Reading VIX & Spotting Volatility

Ripe & juicy trade ideas

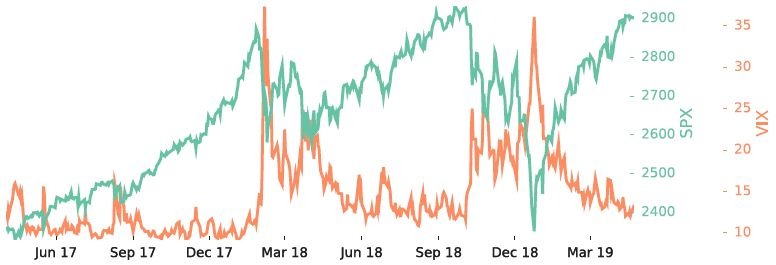

At the time of this writing, the S&P 500 (SPX) has risen by 16% since the beginning of the year to near all-time highs. With that increase, the CBOE’s Volatility Index (VIX)—a measure of fear in the market—has decreased because fear and price are inversely related. In other words, the higher the S&P 500 price climbs, the more the market feels complacent and the less it fears. That equates to a lower VIX price (see “Fall and rise of the VIX,” below).

Fall and rise of the VIX

The higher the S&P 500 price climbs, the more the market feels complacent and the less it fears (lower VIX price).

So, how exactly would an investor interpret the VIX? How can an investor use it to provide a better expectation of movement within an account?

With the VIX at 13 at the time of this writing, the 1-month expectation of price movement in the S&P 500 is ±3.8%. That means that traders are expecting the S&P 500 to rise or fall by 3.8% over the next month 68% of the time. Having this cheat sheet provides a better understanding of the market and enables one to make better-informed decisions in the market.

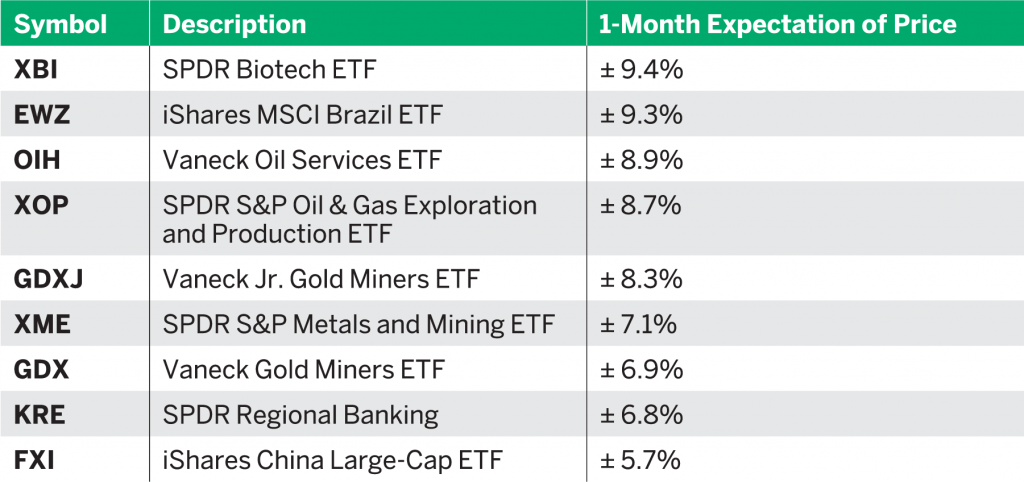

But while the S&P 500 is relatively muted with respect to the expectation of movement, the same can’t be said about other indices and sectors. For example, the Biotech ETF (XBI) is expecting moves of ±9.4% over the next month. Brazil (EWZ) and oil production and service (OIH and XOP) are also seeing a large move expectation, as is shown in “Sectors at a glance,” below.

Sectors at a glance

While the S&P 500 is relatively muted with respect to the expectation of movement, the same can’t be said about other indices and sectors.

That, luckbox reader, is how to take advantage of volatility.

XBI bullish, short put

XBI is down 13% over the past month while the overall market is up over the same period. For the trade idea, we’ll take a bullish stance by selling a put, five strikes below the last sale using the next month’s expiration. For example, with the price of XBI currently at 84, this would involve selling the 79 strike for a price of $2.40.

GDXJ neutral strangle

The Gold Junior Miners—exploration companies that are often considered growth stocks—has been stuck in a range. Here, investors can take advantage of the high expectation of price movement by selling a $2 wide strangle—in other words, sell a put $2 below the current price and a call $2 above the last price. That will profit if the price stays between the strikes.

To sign up for free cherry picks and daily market insights, visit tastytrade.com

To sign up for free cherry picks and daily market insights, visit tastytrade.com

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade.