These Markets Could Be Hardest-Hit by a U.S. Government Default

Current projections suggest the United States government could move into technical default by early June 2023, assuming Congress doesn’t act soon to raise the country’s debt limit. Here's what traders need to know.

In 2023 the financial markets have been grappling with the effects of the ongoing banking crisis, but recent volatility could pale in comparison to the fireworks generated by a U.S. government default.

And as of right now, current projections suggest that a default could occur as soon as early June—assuming Congress doesn’t act to raise the country’s debt limit in the interim.

The debt limit (a.k.a. the debt ceiling) is the maximum amount of money that the United States government can borrow to pay its bills. The United States has come to rely on debt because the country often runs an annual budget deficit—meaning the government typically spends more than it brings in.

For many decades, the legislative process of raising the debt limit wasn’t politically contentious, at least not to the degree observed in recent years. Congress has raised the country’s debt limit 78 times since 1960, and the vast majority of those were routine votes.

However, starting about 10 years ago, the process became arduous, and characterized by extreme political partisanship. These days, any attempt to raise the debt limit is viewed as an opportunity to negotiate political concessions, whereby the ominous threat of default is used as leverage.

Since 2011, the process for raising the debt limit has followed a similar script. Lawmakers spend weeks (or months) airing their political grievances, before ultimately negotiating a path forward–often at the 11th hour.

The U.S. government hasn’t defaulted in modern history, and it isn’t expected to do so in 2023, either. But the remote possibility of a default—referred to as “tail risk” in the financial markets—is something that investors and traders can’t ignore.

If the United States were to default, most projections suggest that the financial markets would react in volatile fashion. That said, it’s impossible to predict exactly how things could play out because there’s no historical precedent for it.

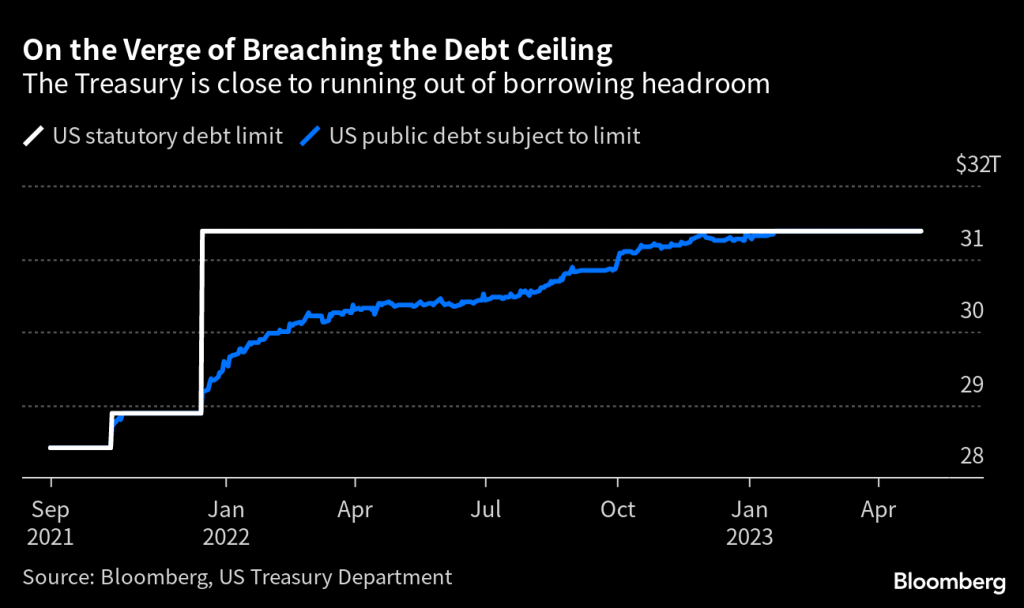

Currently, the U.S. Treasury has adopted “extraordinary measures” to ensure the United States can pay its bills for the time being. But the clock is ticking, and many believe those measures will be exhausted by early June.

As of now, Congressional leaders are expected to meet with President Biden on May 9 to try and resolve the current impasse. The debt ceiling is currently set at $31.4 trillion, as illustrated below.

Potential Repercussions of a U.S. Government Default

Since there’s no historical precedent for a U.S. default it’s difficult to predict exactly what might transpire should one come to pass.

Moreover, there’s a big difference between failing to raise the debt limit (known as a “technical default”), versus an “actual default,” whereby the U.S. is unable to raise money to pay its obligations.

That’s why a technical default in 2023 would be considered “manufactured,” due to lawmakers’ failure to act, as opposed to a collapse in confidence in the “full faith and credit” of the United States government.

Regardless, most expect that the stock market would suffer a sharp correction in the event of a 2023 default, and elevated volatility in the financial markets is considered a virtual certainty.

That sentiment was underscored in a recent article by the Brookings Institute which highlighted that financial disruptions stemming from a U.S. default “would very likely be coupled with declines in the price of equities, a loss of consumer and business confidence, and a contraction in access to private credit markets.”

Those aren’t pleasant tidings.

Another big concern revolves around the health of the underlying economy, because so many citizens—from government workers to seniors on social security—rely on payments from Uncle Sam for income. It’s believed that a default would result in delayed government payments, which would result in lower consumption, and a significant decline in U.S. economic activity.

As most are well aware, the economy is already in a weakened state, which means a default could trigger the onset of a recession, and potentially a more severe contraction in the economy than many currently expect. Along those lines, a model produced by Joseph Brusuelas and Tuan Nguyen projected that unemployment in the U.S. could spike as a result of a technical default.

Moreover, a default by the U.S. government would almost certainly exacerbate the ongoing U.S. banking crisis. To wit, Treasury Secretary Janet Yellen recently told lawmakers that a breach of the debt limit would be “completely devastating” for the banking industry.

And with respect to the financial system, one of the primary concerns relates to interest rates.

During a normal crisis, investors and traders plow into U.S. government bonds in what’s known as a “flight to safety” (a.k.a. “flight to quality”). Flights to safety typically push up the value of “safe” government bonds, and push down associated yields, because the two share a strong negative correlation.

This time around, however, a default could catalyze the opposite, triggering a selloff in government bonds. Such a development could be cataclysmic, because it could trigger a spike in interest rates.

The U.S. Federal Reserve sets short-term interest rates, but middle-and-long-term rates are set by the market. And in the event of a default, those markets could be thrown into chaos.

A U.S. government default would also likely weigh heavily on the dollar, due to the increased potential for a downgrade of the country’s credit rating.

As one can see, the list of potential concerns is lengthy and would include many unforeseen (and equally unpleasant) surprises, as well. According to Mark Zandi—the Chief Economist at Moody’s Analytics—a U.S. default could occur as soon as June 8.

History says that Congress will act and raise the debt limit ahead of a technical default, but much like in the markets, past results don’t guarantee future performance.

For the time being, investors and traders may therefore want to adhere to disciplined risk-management practices, and keep a close eye on this story in the coming days and weeks.

To learn more about risk-managing a portfolio during periods of uncertainty in the financial markets, readers can check out this installment of Best Practices on the tastylive financial network. For more background on tail risk, readers can also check out this recent Luckbox article.

To follow everything moving the markets on a daily basis, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.