Trades

Forget Mayweather-Paul, how do Growth stocks stack up vs. Staple stocks?

Ripe & Juicy Trade Ideas

|

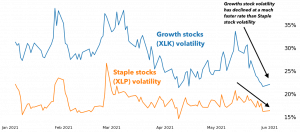

Growth stocks (XLK) have seen a huge decline in volatility. The growth stock index, XLK, has declined from a peak implied volatility of 35% to 22%, whereas staples (XLP) has declined from 20% to 16%. The graphic below represents this change:

So how can we trade this market?

- Since volatility is low in XLK and has the potential of increasing at a faster rate—we can use a Calendarized Diagonal trade, which is getting long the back month and then selling the front-month expiration.

- With IV Ranks of 9% and 3% in XLP and XLK respectively, standard short premium trades such as credit spreads or strangles don’t collect much premium. Instead, traders may look to get directional, buying debit spreads.

- Price-wise, XLP is up 5% in 2021, XLK is up 6.5%. Both fall short of the overall S&P 500 which is up 12% YTD. With a historically slower-moving index—choose XLP. Want something with a bit more action, choose XLK.

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Data Science at tastytrade; James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade; and John Kicklighter, Chief Strategist at DailyFx with an expertise in fundamental analysis and market themes.

Cherry Picks

-

The Diversification Myth

|Buying a wider variety of stocks won’t decrease risk much if their prices are closely correlated -

Fundamental Intelligence

|Getting smart about these AI stocks begins with an understanding of the basics Be smart picking stocks in the artificial intelligence sector by considering the fundamentals of 12… -

Good Pharma Karma

|The healthcare sector is set to contribute to your bottom line The market downturn has been kind to the healthcare sector. The S&P 500 (SPY) dropped 16% since the beginning… -

Affordable Futures

|Retail investors can use new smaller futures contracts to hedge their portfolio bets Hedge fund managers and other big investors have been using futures to reduce risk for years, but… -

Six Traders, Six Trades

|A trading committee offers long- and short-term strategies for the new year Tony “BAT” Battista Bullish investors looking to take a long-term view could consider a very wide broken wing… -

2 Trades for the Cautious Gold Bug

|Here’s how investors can make money from the glittering precious metal, even when it’s declining in value Many in the financial world think of gold as a safe investment and… -

Home in on Cyclical Stocks

|Use a counter position to take advantage of the volatility of equities that move with the market -

The Blunt Truth About Pot Stocks

|Cannabis-related stock prices are falling as the nation awaits federal decriminalization After the 2020 U.S. presidential election, cannabis stocks reached new highs as the nation waited for President Joe Biden… -

6 Looks at Energy Stocks

|Crude oil prices of more than $100 a barrel are boosting stock prices in the petroleum sector, but the effect on the S&P 500 is limited because the commodity accounts… -

Futures Notional Values, the Crude Oil Curve and Current Index Skew

|Current Futures Notional Values Below are the current notional values for popular futures contracts. We also included their ETF approximate share equivalence, as well as their correlations to the ETFs.… -

Drawdowns, Data Sources and Trades Ideas

|What kind of drawdowns can be expected if you bought at the absolute worst time every month? Here are the 30-day drawdowns, over the past five years, of buying at… -

Backtest and Forward Test with Lookback

|See how a strategy performs before risking money on a trade Lookback, a free options analysis tool from tastytrade, provides two ways of examining the profit and loss around an… -

Correlations, Volatilities and Meta

|If you like X, you might also like A, B and C Take a look at the three most correlated stocks for every stock in the Nasdaq 100. We are… -

Historical Volatility and Implied Volatility

|Free Download – Historical Volatility and Implied Volatility In this morning’s Cherry Picks, we are providing a free download of approximately 1,100 stocks and ETFs along with their historical and… -

The One with All the Earnings

|Earning Season, Birds of a Feather Flock Together Earning Season “officially” begins with the big banks. See the graphic below that shows the number of sectors that report per day.… -

Yields, S&P Sector Performance and Earnings

|Yields on the Move With all the discussion of yields in the news lately, it is nice to see what’s moving. As seen on the graphic below, most of the… -

Seeking Diversity

|Rather than seeking to predict the next big thing, consider buying any of these 20 tickers to diversify a portfolio in the new year When all of the stocks and… -

What’s going on with the market?

|Take a look at the major indices (SPY, IWM, QQQ) and the equity sectors. Discretionary (XLY) is down the most over the past month, while Health Care (XLV), Real Estate…