Office REIT Reckoning

Workers and small-business owners suffered in the first months of the pandemic, but real estate investment trusts could feel the shock later. Nevertheless, one ticker merits consideration.

Social distancing has claimed millions of victims. Start with the people who make their living from social interaction.

It’s a long list of “little guy” personnel that includes servers and hosts at restaurants, store cashiers, childcare providers, hairdressers, fitness instructors and hotel workers.

Also factor in people who work at car dealerships, mines, dry cleaners, laundromats, construction sites, amusement parks, concerts and other big-venue gatherings.

The lower- and lower-middle-class have been hit hard throughout the shutdowns. But office REITs are going to feel similar problems and pain.

The phrase “office REIT” refers to real estate investment trusts that own office buildings and lease them to companies. They pay much of their taxable income to investors in the form of dividends.

Twenty-four of them account for roughly $75 billion in market value. And the sector itself is segmented into two categories:

“Gateway REITs” hold portfolios concentrated in six U.S. cities—New York, Chicago, Boston, Los Angeles, San Francisco and Washington.

“Non-gateway REITs” hold portfolios concentrated in locations outside those ultra-dense cities, generally in the Sunbelt or in secondary office markets.

Overall, analysts remain bearish on the office REIT sector with its weakening long-term demand and a significant pipeline of supply growth.

Just the same, opportunities can arise in the sector. Let’s take a closer look at why.

On-time office REIT rents

The near-term outlook remains relatively steady. Office REITs reported little difficulty collecting rent during a scary part of the pandemic in April.

They achieved 94% of office rents and 92% of total rents in April. leaders included Easterly Government Properties (DEA) at 99%; and Equity Commonwealth (EQC) at 98%.

On the other end, Empire State Realty Trust (ESRT) reported achieving just 73%, but that figure jumps to 93% when charges to security deposits are included.

The 92% total rent collection from office REITs compares to:

96% for residential REITs

92% for industrial REITs

73% for net lease REITs

59% for shopping center REITs

22% for mall REITs

Strong rent collection has—for now, at least—enabled the vast majority of office REITs to maintain dividends at current rates. An exception was small-cap City Office REIT (CIO), which reduced its dividend from $0.24 to $0.15.

It’s the lone pure-play office REIT to announce a dividend cut since the start of the pandemic. [On the other hand, office-heavy diversified REITs Armada Hoffler (AHH) and American Assets (AAT) did too.]

Expect a few more highly leveraged small-cap office REITs to reduce dividends in the months ahead—if only out of an abundance of caution—given their elevated payout ratios and debt metrics.

Thirteen office REITs command investment-grade bond ratings from the S&P 500. And the larger sector operates at leverage ratios generally in line with the REIT sector average of around 40%.

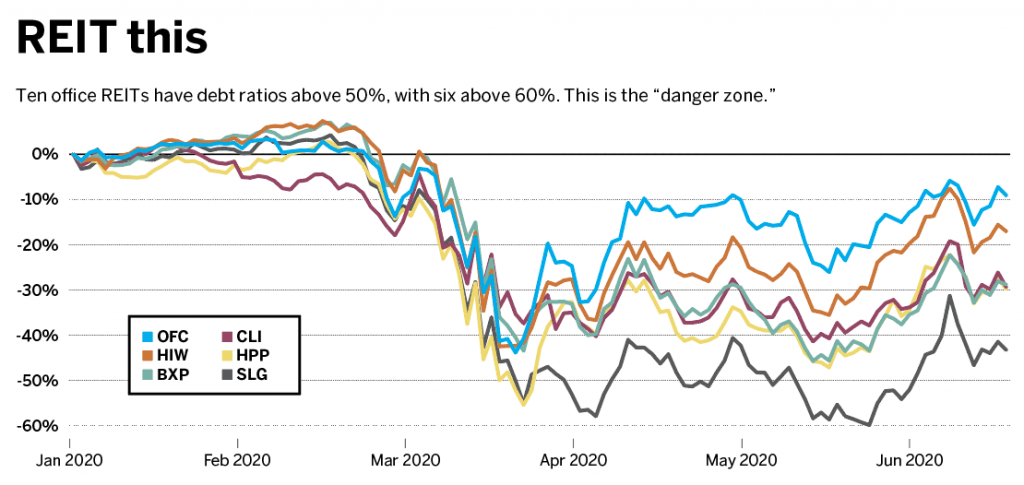

That said, 10 office REITs have debt ratios above 50%, with six above 60%. This is the “danger zone” for potential dividend cuts or other means of deleveraging.

Also of note, all but one office REIT—Office Properties (OPI)—operates under the traditional internally managed corporate governance structure.

Gives and takes

Office REITs tend to be concentrated in coastal “gateway” markets, where post-recession job growth has been strong. But so has supply growth.

Several of those ultra-dense spots, including New York and Chicago, are expected to see slower population growth and might even fall victim to an “urban exodus” of residents abandoning big cities. That poses a risk for gateway-focused REITs.

It’s a shame because office REITs were finally hitting their stride over the last two years. Before that, they had suffered a decade of middling performance. But then came seemingly unstoppable job growth until the pandemic struck.

They had been in the sweet spot. Same-store net operating income growth for office REITs averaged 2.54% in 2019. That easily outpaced the 2.12% average growth of the broader REIT index.

The sector tends to outperform later in the economic cycle, given the typically long-term structure of office leases. They average five to 10 years for suburban assets and 10 to 20 years for central business district assets.

The sector’s foibles

Office ownership is a capital-intensive business with relatively low operating margins and high capital-expenditure needs. Tenants tend to have quite a bit of negotiating power relative to landlords, particularly given oversupply.

Given the high fixed costs of managing an office property—whether fully occupied or mostly vacant—operating leverage is high. So small changes in occupancy and market fundamentals can have significant positive or negative effects on performance.

More than other REIT sectors, office REITs have a relatively small tenant roster and tend to be geographically concentrated. Vacancy rates across the sector have consistently averaged more than 10% for most of the post-recession period.

Metrics have improved in recent quarters. But it’s expected to be short-lived, given the coronavirus (including work-from-home trends) and the large development pipeline.

One bullish forecast

One name analysts are bullish on is Corporate Office Properties (OFC). (See “This REIT wins playing defense.”) It’s the only office REIT focused on serving U.S. government agencies and defense contractors engaged in defense information technology and national security.

This is a strategic niche with tenants generally focused on knowledge-based activities, such as cybersecurity, R&D and other technical defense and security areas.

The niche provides real estate to a specialized cyber-based platform. The defense installations (or government demand drivers) where its tenants operate are knowledge-based centers that aren’t weapons- or troops-related.

Shares in Corporate Office Properties trade at 13.1x P/FFO with a 4.11% dividend yield. Analysts estimate earnings growth of 6% in 2021, which translates into potential returns of around 15% annually.

Brad Thomas, editor of Forbes Real Estate Investor and founder of Wide Moat Research, publishes commentaries at bradtom.com and appears regularly on Fox Business. @rbradthomas