Cage Match: Weekly vs. Monthly Options

The Chicago Board Options Exchange (CBOE) first introduced what we refer to today as a standard call option in 1973. The standard put option was introduced four years later, in 1977.

While options are traditionally structured on a monthly basis (expiring on the third friday of each month) innovations in the industry have brought about the introduction of both long-term equity anticipation securities (aka “LEAPS”) as well as weekly options (aka “weeklys”).

LEAPS are defined as options that expire at least one year from the initial trade date, and were first offered in 1990. In terms of contract specifications, the only difference between a LEAP option and a traditional “monthly” option is the extended expiration date. LEAPS provide investors and traders with additional flexibility for taking and managing long-term risk(s).

Weekly options operate much like regular “monthly” equity derivatives as well, except that their duration can range anywhere from one week to five weeks long. As with LEAPS, the contract specifications of weeklys are identical to those of regularly listed monthly expiration options. The introduction of weeklys was intended to provide traders with additional flexibility in taking and managing short-term risk(s).

Weekly options were first piloted by the CBOE in 2005, and since that time have gained significant traction in the marketplace. In 2017, trading in weekly options accounted for 28% of the total option volume for the entire year in the United States.

Due to the increasing popularity of weekly options, it’s possible that both new and experienced traders alike have considered using these instruments, or will do so at some point in the future. From that standpoint, traders may be interested in reviewing a new installment of Market Measures on the tastytrade financial network, which focuses specifically on weeklys.

On the show, a market study is presented that compares the historical performance of weekly options to that of longer duration traditional monthly options.

According to previous research conducted by tastytrade, there is evidence suggesting 45 may be a somewhat optimal number for days-to-expiration (DTE) when it comes to short premium positions. For this reason, the market study was conducted as a side-by-side comparison of weeklys (7 DTE) versus monthly options with on average 45 DTE.

The strategy backtested in the study was a simple short at-the-money (ATM) put, continuously deployed. The backtests were conducted in SPY using historical trading data from 2009 to present. A third category of options, with on average 30 DTE, was also backtested for added context.

The backtest on each option type was run twice—once without a trade management approach, and the second time with a trade management approach.

The trade management approach that was incorporated for the 30 DTE and 45 DTE options called for the trades to be closed on the 21st day after trade initiation. Trade management was not used for the 7 DTE approach because shortened trade duration does not provide for much ability to “manage.”

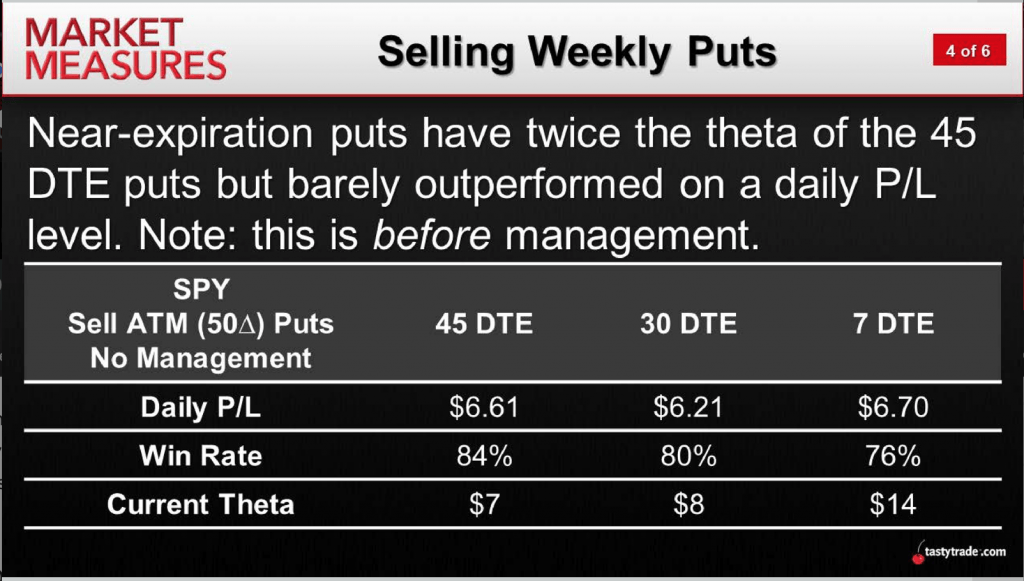

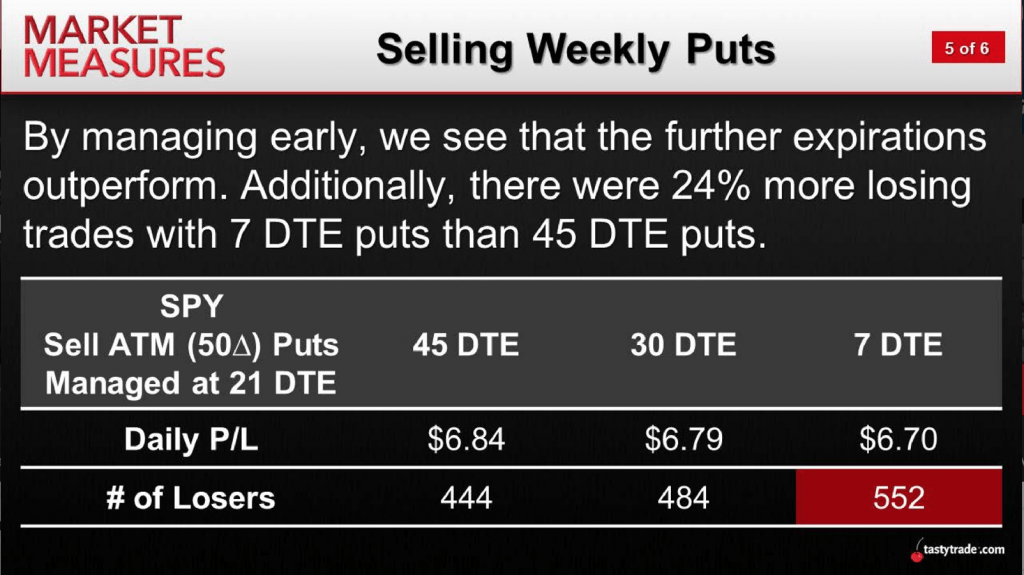

The first slide below shows the historical performance of each option type without the application of a trade management approach, while the second slide reflects the respective performance using a trade management approach on the 30 DTE and 45 DTE option types:

As one can see in the first slide, the average daily P/L was highest for the 45 DTE and 7 DTE options. However, the overall win rate was considerably higher for the 45 days-to-expiration options.

Looking at the second slide, when the trade management technique was applied, the average P/L increased for the 30 DTE and 45 DTE option types. This slide also highlights how the 7 DTE options resulted in significantly more “losers” than the other two.

Combining the above with a previous tastytrade study on weeklys, the Market Measures team uncovered several important factors which appear to limit the performance of the shorter duration options (i.e. weeklys) in comparison to regular monthly options, such as:

- Smaller trade credit, reducing breakevens

- Less time for tested trades to bounce back

- Lower overall trade performance (due to the above)

Due to the importance and complexity of this topic, traders may want to review the complete episode of Market Measures focusing on the historical performance of weeklys when scheduling allows.

It should be noted that the aforementioned analysis centered on a systematic short premium trading approach over a long period of time, therefore representing only one of many different ways that a trader might utilize weekly options. Depending on one’s unique trading approach and risk profile, it’s entirely possible that weeklys may be a good fit for the portfolio—on a one-off basis or otherwise.

Traders should be aware that new weeklys are introduced on Thursdays and that they’re typically not offered for each and every week in a given month.

Because there are many weekly expirations to choose from, traders should be extra careful when selecting the specific contract to ensure it possesses the desired expiration date. While weeklys generally offer strong volumes, traders should also be aware that certain weekly strikes may trade with considerably higher volumes than others—much like monthly options.Weekly options are offered on roughly 400 of the 4000+ optionable stocks and ETFs. Traders seeking to stay current on upcoming weekly offerings in the options marketplace can monitor the Options Clearing Corporation website dedicated to updating information on forthcoming weeklys.