Crude Moves

A veteran futures trader sees opportunity in recent volatility

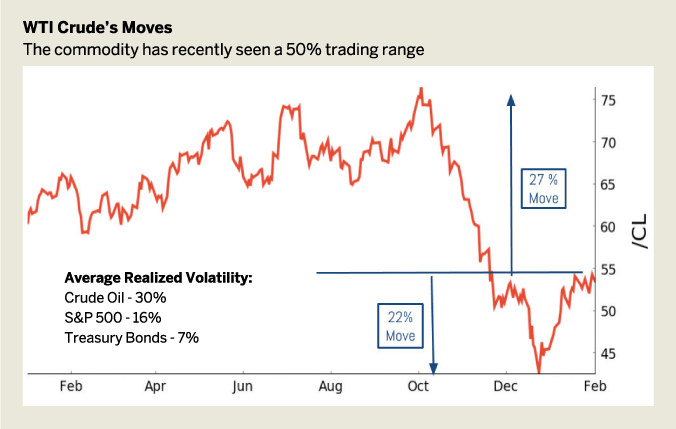

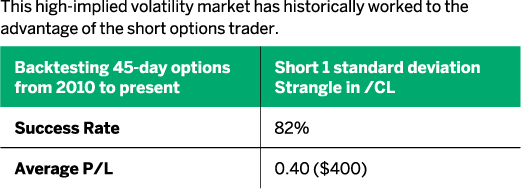

Investors around the world trade an average of a million light sweet crude oil (WTI) futures and options contracts every day. With that mind-altering volume changing hands, WTI futures and options present traders with plenty of attractive asset speculation and hedging opportunities. This high implied volatility (IV) market has historically worked to the advantage of short options traders.

Crude oil is the unprocessed product that’s been withdrawn from the ground. It’s the fossil fuel that’s refined to give consumers their daily rations of gasoline, heating oil, jet fuel and plastics.

Crude oil futures represent the consummate commodity because it’s the most-traded commodity market today. On average WTI crude futures trade two billion barrels per day, the equivalent of almost 30 times the amount of oil used around the world each day.

Crude oil has had an extraordinary amount of movement over the last 12 months. Making a high of $75.40 a barrel in November of last year, the market plummeted to $42.80 before seeing a solid $13 bounce off the lows.

For a pure directional play, traders looking to see a revision of the downtrend after a “healthy” 22% bounce can use a short future, adding a covered put to enhance cost basis and decrease the short delta of the overall position.

The same strategy holds if the upside move resumes and reaches back into the $60 to $65 range into 2019. Keep in mind that with covered puts and covered calls traders can add the call or put against an existing futures position at no additional buying power reduction, or BPR, as long as the expiration month of the option aligns with the future. (BPR refers to using buying power efficiently to maximize the number of occurrences and return on capital.)

While implied volatility has recently decreased from +60%, it currently sits at its five-year historical mean of 35%. With an average correlation of -0.35, crude oil IV is much more two-sided than stock’s IV, which has a correlation of -0.7 relative to price. That’s to say that crude oil experiences spikes in volatility in both directions, so we may not have to wait for new lows in /CL for more expensive options.

iron condors become attractive for defined risk, delta-neutral trades

If IV climbs back into the 50s, iron condors become attractive for investors looking for defined risk, delta-neutral trades. (Iron condors are defined as non-directional options trading strategy.)

Strangles also come into play for those looking for undefined risk. Skewing strangles as the market moves to $60, or to the downside, adds a price reversion aspect to the trade with an attractive theta component.

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the main flagship programming slot called Splash Into Futures.