: A gain of 5% to 10%. Inflation.

Ryan Grace: A gain of less than 5%

The biggest headwind for gold over the next couple of quarters will be higher real interest rates, which is what seems to be setting up presently.

Tom Sosnoff: A loss of less than 5%. Gold is already overbought.

What will the returns on Bitcoin be from its closing price on election eve ($13,550.49) through closing on March 31, 2021?

John Carter: A gain of more than 15%

For me, bitcoin is where you put 5% of your net worth and forget about it for 10 years. It’s either going to zero or six figures.

Sean McLaughlin: A gain of more than 15%

If gold moves higher, bitcoin will join with a higher beta.

Ryan Grace: A gain of more than 15%

I think more investors are starting to look at BTC as an inflation hedge, especially if we see a continued policy shift toward MMT/UBI, negative interest rates, etc. At its current market cap, it’s a relatively small asset class and it’s under-owned.

Dylan Ratigan: A gain of 10% to 15%. Inflation.

Tom Sosnoff: A loss of more than 15%. Bitcoin is currently grossly overbought.

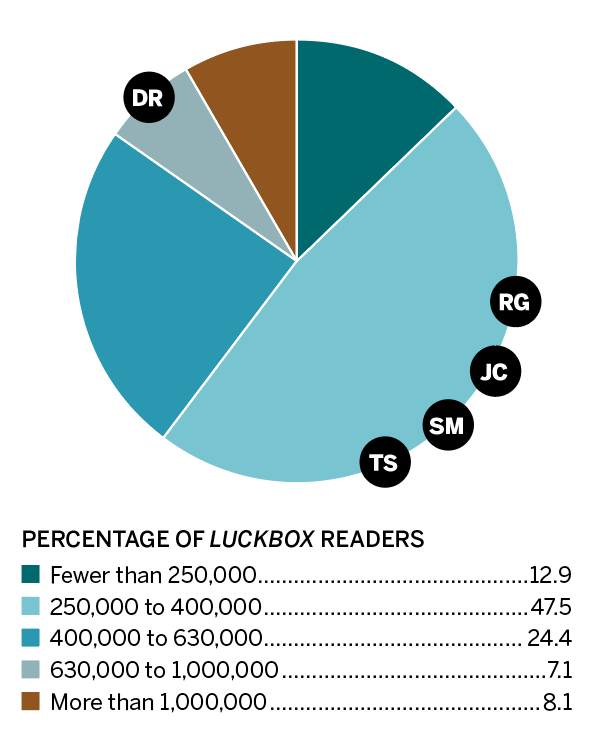

How many U.S. deaths from COVID-19 will be reported or estimated as of March 31, 2021?

Dylan Ratigan: 630,000 to 1,000,000. Parabolic math.

John Carter: 250,000 to 400,000

Right now, the infection rate is exploding, but the death rate seems to be lower as an overall percentage of infections—maybe because the most at-risk are staying home.

Sean McLaughlin: 250,000 to 400,000. Fingers-crossed that it’s not worse than this.

Tom Sosnoff: 250,000 to 400,000. Math.

Ryan Grace: 250,000 to 400,000

This is around the current run rate, though the death rate decreases as we learn more about the virus, more effective treatments are available and we ultimately have widespread distribution of a vaccine.