Biotechs Reach New All-Time High in 2020

While many investors and traders stare open-mouthed as the Nasdaq and S&P 500 approach their all-time highs in the face of a crippled economy and wave of social injustice protests, there’s one segment of the stock market that has not only reached its previous February 2020 peak, but also surpassed it: the SPDR S&P 500 Biotech ETF (XBI).

The XBI got as high as $98/share when the Nasdaq and S&P 500 set all-time highs in late February 2020. Fast-forwarding to June 2, and it closed above $105.

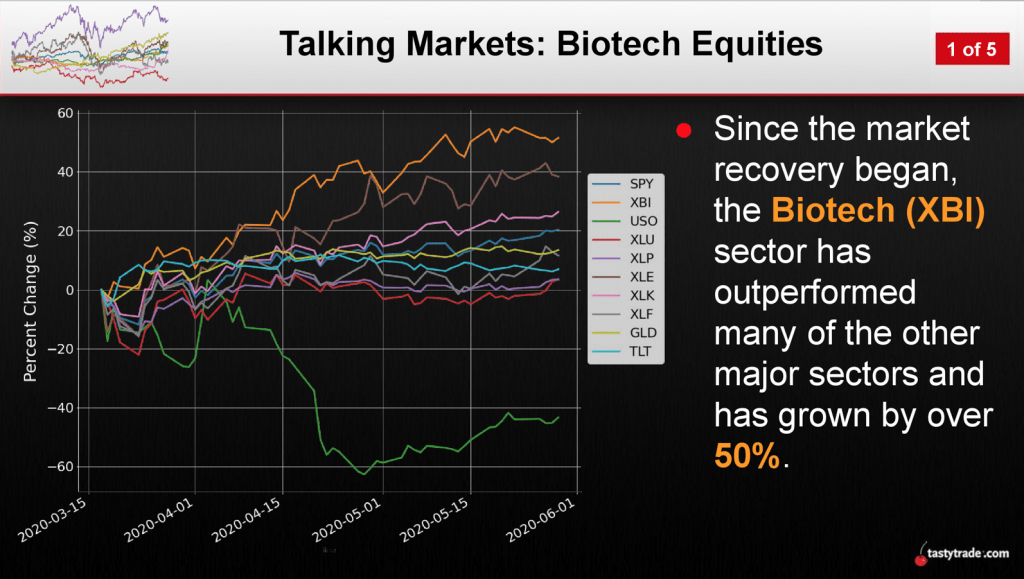

The XBI dropped to as low as $63 during the height of the coronavirus crisis in March, which means it has skyrocketed 54% in two and a half months, as illustrated below:

Certainly the biotechnology sector has benefited from a broad-based rally in the entire stock market ever since the U.S. Federal Reserve unleashed what’s now commonly referred to as “QE infinity.” After all, a rising tide is said to lift all boats.

But it might also be asserted that in the current environment of a global health pandemic the biotech sector may be benefiting from extra attention.

After all, the biotechnology and pharmaceutical sectors are currently in the spotlight due to their ability to directly alleviate the crisis, whether it be in the form of drugs that treat COVID-19 or potential vaccines that could help limit further spreading of the disease.

Further evidence of the current dominance in the biotech sector is evidenced by the strong flow of capital toward the industry at a time when capital is arguably harder to come by. Unlike most industries, the biotech sector has actually seen a flurry of initial public offerings (IPOs) in 2020.

On Tuesday, June 3, Pliant Therapeutics (PLRX), a developer of fibrosis drugs, became the 15th biotech company to IPO in 2020. The volume of new offerings this year means the biotech sector is actually keeping pace with its 2019 IPO rate, almost unheard of when compared to most other sectors in the current market environment.

Existing biotech companies, especially those boasting success in COVID-19-related drugs and vaccines, have also been able to tap new financing. On May 18, eight drugmakers, including Moderna (MRNA) and Bluebird Bio (BLUE), raised nearly $3 billion in new offerings of equity and debt.

The one caveat to all the excitement is that the biotechnology sector also tends to bring another well-known market saying to mind: Easy come, easy go.

Biotech companies are often characterized by “boom” or “bust” scenarios, due to the difficulty of actually bringing new drugs and treatments to market. For this reason, biotech companies are often said to represent “binary plays.”

The biotechnology sector is different from the traditional pharmaceutical industry for a couple of important reasons. First, while both develop medicines and treatments, those developed by biotech companies often originate from living organisms, whereas traditional pharmaceutical companies depend on medicines with a chemical basis.

In terms of operation, biotechs often use the bulk of their capital for research and development (R&D). That means capital is consumed as these companies attempt to bring a drug to market.

A failure to do so can often be catastrophic, at least in terms of the underlying stock price.

Pharmaceutical companies, on the other hand, typically rely on a steady stream of income from an existing portfolio of products and use a portion of that to invest in R&D—either through in-house projects or external mergers and acquisitions.

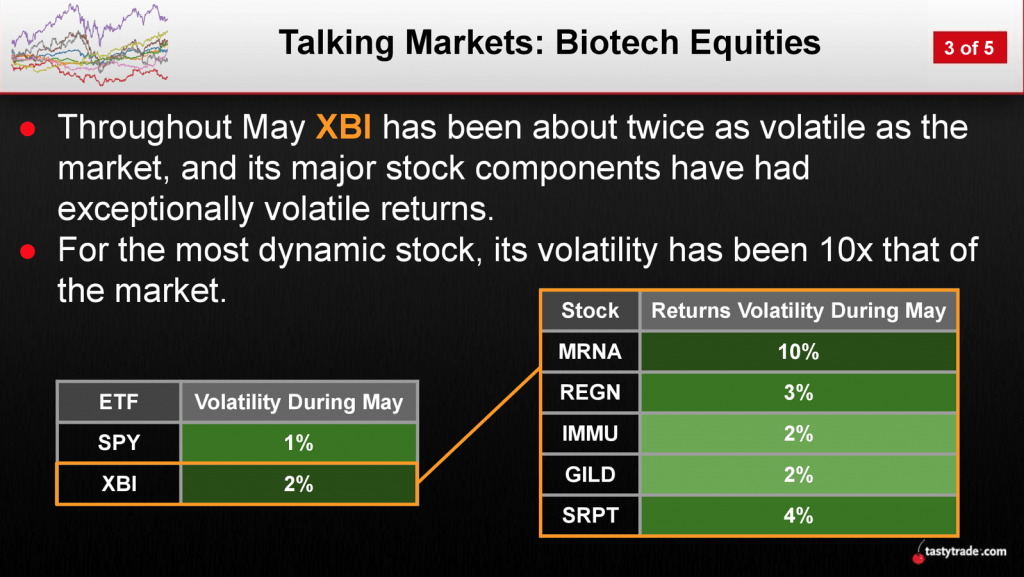

The fact that biotechnology companies are generally lower capitalized relative to pharmaceuticals, combined with the binary nature of their drug development efforts often translates to much higher levels of implied volatility (IV) and realized volatility (RV).

As illustrated in the graphic below, that volatility has been even more pronounced in 2020:

Due to the outsized levels of realized volatility (i.e. actual volatility) observed in the biotechnology sector in 2020, there’s actually been relatively less contraction in implied volatility across the sector as well.

While that may seem like a potential opportunity, investors and traders need to keep in mind that in this particular case, inflated levels of implied volatility may actually be warranted.

According to previous tastytrade research on implied and realized volatility, the most effective short premium trades are generally produced when the spread between IV and RV is on the high side.

Traders seeking to dip a toe into the biotechnology sector, especially as it pertains to volatility trading, should therefore be extremely careful when evaluating potential opportunities.

As evidenced by the outsized rally observed during the recent market rebound, this is one sector, in particular, that isn’t necessarily like the others.

For more information on 2020 performance in the biotech sector, readers may want to review a recent installment of Tasty Extras when scheduling allows.

A recent Luckbox article focusing on the global race toward a viable COVID-19 vaccine may also be of interest.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.