Silver Finally Follows Gold Higher

When rare and extreme things occur in the financial markets, news of these events usually spreads like wildfire. This tends to capture the attention of not only investors and traders, but also millions of people that don’t usually monitor the financial markets.

For example, in the entire trading history of the Dow Jones Industrial Average, which has been tracked for nearly 135 years, there have only been 11 days in which the index has moved more than 6% from open to close. Interestingly 9 of those 11 instances occurred during the Great Recession (2008-2009), which helps underscore just how unusual that period was in market history.

While no such move has yet been observed in the Dow Jones so far in 2019, there are some other extremely rare and extreme moves occurring in other niches of the financial markets. One great example can be found in the precious metals sector, which has seen some very unusual activity so far in 2019.

As reported by luckbox magazine earlier in the summer, the Gold-Silver Ratio notched nearly 30-year highs already this year. And while this news doesn’t equate to a historic high or low in the value of gold and silver themselves, it does speak to a historic move in the price relationship between these two highly correlated precious metals.

In fact, there have only been a few periods in the entire 100+ year history of gold and silver trading that have seen such behavior – the early 1940s, the early 1990s, and now.

The extreme behavior itself all boils down to the traditional trading relationship between gold and silver, which has historically been characterized by a very strong positive correlation – on average about 0.89. Given that a perfect correlation equates to 1.00, one can see how gold and silver tend to move together to a very high degree, on average.

It’s when this trading relationship breaks down, as observed in recent months, that gold and silver traders tend to move closer to the edge of their seats. And one metric commodities and futures traders use to monitor the gold and silver trading relationship is known as the Gold-Silver Ratio.

The Gold-Silver Ratio is calculated by simply taking the price per ounce of gold and dividing it by the price per ounce of silver. The quotient of that equation essentially reports how many ounces of silver are required to buy a single ounce of gold, at any given point in time.

For example, at the start of the year, when gold was trading for roughly $1,283/ounce, and silver was trading for $15.70/ounce, that meant approximately 82 ounces of silver were required to purchase a single ounce of gold ($1,283/$15.70 = 82).

During the last 20 years or so, the typical range in the Gold-Silver Ratio has been roughly 45 to 80. However, in recent months, the Ratio had sky-rocketed higher, making its way toward heights rarely observed in the entire trading history of these two metals.

On the wings of a strong gold rally, alongside relative stagnancy in the silver market, the Gold-Silver Ratio got within a whisker of 100 recently – a level only previously observed in the 1940s and the 1990s.

For reference, that also means 100 ounces of silver were required to purchase a single ounce of gold. When one considers that 30 ounces of silver would have bought you 1 ounce of gold at several different points in history, the recent disparity in the price relationship of these metals certainly seems extreme.

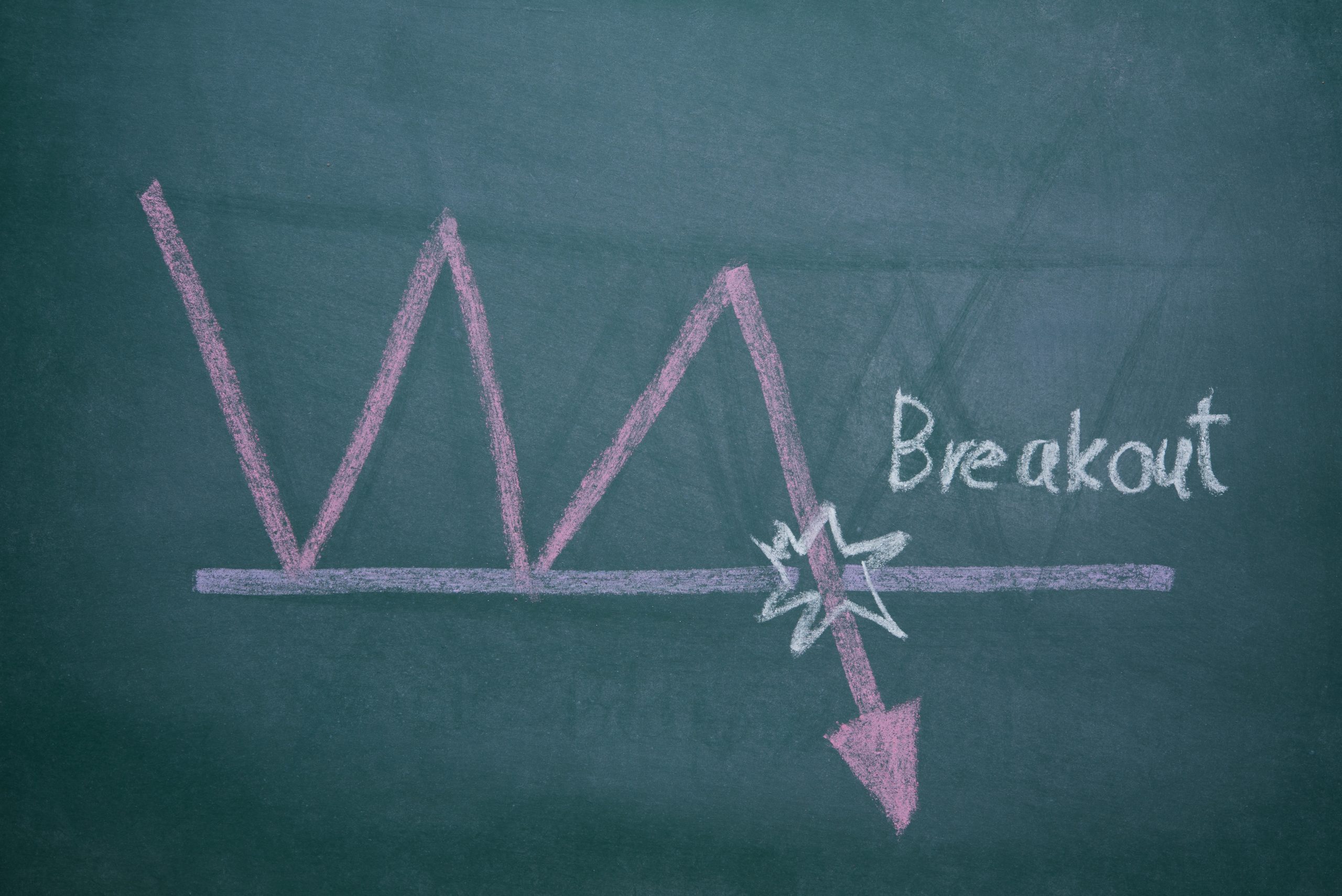

And when extremes are breached – whether they be the lower or upper ends of the Gold-Silver Ratio – pairs traders tend to start paying closer attention. This summer, the Gold-Silver Ratio is pushing the upper boundaries of its all-time highs, which certainly qualifies as a potential opportunity.

To play a divergence such as this, a pairs trader would strongly consider short selling gold in favor of purchasing silver. A short gold and long silver pairs position theoretically benefits when the Gold-Silver Ratio moves lower.

Recently, due to an absolutely breath-taking rally in silver, the Gold-Silver Ratio did just that. As of July 18th, the Ratio had dropped from the nose-bleed levels of nearly 100, all the way back down to 88 – which is actually still very high by historical standards.

Prior to the July rally, silver had actually been down on the year, despite the fact that gold was in the midst of a strong rally over the last couple months. Year-to-date, gold is now up 11%, while silver is only up about 4%, which means there may be room left in the silver rally.

It should be noted that silver started 2019 trading at roughly $15.80, and dropped down to nearly $15.00 before the July rally started. That’s why the current price of around $16.40 represents only a net rally of about 4% on the year.

The biggest takeaway from the recent rally in silver, and ensuing drop in the Gold-Silver Ratio is that traders looking for action may want to start monitoring the precious metals space a little more closely.

Should the Gold-Silver Ratio rebound from 88 and trend higher, there may be another opportunity to deploy the short gold and long silver pairs trade – if a trader’s outlook called for a drop in the Ratio.

Alternatively, volatility traders may also be attracted to the precious metals sector. As reported on a recent episode of Options Jive on the tastytrade financial network, implied volatility in the precious metals sector has also been spiking.

Traders seeking to learn more about volatility-related opportunities in the precious metals space will find the aforementioned episode of Options Jive extremely compelling.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.