Naked Puts for the Risk Averse

In the Tactics section of this issue, an article entitled Three Ways to Play Long Odds offers three strategies for placing speculative trades. Here, readers will find an “anti-speculative” strategy that’s less risky than buying stock.

It’s called the naked put in a liquid exchange-traded fund (ETF) such as SPY, QQQ, IWM, DIA or XLU.

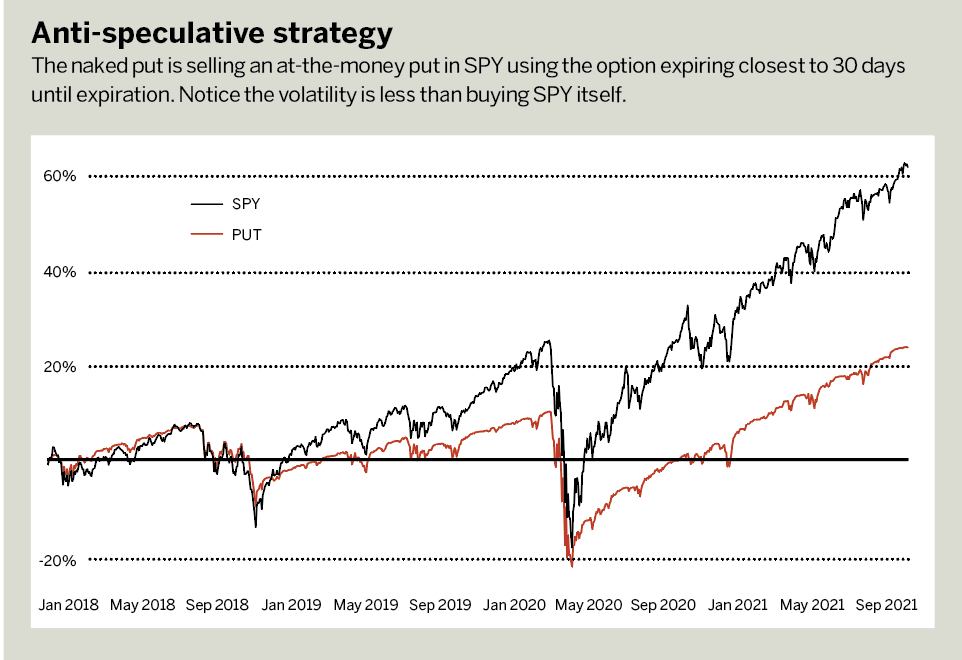

This is the equivalent of taking a long position in a stock but with less risk. For an example, take a look at Anti-speculative strategy, below. SPY is the equivalent of buying shares of the S&P 500 three years ago. The naked put (PUT) is the equivalent of selling an at-the-money put in SPY using the option expiring closest to 30-days until expiration. This is held and then repeated.

Notice the simple put underperformed during this period. But it’s OK to underperform the market, even though financial gurus often suggest investors have to outperform a benchmark to be successful.

The advantage of the short put is it tends to make money more consistently and with less volatility on a month-to-month basis. Less volatility simply means the position will have a tendency not to move too much. It will have lower peaks and higher troughs.

For a lot of savvy investors, trading isn’t necessarily about making 10%, 20% or 30% returns on a yearly basis because those high returns often come with a higher likelihood of large losses. Instead, many would prefer the consistency that comes with selling a put in an ETF that they wouldn’t mind getting long in.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin

Sign up for free cherry picks and market insights at info.tastytrade.com/cherry-picks