Dovish Fed Pairs Trading: Stocks and Yields

After conducting three rate cuts so far in 2019, the upcoming meeting of the U.S. Federal Reserve from Dec. 10-11 is expected to be a little less eventful.

The language used by the Federal Open Market Committee (FOMC) after its last meeting in October suggested that, barring any significant changes to the underlying economy, they were likely done adjusting benchmark rates for this year.

While that won’t be known with 100% certainty until Dec. 11, all signs currently suggest that the target benchmark overnight lending rate will remain unchanged, staying put at 1.50-1.75% until at least early 2020.

Although short-term rates may not be changing during the central bankers’ December get-together, there will likely still be some important information conveyed to the financial markets on the 11th, particularly related to positioning by the U.S. central bank going forward in 2020.

Given how closely leadership at the Federal Reserve appears to be following the stock market this year, it seems a good bet they won’t stray too far from the “accommodative” stance that investors have come to find so comforting.

Many might recall that it was the adoption of that same accommodative posture late last year that helped pull equities out of a deep swoon, and it might be the single largest factor in adequately explaining why the S&P 500 has notched record highs in 2019. One can’t forget that the Federal Reserve was actually raising rates as recently as last year.

Dovish posturing by the Fed may also help explain another curious pattern that’s emerged in the financial markets this year, and that’s the breakdown in the traditional relationship between U.S. equity prices and U.S. yields, as outlined in a recent episode of Futures Measures on the tastytrade financial network.

As many market participants are already aware, there exists a strong inverse correlation between bond prices and yields. As yields drop, demand for bonds tends to increase, which pushes up prices. The reverse occurs when yields are rising—bond prices tend to decline.

Along with that relationship is the fact that equity prices and bond prices tend to share an inverse correlation. So when equity markets enter periods of uncertainty, investors exit riskier stock positions in favor of purchasing bonds.

Taking all of these relationships in sum, one can further infer that equity prices and bond yields therefore share a positive correlation. Meaning, when equity prices are dropping, bond prices typically increase, while yields decline.

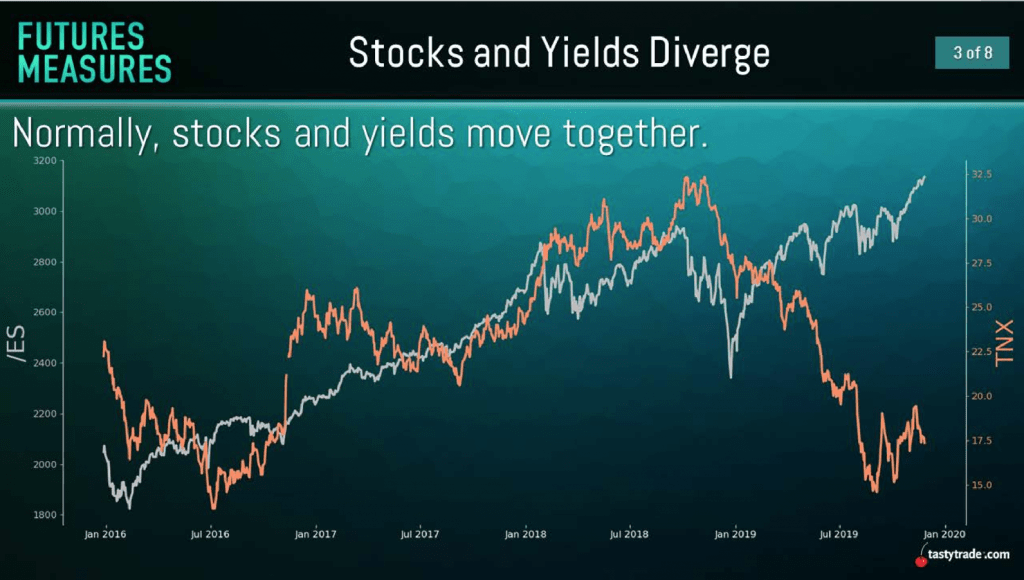

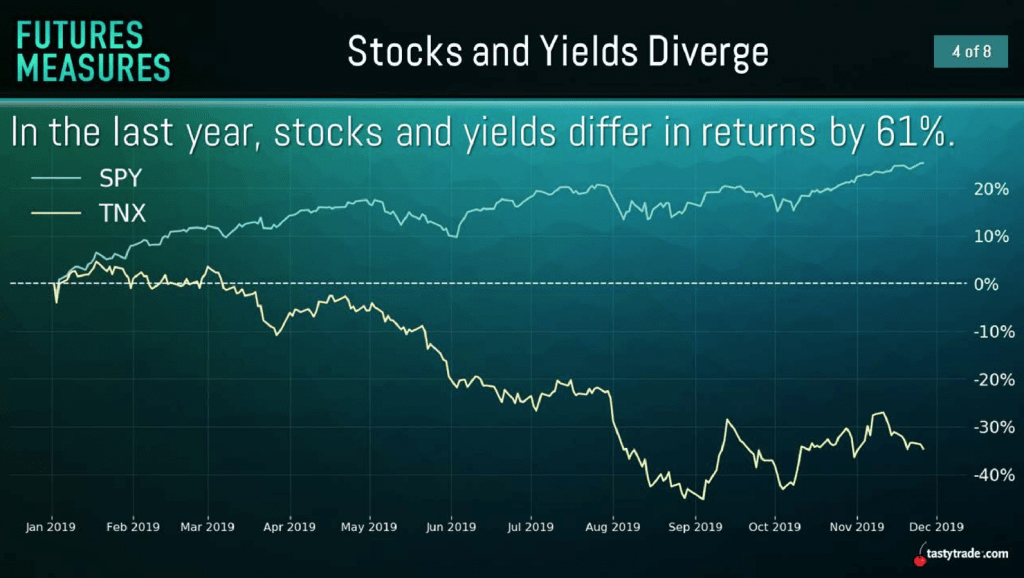

Interestingly, recent tastytrade research on the subject illustrates that in 2019, the positive correlation between equity prices and yields appears to have broken down. As one can see in the graphics below, yields in 2019 have dropped, while equity prices have risen—which is somewhat contrary to the historical relationship:

As indicated in the graphic above, the difference between the respective returns of stocks and yields so far in 2019 is a whopping 61%, the largest gap (on a one-year rolling basis) since 2010.

While it’s hard to precisely identify why such a situation would have developed this year, one could point to the about-face by the Federal Reserve as the most likely culprit.

The Federal Reserve typically reserves rate cuts for periods in which the U.S. economy is experiencing a severe downdraft in growth. Equity prices can sink during rate-cutting periods because a slowdown in the economy generally isn’t great for businesses operating in said economy, either.

The unique issue at hand in the past couple years involves the economic uncertainties presented by the U.S.-China trade war, which has at times produced conflicting indicators. One could argue that the Federal Reserve’s recent change from raising rates to cutting them was a preemptive action to comfort the financial markets in case “a shoe dropped” in the trade war.

The Chairman of the Federal Reserve, Jerome Powell, seemingly backed up that line of thinking when he said after the most recent rate cut in October, “We took this step to help keep the U.S. economy strong in the face of global developments, and to provide some insurance against ongoing risks.” The use of the word “insurance” in that context certainly sounds “preemptive.”

Taking that logic a step further, is it any surprise that investors have pushed equity prices to record highs, backed by an uber-dovish Fed?

Whether that’s the precise reason for the breakdown in the relationship between equity prices and yields, the data nonetheless clearly illustrates that yields have gone down in 2019, and that stock prices have gone up.

And one might next wonder how long that paradigm can last?

On the aforementioned episode of Futures Measures, the hosts outline a hypothetical pairs trade involving equities and yields. The intent of the trade is to capitalize on the breakdown in the relationship between equity prices and yields, such that a return to “normal” would theoretically benefit this structure.

For a complete rundown on the current relationship between equity prices and yields, as well as more insight on the sample pairs trade, traders may want to review the complete episode of Futures Measures when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.