Options With Futures

Why trade E-mini S&P 500 futures when Micro E-mini S&P 500 futures is also liquid and more appropriate for smaller accounts? Trading the /ES on the Chicago Mercantile Exchange (CME Group), for example, is the equivalent of holding $197,000 worth of stocks in the S&P 500, whereas the micro version of this symbol, /MES, holds 1/10th the stock, at $19,700.

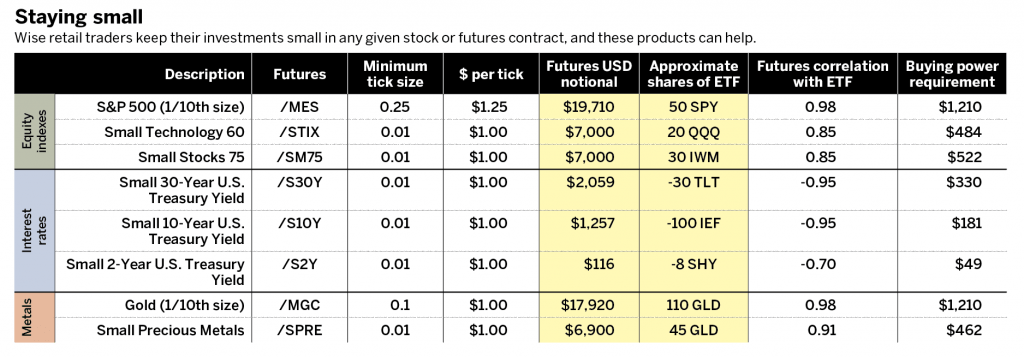

The table below has smaller futures from both the CME Group and the Small Exchange. Here are a few reasons for trading futures:

• No pattern day trading rules in futures. Investors are considered “pattern day traders” when they trade more than four times within five days. They then risk a restriction for 90 days or until the account reaches $25,000.

• Five times greater leverage with futures. Futures margin is based on the exchange’s margining, which enables higher leverage for market participants. It’s not unusual to have leverage of 20:1 with futures, whereas with stocks, it’s 2:1 (and intraday it’s 4:1). That can provide more trading opportunities for market participants.

• Futures have significantly reduced holding costs. Futures’ implied costs are closer to borrowing money at the “wholesale rate” (i.e., the three-month USD-LIBOR rate) with stock, and exchange-traded fund (ETF) margin is at the more expensive “retail rate,” while stock margin can be closer to 10% or more.

• Futures offer favorable tax treatment. Whether a trader has owned futures for a second, a minute or a month, the gains and losses are marked-to-market and taxed at a blended rate of 60% long-term capital gains and 40% short-term rate (which is ordinary income). If a trader disposes of ETF shares within one year, the feds tax 100% of the income at the higher short-term capital gains rate. Those are huge savings—but make sure to consult a tax advisor.

• Futures are neutral products and are as easy to buy as they are to sell. Futures have no uptick rules. The Securities and Exchange Commission’s alternative uptick rule governs securities that have experienced a large drawdown. It locks traders out during some of the most exciting times.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin

Sign up for free cherry picks and market insights at

info.tastytrade.com/cherry-picks