For Moonshots, Avoid ETFs

Sometimes traders strain to achieve a “moonshot.” They dream of picking a single stock that quickly moves from $1,000 to $100,000. But they shouldn’t expect that to happen with a special-purpose acquisition company exchange-traded fund, or SPAC ETF.

Three such funds are available during the current SPAC craze: the SPAC and New Issue ETF (SPCX), Defiance Next Gen SPAC-Derived ETF (SPAK) and Morgan Creek Exos SPAC Strategy ETF (SPXZ).

But they’re unlikely to launch a moon rocket because ETFs diversify to avoid having all of their assets in a handful of stocks. If they pick a stock that has a dramatic increase in value, most of it will be “rebalanced away.”

Take the case of Apple (AAPL). Apple stock worth $1,000 about

20 years ago is now valued at $459,000. Not bad.

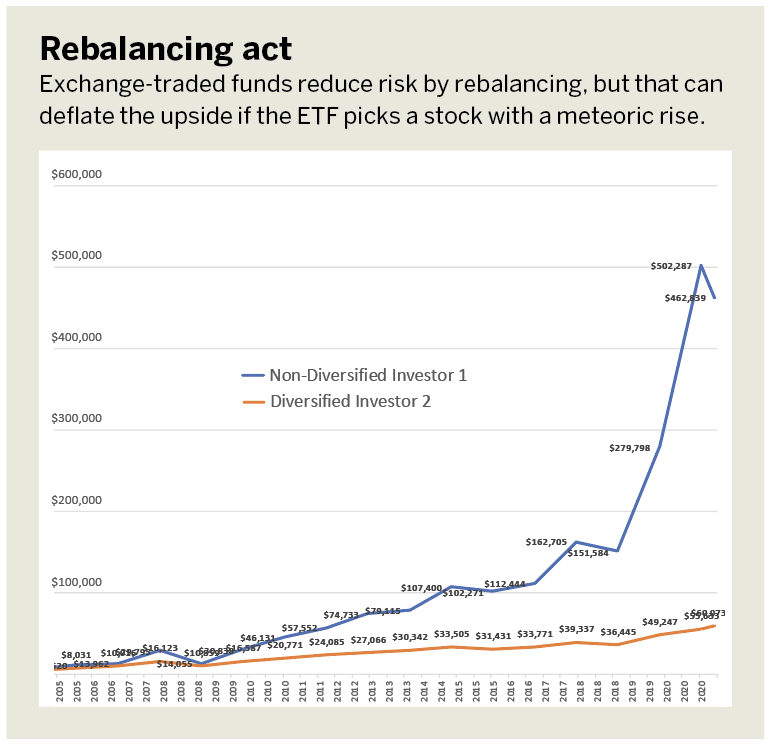

Now, take two investors. Each begins with the same amount of stock in Apple, but Investor 1 holds onto assets for the long term, while Investor 2 trades the way an ETF would.

The specifics: Twenty years ago, “non-diversified” Investor 1 bought $1,000 worth of stock in Apple, Coca-Cola (KO) and Exxon Mobil (XOM). After that, he didn’t touch the account.

“Diversified” Investor 2, on the other hand, bought $1,000 worth of stock 20 years ago in each of the same three companies. But at the end of each year, Investor 2 rebalanced the portfolio to distribute one-third of its value among those three stocks. That’s the way many ETFs work.

Today, Investor 1 has an account worth $463,000, while Investor 2’s account is worth $60,000—even though both accounts held Apple for the entire 20 years.

ETFs mimic Investor 2’s approach. At the end of every quarter or year, they generally rebalance to reduce risk. But gaining diversification can cause underperformance.

In the previous example, Investor 2 is selling shares of the strong performer, Apple, to buy more shares of Coca-Cola and Exxon Mobile, which aren’t performing as well. It’s a classic case of rewarding underperformance.

But that’s what ETFs often do. So they’re great for traders who shy away from “putting all their eggs in one basket,” but they’re less than ideal for those who want to “take the shot.”

Traders invest in SPACs or initial public offerings (IPOs) with the hope they’ll achieve stellar performance, right? So, why invest in a SPAC ETF that prizes diversification that might lead to underperformance?

What can investors do differently? They can peruse the prospectus of each of the three SPAC ETFs and consider their merits and pitfalls. Don’t let the ETF managers reward the lame stocks at the expense of the highflyers!

Michael Rechenthin, Ph.D. (Dr. Data) heads research and data science at tastytrade. @mrechenthinMichael Rechenthin, Ph.D. (Dr. Data) heads research and data science at tastytrade. @mrechenthin. Sign up for free cherry picks and market insights at info.tastytrade.com/cherry-picks