Seasonal Opportunities in the Natural Gas You Can Trade

While the heavyweight in global energy markets remains crude oil, natural gas is no slouch.

On any given day, trading volumes in natural gas futures are typically the second highest within the energy sector. Even when considering the entirety of the futures-trading marketplace, total daily volume in natural gas usually places it in the top 10 of all available products.

But with crude oil making headlines in terms of movement and volatility, one might wonder why natural gas still gets so much attention.

Well, there are a couple reasons.

First, natural gas prices are arguably trading at a price extreme—or very close to one. Natural gas is priced at $2.22, which is only a hair above $2.20 per MMBtu. The latter value ($2.20) represents a three-year low in natural gas prices, which is where the commodity traded briefly in June of this year.

Putting that price in context, consider that sub-$2 natural gas prices are relatively rare. Looking at a longer-term historical chart in natural gas, one can see that prices briefly got as low as $1.65/MMBtu only once in the last five years. Before that, one would have to go all the way back to the 1990s to find a similar level—$1.69/MMbtu in 1995.

On the opposite end of the spectrum, gas prices got as high as $5.53 in January 2014, and reached the dizzying heights of $15.47 in July 2008. These values infer there’s plenty of upside available for natural gas if it ever goes on a run.

The fact that natural gas is currently probing the lower end of its historical range is certain to have caught the attention of more than a few traders who embrace the contrarian philosophy.

Beyond the low price levels, another reason for increasing interest in the commodity at this time relates to the season. Natural gas is integral for heating homes throughout the United States (and the rest of the world), and the onset of winter has traditionally represented a period when natural gas prices experience the highest degree of volatility.

It’s the combination of low prices and the cold weather season that caught the attention of the Options Jive team at tastytrade—and why they featured this dynamic commodity on a recent installment of the series.

The great thing about this specific episode is that the hosts of Options Jive not only highlight why increasing winter demand for natural gas could prove fruitful for bullish traders, they also outline how current trading conditions in futures options associated with natural gas may be worth a second look.

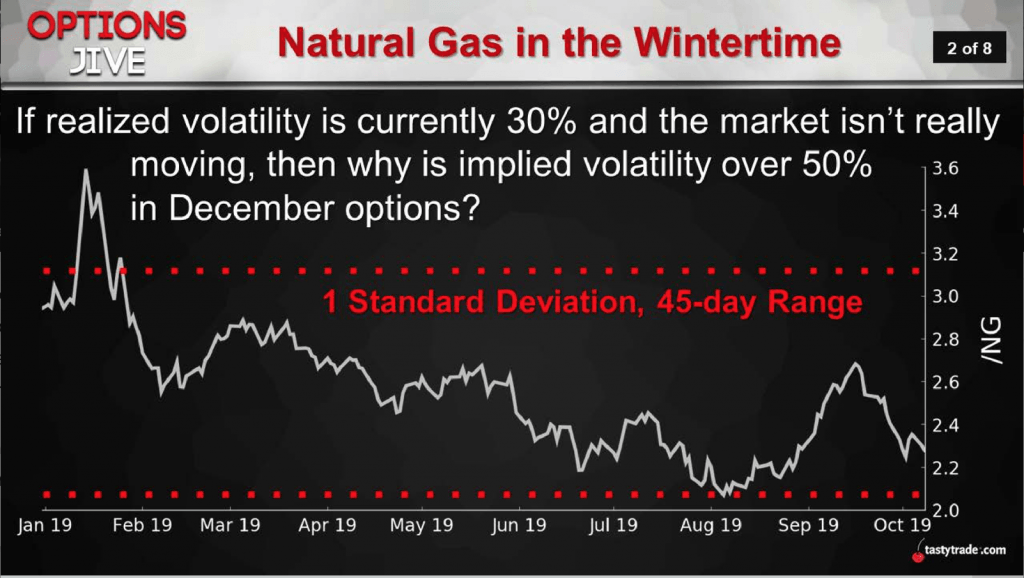

The chart below illustrates how natural gas options are currently trading at 50% implied volatility, despite the fact that realized volatility lately has been far lower—only 30%.

The one caveat to the above information is that colder temperatures have already arrived in some places around the United States, which means higher levels of realized volatility may not be far behind.

The above means that short volatility traders will need to weigh the extra premium available in the market against a potential weather catalyst, the official start of winter. Obviously, natural gas isn’t immune to other major news narratives, and important developments related to the trade war could push prices in one direction or the other. A resolution of the trade war would almost assuredly “lift all boats” in terms of impact on the financial markets.

Looking past the impact of weather, another important metric to follow in the natural gas arena is the weekly storage report.

Just as crude oil traders closely monitor how much “black gold” is held in storage around the U.S. as an indication of demand, so too do traders of natural gas. As of now, natural gas stores are nearly level with the average of the last five years. In that regard, the demand-supply dynamic isn’t necessarily in line with the current drop in prices, either.

Traders seeking more information on the current trading environment in the natural gas market may want to review the complete episode of Options Jive when scheduling allows. Additionally, pairs traders should find a previous installment of Closing the Gap: Futures Edition equally compelling. The show features a position structure that pits crude oil against natural gas, as the two tend to trade with a degree of positive correlation.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.