Southwest Airlines: A Lot to LUV

With lots of cash and relatively low expenses, Southwest Airlines’ profits and stock price will take off when air travel recovers.

The COVID-19 pandemic has crushed airline stocks, and for good reason. Since late March, the number of passengers passing through TSA screening checkpoints has been down more than 90% year-over-year. And during much of April and early May, the biggest U.S. airlines were averaging just 17 passengers per domestic flight. As a result, airlines have been burning through cash at a rapid (and unsustainable) pace.

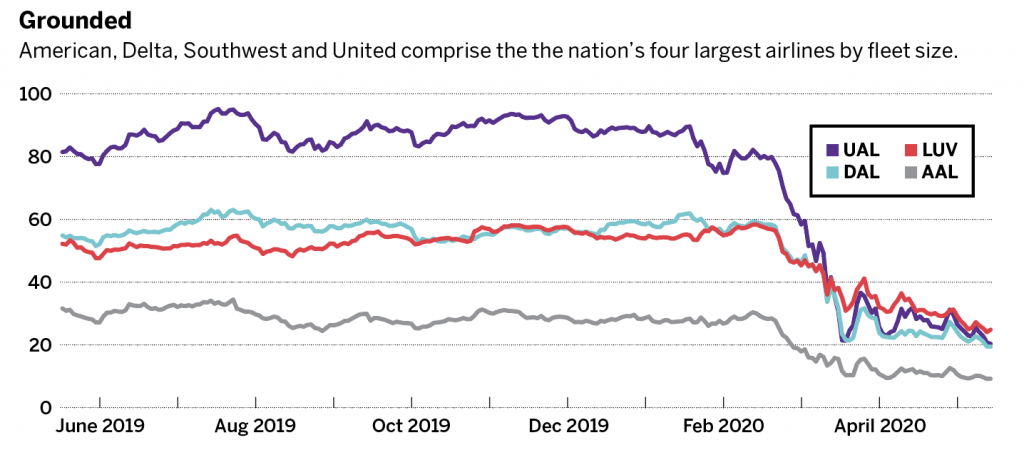

This turn of events led Warren Buffett to sell all of Berkshire Hathaway’s airline stock positions in March and April. Previously, Berkshire had been a top holder of the four largest U.S. airlines: American Airlines (AAL), Delta Air Lines (DAL), Southwest Airlines (LUV) and United Airlines (UAL).

Yet some airlines are well positioned to manage the current downturn and come back stronger than ever when demand returns. Others will exit the crisis with bloated debt loads, blunting their ability to seize growth opportunities in the years ahead. In a worst-case scenario, bankruptcy could even be on the table.

Southwest Airlines clearly fits into the former category. That makes the massive sell-off in Southwest Airlines stock over the past three months a buying opportunity for patient investors.

Air travel demand will likely remain severely depressed for the rest of 2020 and recover slowly thereafter. Businesses will suspend non-essential travel as long as COVID-19 poses a major threat to employees’ health. Even after the pandemic subsides, economic weakness could have a lingering impact on business travel as companies try to minimize costs. Similarly, fears of contracting the virus and high unemployment could combine to limit leisure demand.

Rock-solid balance sheet

Most airlines appear likely to continue burning cash for the remainder of 2020. That makes having a rock-solid balance sheet indispensable.

Southwest Airlines is best-in-class in this respect. It ended the first quarter with $6.3 billion of debt and lease liabilities, mostly offset by $5.5 billion of cash and investments, putting net debt at just $804 million.

By the time of its April earnings call, Southwest had increased its term loan debt by nearly $2.7 billion and received the first round of CARES Act payroll support, giving it more than $9 billion of cash. (The other half of the $3.3 billion in government payroll support funds was slated to arrive in installments between May and July.) Since the earnings report, Southwest has raised about $7.7 billion in additional capital by combining a stock offering, convertible notes, additional debt and a sale-leaseback deal for certain aircraft.

Thus, while Southwest expects minimal cash ticket sales during the second quarter and average daily cash outlays of $30 million to $35 million, the airline is poised to end the period with more cash than debt. In fact, its cash and investments balance may exceed $15 billion by June 30.

Ticket sales are likely to recover somewhat, albeit modestly, in the second half of 2020. And even if they don’t, Southwest will be able to further reduce cash burn later this year through layoffs and other austerity measures.

This means the airline is in no danger of running out of cash, no matter how slow the recovery from COVID-19 may be. It also means Southwest seems unlikely to take on a crippling debt load—one of Buffett’s key concerns about airlines. While it has taken on billions of dollars of debt since March, most of that capital is sitting in cash on the balance sheet. Once demand stabilizes, Southwest will be able to use that cash to pay down debt quickly.

The competition

Contrast Southwest’s position to the situation at American Airlines and United Airlines. American ended Q1 with $34.1 billion of debt and lease liabilities, offset by just $3.6 billion of unrestricted cash and investments. Between CARES Act proceeds and other financing moves, American expects to end Q2 with $11 billion of liquidity. But with cash burn expected to remain at around $50 million a day in June, American could face a major cash crunch if demand doesn’t recover in a meaningful way by this time next year. Even if it avoids bankruptcy in the near term, the company’s mountain of debt makes the stock virtually worthless.

United seems better off, but not by much. It had $23.4 billion of debt and lease liabilities at the end of Q1, compared with $5.2 billion of unrestricted cash and investments. It is also burning less cash than American. But while that makes bankruptcy a little less of a risk, United will still have a crushing debt load.

A lucrative business model

Southwest has been extremely profitable. Last year, it generated approximately $3 billion of operating income on $22.4 billion of revenue, despite a nearly $1 billion earnings headwind from the Boeing 737 MAX grounding. What’s more, it’s been profitable for each of the last 47 years—a streak that will almost certainly end in 2020.

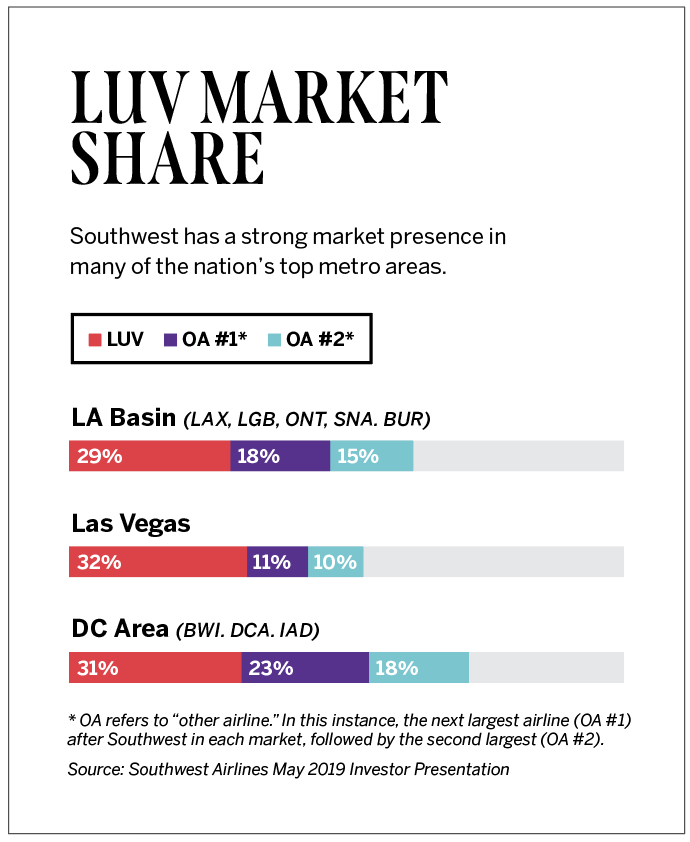

While demand probably won’t recover fully for at least three years—Buffett’s other major concern about airline stocks—Southwest is well positioned to return to profitability faster than that. First, its route network is built around short flights of mainly one-to-three hours, which could see a quicker demand recovery than long-haul markets. Second, the company’s strategy of using only 737s keeps operating costs low, which will help stimulate traffic with low fares. Third, Southwest’s position as the top airline in numerous major cities gives it ample flexibility to deploy capacity wherever demand recovers fastest.

When demand does fully recover in perhaps three or four years, Southwest’s profitability could reach new heights. Looking further ahead, Southwest could benefit from new growth opportunities if weaker competitors like American and United retrench in non-core markets. Additionally, Boeing will be more desperate than ever for 737 MAX orders, potentially allowing Southwest to lock in favorable pricing for deliveries to meet growth and replacement needs in 2026 and beyond.

In contrast, American and United have had significantly weaker margins than Southwest in recent years. That margin gap will only grow over the next few years, as a slow recovery in business demand and long-haul international travel demand will disproportionately hurt the global network carriers.

A compelling valuation

After trading mostly between $50 and $65 between early 2017 and early 2020, Southwest Airlines stock has moved sharply lower over the past few months. The stock fell to a new multiyear closing low of $24 in mid-May. This reduced its market cap to $14 billion, compared with $30 billion as recently as February.

This seems like a massive overreaction. CARES Act payroll grants and the recent stock offering will cover most of the company’s 2020 losses. Even if cash flow remains modestly negative in 2021, Southwest’s debt load won’t get out of control. A few years of improving profitability thereafter could be sufficient to pay down all of the company’s pandemic-related debt issuances.

When demand recovers, Southwest should be back to earning record profits, thanks to the cost benefits of shifting the fleet toward the more efficient 737 MAX 8. Net profit could rebound to $3 billion or more, justifying a stock price more than double recent levels. That upside potential makes Southwest stock a compelling buy.

Adam Levine-Weinberg, an investment analyst and financial writer, focuses on the airline, retail and real estate industries. He received his CFA charter in 2017. @adamllw