Sosnoff Rocks the World of Finance

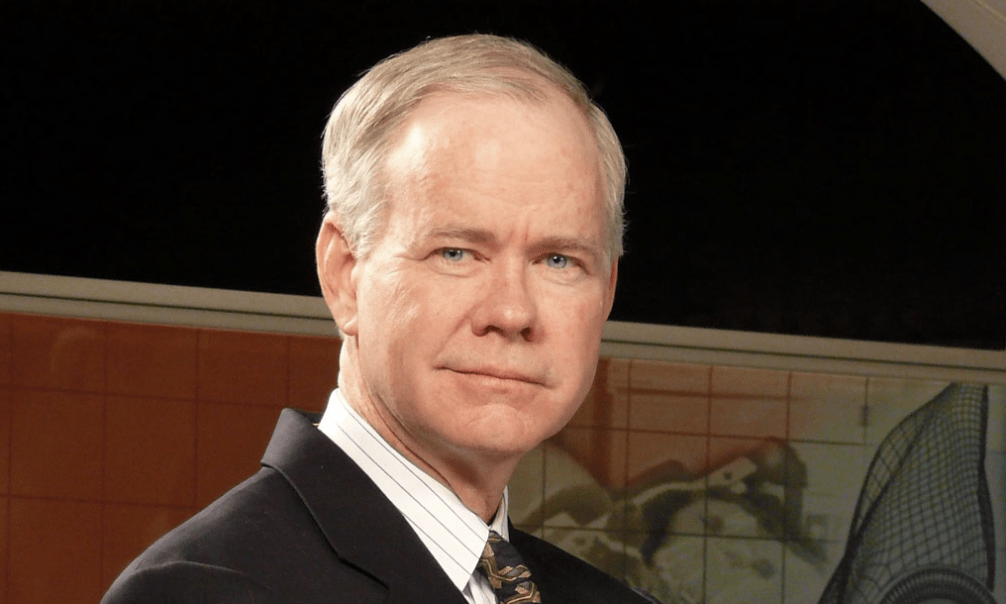

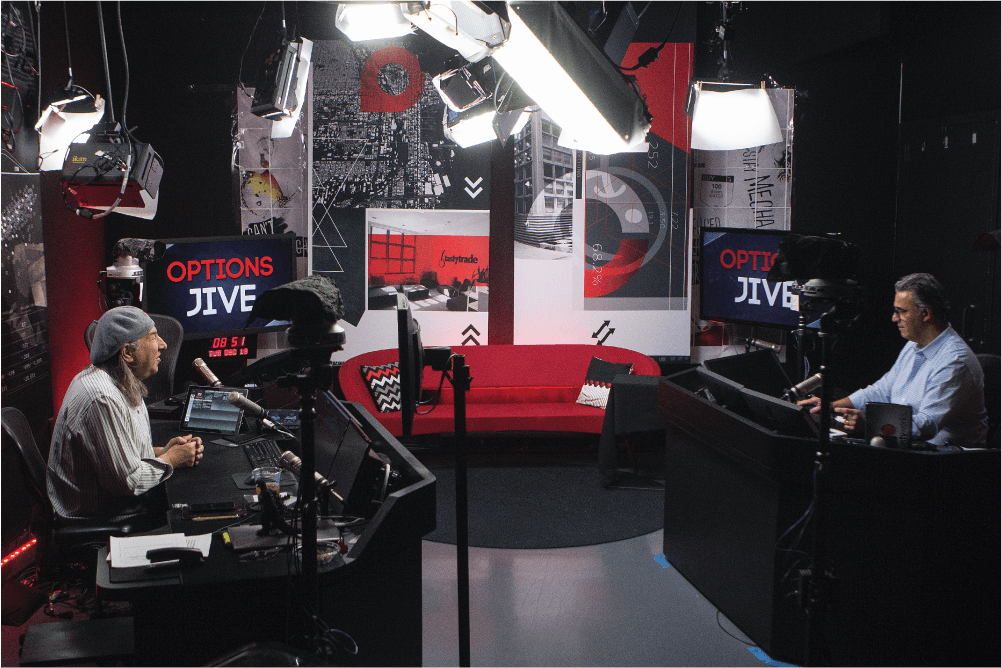

Not you again…I’m sick of seeing you,” complains Tom Sosnoff as he contorts himself into an exaggerated slouch and sighs like a teen- ager whose Wi-Fi has just been turned off. I sidle up to the long communal wooden lunch table that he calls his office. It’s the epicenter of activity in a converted industrial loft in Chicago’s West Loop that serves as headquarters for tastytrade, a rapidly growing online financial network.

I’ve arrived at the table to gather notes for a profile of Sosnoff, tastytrade’s co-CEO. He’s clearly not happy about it, but his protests don’t deter me. I’ve worked with him for years, and his reluctance to sit still for an interview illustrates some of his finer traits – impatience, irreverence and contrariness. He’s happiest when he’s trading, or talking about trading or explaining how to trade. But an assignment is an assignment, and I have been challenged to capture – I check my assignment notes – “the essence of his brilliance, wisdom, knowledge, perseverance, decisiveness, independence and fearlessness.” As Sosnoff likes to say,”Oy.”

It’s those qualities, both the stellar and the contrary, that intertwine to form the character of a man whose vision has changed the game of finance. Sosnoff empowers all sizes and types of investors to make their own decisions, “trade small and trade often,” and seize control of their portfolios. He does it by “showing – not telling” in streaming online shows, live on-air trades and multiple public appearances.

Think of Sosnoff as a true financial savant. He can explain intricate Black-Scholes pricing models with alacrity and then point to a pan of food at lunch and admit that he’s perplexed by the complexity of fajitas. He lives for the markets. For him, torture isn’t a rendition site run by a black-ops CIA operative. It’s a stock market holiday from trading. He’s at his happiest when the markets re-open after a three- day weekend. “Looks like we’re going to have some nice whackage here,” he’ll mutter as he cracks his knuckles before his fingers dance over the keys, sending a flurry of orders that would make anyone else’s head spin and bank account crash.

Reluctant Rock Star

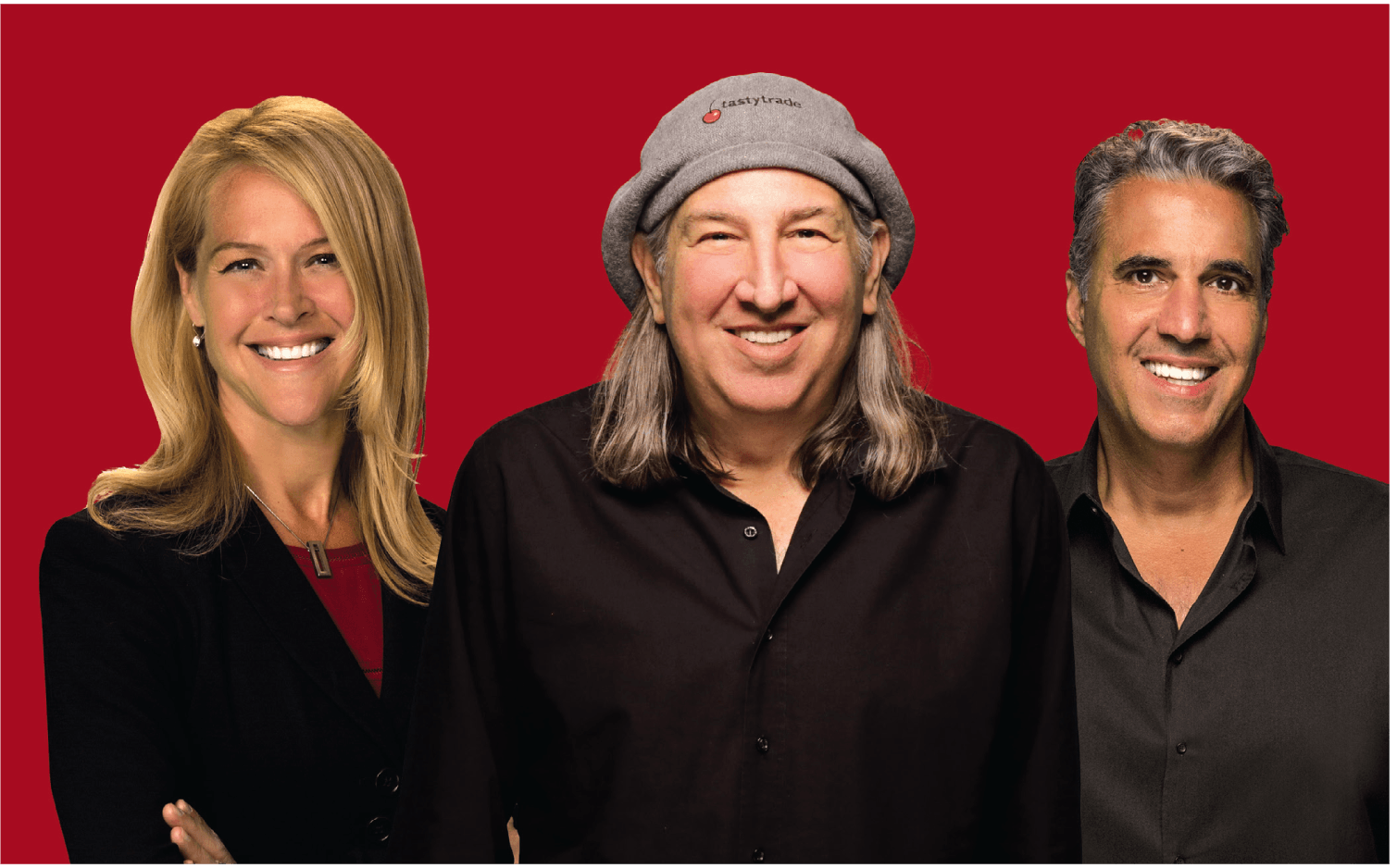

Even with all of that material to cover, I’m in a writerly bind. Sosnoff’s adamant that I avoid writing a “rock star” profile because it’s the last way he would describe himself. “Good menu orderer” would be his preferred designation. On the other hand, Kristi Ross, tastytrade’s co-CEO, is urging me to explain just how transformative and legendary Sosnoff has been to the financial industry. “Sosnoff is a true serial entrepreneur and visionary,” says Ross. “He’s leveled the playing field for the self-directed investor, not just once but multiple times, through innovative trading technology, unencumbered accessibility and now through empowering content – all while making it fun for the end user. How many people can say they’ve made finance fun? To most it seems like an oxymoron.”

We’re all traders, with Sosnoff leading the trading pack.’

– Kristi Ross

Ross persists. “I’ve witnessed the impact he’s had on the everyday investors,” she. “Customer emails to Tom that have said, ‘You’ve changed my life. I finally understand this stuff.’” She’s almost rabid in her zealotry, extolling Sosnoff’s virtues even though as co-CEO she wants to kill him most of the time.

But she’s right, so that’s my opening for an interview. I press Sosnoff on his aversion to the rock star moniker. I’m not prone to obsequiousness and ingratiation, but I’ve seen him on stage brimming with charisma, winning the adulation of legions of fans. He’ll shuffle onto stage, his graying locks flowing past his shoulders from beneath his trademark beret. The audience responds with rapturous applause. But the adulation doesn’t go to Sosnoff’s head. “It makes me uncomfortable” he says of the rock star sobriquet. “I’m embarrassed by it, and it doesn’t mean anything to me.”

So how would Sosnoff describe himself? “I think I may have finally figured out how to define myself,” he says. “I’m a trader geek! That’s why I’m pretty indifferent to product or strategy.” That’s why Sosnoff advises “standing out from the herd.” He’s certainly too complex to fit preconceived categories. He wields an encyclopedic knowledge of the markets, and the breadth of his trading prowess seems nearly unparalleled.

Daily Dollops of Advice

Remarkably, he’s willing to share every bit of his knowledge for free, and one avenue for sharing that endless knowledge is the tastytrade network’s daily original live programming. Sosnoff spends three and a half hours a day, five days a week on camera, making trades, providing analysis or as he calls it, “tape reading” and sharing ground- breaking research. His trading marathons with tastytrade co-host and former floor trader Tony Battista are conducted on their show “tastytrade live,” which airs from 7 a.m. to 10 a.m. Central. That’s when they cover the market open. Their other show, “Last Call,” airs from 2:30 p.m. to 3 p.m. Central and covers the market close. All told, tastytrade generates 40 hours of weekly finance-oriented programming.

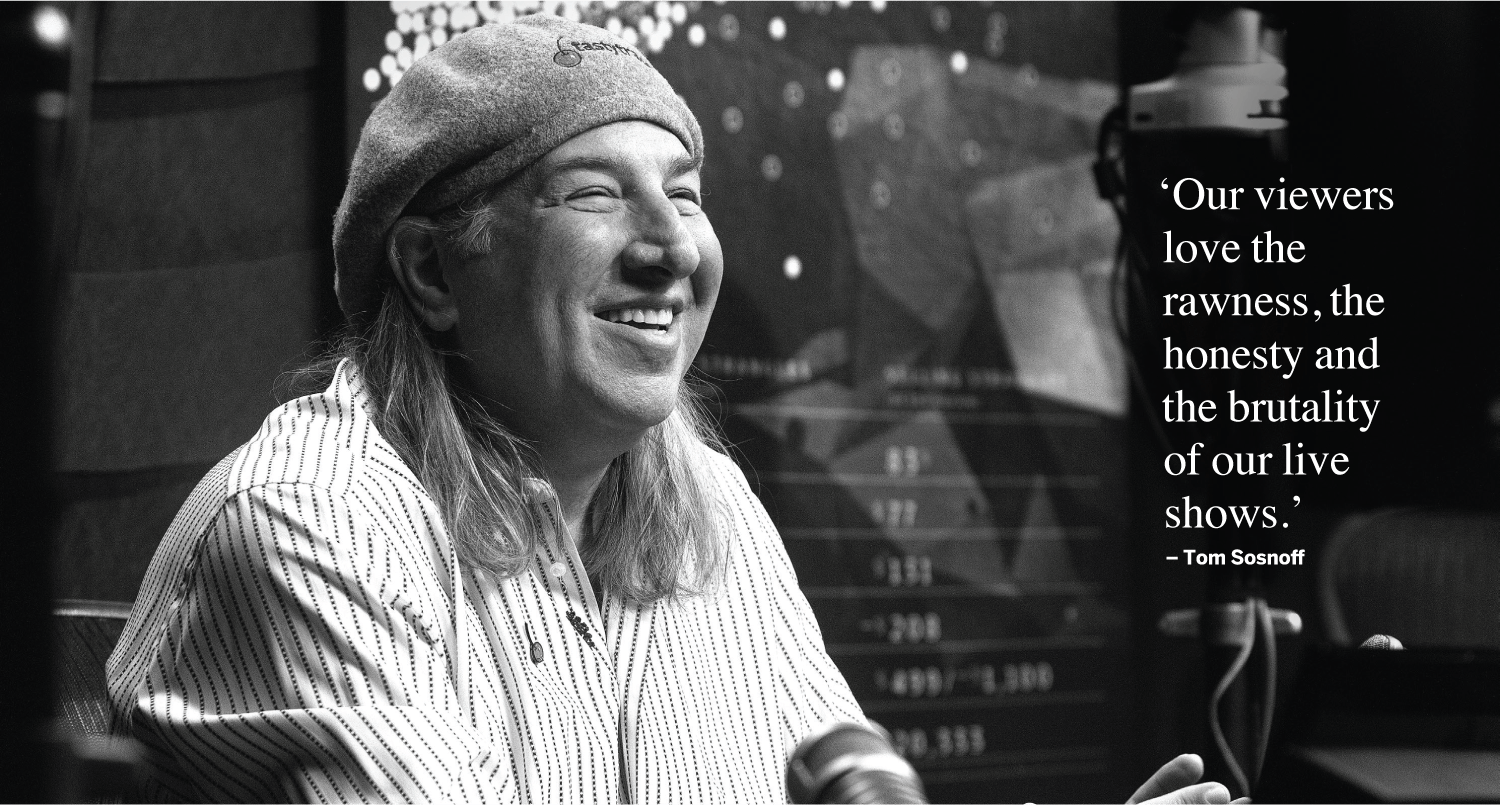

“Our viewers love the rawness, the honesty and the brutality of our live shows,” Sosnoff says. “In the world of finance, there isn’t much like it.” The originality starts with Sosnoff’s personality and appearance. He’s a born performer, effusive and loquacious. He’s usually clad in ripped jeans, motorcycle boots and that signature beret. He doesn’t fit the old-time stereotypes of financial professionals in wingtips, starched shirts and pin-striped suits.

On camera, Sosnoff delivers his live-streamed message without artifice or pretense, enthralling a fanatical following of traders who admire him immensely. He also fills conference halls and music venues, where he delights rapt audiences. At tastytrade’s “He Said She Said” roadshow earlier this year, many audience members had traveled great distances to see him. Interviews with audience members revealed how the show changed the way they trade and make decisions. Time and again they gave nearly the same response: “The show makes me a better trader and a better person.” After the show he waded into the crowd, shaking hands and posing with devotees for selfies. A 10-year-old girl at a show in Dallas spoke of the life-sized poster of Sosnoff that graces her bedroom and declared that she wants to be a trader when she grows up. Those interactions just aren’t typical in the staid world of finance.

But Sosnoff inspires that desire for personal contact because his street cred is legit. His ability to assess risk, make quick decisions and cast aside fear of failure have made him a true serial entrepreneur.

And he’s accomplished that without the turmoil, fear and anguish that plague so many in finance. Instead, he calmly accepts his contrarian nature. To him, traditional finance preaches that traders are either “too dumb” or “too scared” to manage their own money.

In fact, that’s why tastytrade was created. The company provides the financial world with two missing elements: empowerment and entertainment. Sosnoff wants to make finance great again for investors who can’t stand to watch CNBC unless they’ve turned off the sound. “Nobody wants to listen to some suit who’s never made a trade try to explain the obvious,” he once said in a video rant.

Instead, Sosnoff wanted to create programming that entertained while providing information viewers could use to help manage their portfolios. With a full slate of on-air personalities, the programming makes the markets approachable by providing a logical, mechanical way of investing. It’s done without scripts or teleprompter. He won’t wear makeup even though the show’s in high definition.

Viewers get real, unfiltered actionable information.

Sosnoff strives to carve a niche for tastytrade’s programming by focusing on trading. “We’re going to do our thing, and we’re really good about sticking in our own trough,” he asserts. “We don’t go outside our area of expertise.”

Accessibility keeps tastytrade’s commentary real, in Sosnoff’s view. Think of it as what traders need to know, delivered in a way that’s unvarnished and unfiltered. “This is the same conversation we have just sitting here – just a bunch of traders bullshitting,” he says of the show.

The interactions among tastytrade personalities doesn’t just look real. They are real. Everyone at tastytrade lives the life of an active trader, notes Ross, tastytrade’s co-CEO. “We are customers of our own product,” she says. “We’ve built a culture of empowerment, creating opportunities for employees to learn how to fit investing into their everyday life, which ultimately is the same thing our customers seek to do.”

What delights Sosnoff most is the ripple effect that trading has on people’s lives. “We have found a way to [give] retail investors a vehicle for making decisions, so they can learn,” he observes. “I don’t think we can teach a trader mindset, but we can teach people to make a lot more decisions than they make normally, which will lead to a lot more creative businesses.”

A Star Is Born

But how did that philosophy evolve? It’s the product of a life that doesn’t resemble the misadventures of “Behind the Music.” Notes from conversations with Sosnoff say things like, “Tom’s success was due to his aptitude for trading and decision making, which helped him pivot from trader to trading entrepreneur.” Boring. No trashed hotel rooms? Nothing about biting the head off of a live bat?

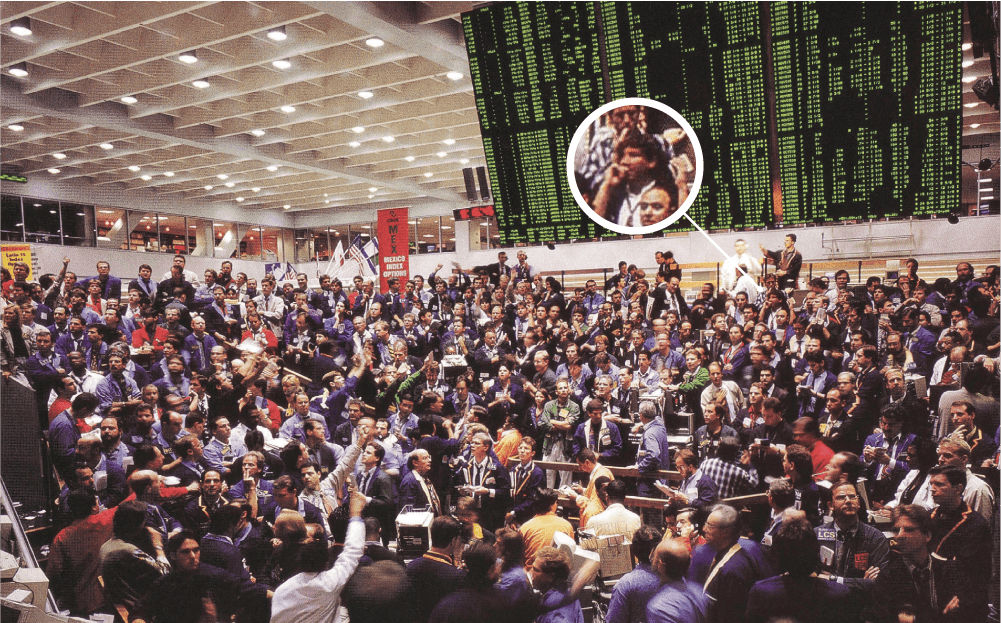

Oh right, rock star of finance. Here’s how Tom Sosnoff became “The Sos.” After graduating from SUNY Albany, he worked for Drexel Burnham Lambert in New York City. In 1981, he decided to move to Chicago, the veritable Wild West for young gunslingers who wanted to make markets or start a business.

The city’s no-holds-barred mentality suited Sosnoff just fine. He arrived in the Midwest backed by a buddy with a $50,000 trading account but with a meager $2,000 in his pocket. His physical location in Chicago would allow him to make trades for his friend back East.

“It was the most money I had ever seen,” he recalls of the funds he had for trading. But working as a proxy to a trader isn’t the same as trading for yourself. The funding pipeline went dry, leaving Sosnoff a new kid in a new town with no job and not much money. What was he to do?

“I networked here among a bunch of clerks, and I got a job option spreading for a month,” Sosnoff says of his recovery from those initial setbacks. His gift for rhetorical acrobatics helped him find a benefactor.

‘I knew Sosnoff would push the envelope. I wanted to be a part of something that could change the world.’

– Tony Battista

“I met this guy, and his brother-in-law gave me a hundred grand to trade with,” Sosnoff recalls. “I never even met the guy. It was a 70-30 split and then went to 80-20, then 90-10.” Simply put, Sosnoff was trading so adroitly that he got to keep 90% of the profits on the trades he made for his benefactor.

What were the odds of achieving that level of success? “Only about one out of 10 or one out of 20 traders made it,” Sosnoff says of those days. But by that point, he was trading thousands of contracts a day.

Soon, Sosnoff decided to square up with his backer and buy himself out. “I made four hundred grand and I gave him his original hundred grand back and then another hundred. He doubled his money and I had my own money to trade with.” Thus, he sowed the seeds that would grow into his core belief in investor empowerment.

First Millions

By 1985, Sosnoff traded his way to his first million at 28 years of age. From there it got better. “My best year was 1987 – made a couple of million dollars that year.” Yet his life in the ‘80s wasn’t like the Charlie Sheen movie “Wall Street.”

“It’s not what you think,” he insists when asked about those times. Instead of blowing cash on drugs and jet skis, Sosnoff and his trader buddies started some unlikely businesses that included a mattress store, an African gold mine and a pizza parlor.

Eventually, Sosnoff’s fancy turned from pizza to profits. In 1989, he started working with former floor trader Scott Sheridan, who’s now the CEO of tastyworks, a subsidiary of tastytrade. Besides trading, the Sosnoff Sheridan Group managed money so the principals could learn more about the markets. They had $10 million under management and Sosnoff was barely 30. “It went OK, but I didn’t really like it,” he says of that phase. “It was more fun trading for myself.”

But the entrepreneurial itch still needed scratching. In 1999, after 19 years as a floor trader, Sosnoff and Sheridan put together a crew of traders and technologists to build a brokerage firm for retail traders called thinkorswim.

Sheridan had this to say about those days: “Tom is more of a visionary than an entrepreneur, and I mean that in the best of ways. He may come up with Idea A, but that may quickly pivot to B or C with the final product looking nothing like the original idea. That to me is true genius!”

Genius or not, the team had much to learn. “We were just trying to figure stuff out,” Sosnoff reminisces. “We didn’t have any developers. We didn’t have a lot of stuff.” Somehow, the team managed to create technology that made the markets accessible and also was developing ways to teach investors how to trade. That union of financial education and accessible trading fueled thinkorswim’s explosive growth.

In 2009, Sosnoff and the crew sold thinkorswim to TD Ameritrade for $750 million. He could have pocketed his eight-figure cut and pursued a leisurely life, but that wasn’t his style. “So I should go to the beach and just do nothing for the rest of my life?” he shot back rhetorically when asked about early retirement.

The Next Revolution

Instead, Sosnoff bided his time until he could foment another revolution. In 2011, he rolled the dice and took a risk called tastytrade. The new business found a home in a former hip-hop studio in Chicago’s River North neighborhood. Unsure the business would succeed, Sosnoff and company furnished the space with rented amenities – even the dishes were rented.

tastytrade began with the grand ambition of overhauling financial media. Sosnoff made it his mission to do no less than improve the way retail traders think about the markets. To accomplish that he threw a lot of spaghetti at the wall to see what stuck. The key was to put the ideas in front of customers as soon as possible.

‘Tom is a visionary, and I mean that in the best of ways.’

– Scott Sheridan

“Done is better than perfect” became Sosnoff’s raison d’etre. In his view, it’s better to push a new product, feature or idea out for feedback even if it’s not quite ready for prime- time. If an innovation proves worthy, then it’s time to devote countless hours to refining it.

A friend of Sosnoff’s was apparently ready to embrace that credo. Tony “Bat” Battista, who joined tastytrade in its infancy, now serves as on-air co-host of the tastytrade programing and has been a friend of Sosnoff’s for more than 30 years. Their work relationship is stronger than most people’s marriages. If either dies they’ve promised to burn all photos and texts. But why did he take a chance on the unproven venture even if the philosophy behind it seemed sound?

“Because I knew he would push the envelope” Battista say of Sosnoff. “Ihadagoodjob,butIwantedtobea part of something that could change the world or be a legacy. I’ve never created anything, and I’ve always worked alone. To be a part of some- thing bigger is appealing to me.”

To pursue those lofty goals, tastytrade has developed a financial think tank with in-house research staff. The researchers dispense daily content based on liquidity, volatility and probabilistic outcomes. Their findings help flesh out the live, daily tastytrade video programming.

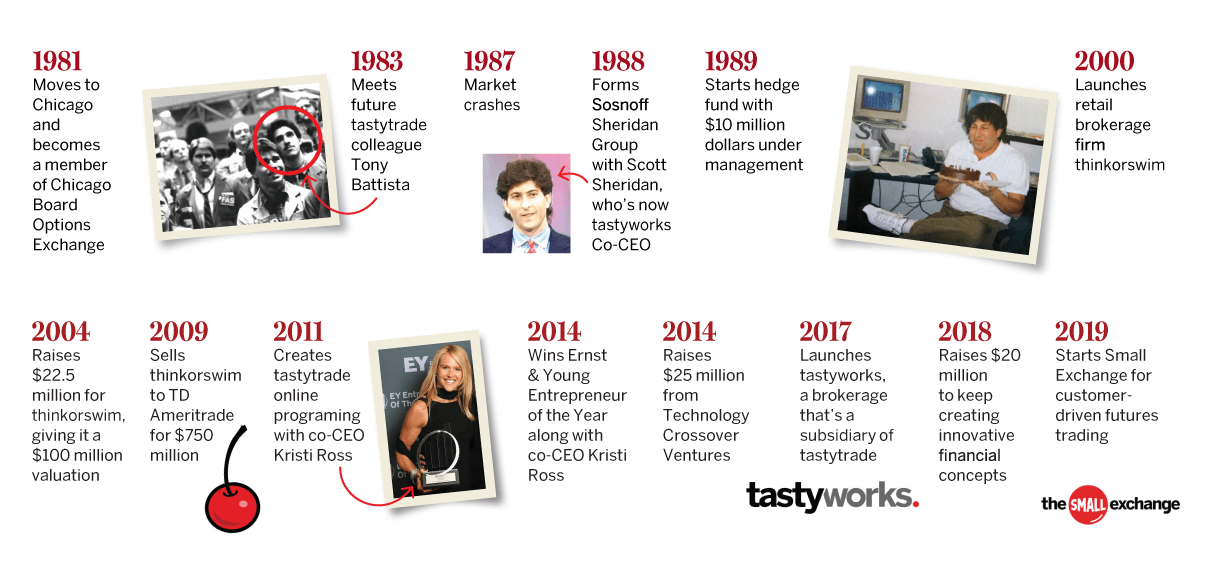

A Sosnoff Timeline

Trade School

Some find the tastytrade programming an acquired taste. In one of his televised rants, Sosnoff outlines “The 10 Most Common Reasons for Turning Off tastytrade.” In Reason No. 5, he admits the content can prove too challenging. In No. 6 he concedes that the research reports may contain too much math.

Yet Sosnoff insists on never “dumbing anything down.” Yet, with thousands of new traders discover- ing tastytrade’s original content every day, the team acknowledges that new traders constitute an important part of the viewership. So, they provide programming that helps rookies decipher trading jargon, contemplate trading strategy and parse Sosnoff’s data science. There’s even a Learn Center to help new traders educate themselves at their own pace for both options and futures products.

It’s a combination of basic and advanced approaches to investing that appeals to a broad audience. The information is interspersed with enough chatter to make the on-air stars seem like family. “We have a certain relationship that I don’t think any other firm has with their clients in the world of finance,” Sosnoff says.

The relationship requires dedication to customer service, and that’s why Sosnoff provides the content and supports it for free. “A goodwill relationship means I give you some- thing, and you’re going to be very appreciative,” he says. “And then you’re going to give us as much as we gave you – or more.”

Apparently so, as legions of tastytraders pay it forward. Referrals represent the biggest source of new brokerage accounts for tastyworks – the brokerage that’s a subsidiary of tastytrade but operates separately.

“That’s our game plan and it works,” Sosnoff says of the arrange- ment. “Does Fidelity operate that way? Schwab? E-Trade? No, they can’t give too much. They have their model, but we found our niche.”

The Road Show

Besides streaming the daily programs, tastytrade’s hosts hit the road regularly and travel across the nation. “The live shows are worth it,” Sosnoff says of the effort involved. “People want to know that you’re real.” The team expects to stage 27 free live events this year.

Customer appreciation takes other forms at tastytrade, too. Sosnoff and his support team respond to email messages within hours, if not minutes. He estimates he spends half his life answering email and the other half contemplating lunch.

The sacrifices are part of an aggressive approach to business – and to life in general – that seems to work. As its audience continues to grow, tastytrade is becoming one of the few true disruptors in financial brokerage and media.

Just the same, an underdog mentality persists. Maybe it’s because Sosnoff advocates for self-directed investors, empowering them with new skills and protecting them from the noise of traditional financial news.

Sosnoff insists that with traditional financial news, “there’s no learning, no wealth creation, no strategy and nothing applicable to true investing.”

But there’s no need to wait for a new generation to take up that cause. Sosnoff’s already hard at work on the task. Call him whatever suits the occasion – entrepreneur, visionary, disruptor, altruist, maverick, oracle, performance artist. But to the tens of thousands of active investors who rely on Sosnoff’s daily delivery of essential insights, he is undeniably their “rock star.” And in achieving that status he also has managed to change the face of finance forever for active investors.

Sosnoff’s approach to financial media: ‘Our message has always been that once people can trade, swim, fish or hunt, they welcome man-made market crises as opportunities and laugh at the people spreading the nonsense. The biggest financial threat has three parts: Lack of understanding and know-how, aversion to risk, and lack of decision-making confidence. If the next generation of financial leaders is going to do something special, they need to start now by engaging people in the world’s greatest free market.’

Vonetta Logan is a writer and comedian who appears daily as a co-host on the tastytrade network. @vonettalogan