Solar Looking Brighter Under Biden

Advances in solar panel technology are pushing solar stocks higher

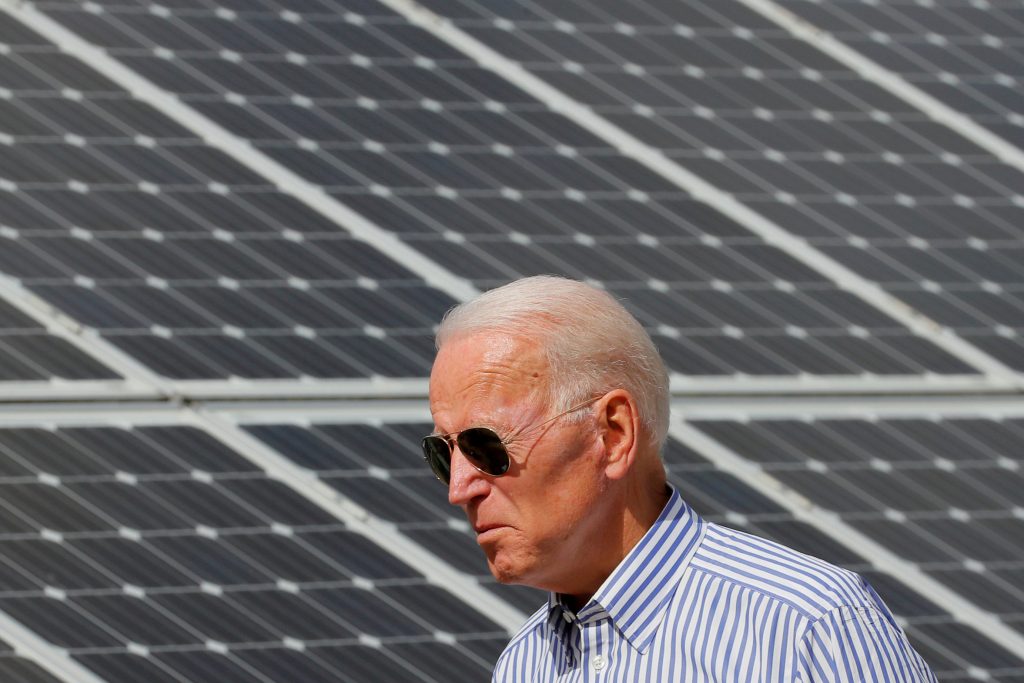

Riding an incredible wave of positive energy, the global solar sector has been sizzling hot in 2020, and the election of former Vice President Joe Biden appears to have further fueled the euphoria.

Prior to the election, the two narratives primarily fueling the sector this year were positive developments in solar panel technology and declining cost trends across the industry.

Speaking to technological advancements, the biggest news relates to so-called “bifacial modules.” That may sound like a mouthful, but “bifacial” simply refers to a new generation of solar panels that utilize both sides of the module to gather sunlight. While that may seem akin to “sliced bread” in terms of innovative simplicity, the small change could prove pivotal for the industry.

It should be noted that bifacial technology isn’t new—it was actually developed in the 1960s. The real story in 2020 is that the technology has finally gained traction and is now building momentum in terms of commercial penetration.

Looking at the basic mechanics of a solar panel, one can see how the “sunny side” can be used to gather sunlight. Silicon cells inside upward-facing solar panels capture photons from sunlight and convert them to energy. At first blush, it’s less clear how the opposite side of the panel—facing away from the sun—might be utilized.

How it works

The key to optimization of the panel’s “dark side” is linked to the type of surface upon which a solar module is installed. When placing a solar module upon a reflective surface, the sunlight that passes alongside or behind the front-facing panel has the opportunity to be reflected off the ground and back into the “dark side” of the panel.

By capturing reflected sunlight, the energy potential of each panel increases significantly.

Estimates suggest that bifacial modules can produce 10%-20% more energy than traditional “mono-facial” (i.e. one-sided) panels. However, the hope is that gains might be as high as 40% in the near future.

Economies of scale

Adding to their allure, the cost of adding the solar panels to the back of the module hasn’t been prohibitive. The incremental cost of producing a two-sided bifacial panel is now seen as more cost-effective than producing two separate mono-facial panels.

The economics of solar panel production are critical because success in the energy market is predicated on the ultimate cost of electricity to the consumer. Raising the energy potential of solar panels without a big jump in cost should theoretically make this source of energy even more competitive in the market.

Interestingly, these benefits dovetail well with the other big solar story emerging in 2020: declining costs across the industry linked to emerging economies of scale.

On Oct. 22, the International Energy Agency (IEA) released a report suggesting that solar is now the cheapest form of electricity that utility companies can build. This announcement was founded in the IEA’s recent assessment that the cost per megawatt of building solar facilities has dropped below that of traditional power plants for the first time in history.

On top of that, the maturing nature of the solar industry has also made the financing of such deals a lot easier to come by, which has likewise reduced costs.

Traditional utilities have long been viewed as “safe” investments by financial institutions, which means they often qualify for some of the lowest corporate borrowing rates. Financing for solar deals has slowly crept lower in recent years as perceived risks associated with solar installations have dissipated.

The declining cost of capital for solar projects has also contributed to the declining cost per megawatt noted by the IEA.

It’s getting cheaper

A decade ago, the global average cost for solar power was about $300 per megawatt-hour. That dropped to approximately $100 by 2016. This year, the cost per megawatt-hour is estimated to have dropped to between $45 and $55 for utility-scale solar plants.

By comparison, the IEA estimates that the cost per megawatt-hour for a traditional coal-powered plant ranges between $55 and $155.

The chart below highlights the estimated range of costs per megawatt-hour for the most pervasive alternative and conventional energy sources. (Note: the “levelized cost” refers to the average cost of electricity generation per megawatt-hour over the lifetime of a plant).

With many global investors now screening for socially conscious—or “green”—investments, the surging competitiveness of solar power plants could represent a critical shift. The IEA report went so far as to suggest that solar could soon be crowned “the new king of electricity supply.”

The fact that wind and solar company NextEra Energy (NEE) displaced ExxonMobil (XOM) as the country’s most valuable energy company this year supports the veracity of that claim.

Solar in a Biden presidency

Factoring these solar developments into the results of the U.S. presidential election provides a fairly strong basis for continuing optimism. President-elect Joe Biden has voiced concerns over climate change many times, as well as a strong interest in pursuing initiatives that reduce the carbon footprint of the United States.

Solar is arguably a perfect fit for that vision.

While President-elect Biden would probably require the assistance of Congress to institute meaningful change, there are some things he could accomplish through executive orders that could immediately benefit the U.S. solar industry. That’s because solar panels are one of the many products caught up in President Donald Trump’s various trade wars.

According to estimates, the tariffs placed on solar panels by the Trump administration have cost the industry about 62,000 jobs and $20 billion in lost investment since inception. Industry experts often list the tariffs as one of the biggest impediments to solar’s growth in the United States.

As president, Joe Biden might not be able to push through a transformational agenda such as the “Green New Deal” without Democratic control of both houses in Congress, but he could almost certainly remove American tariffs on imported solar technologies.

That could be a big reason solar stocks have moved higher in recent days, building upon their strong 2020 performance.

First Solar (FSLR), one of the best-known names in the U.S. solar sector, is up roughly 54% so far in 2020. The stock gapped up as high as $93/share on better-than-expected earnings at the end of October, but has retraced slightly since that time.

In the wake of the election on Nov. 3, the solar sector did experience a strong rally, with names such as SolarEdge Technologies (SEDG), Canadian Solar (CSIQ) and SunPower (SPWR) all climbing more than 10% on Nov. 5, when Joe Biden’s election to the White House became increasingly apparent.

Other companies with heavy exposure to the solar industry that investors and traders might want to track include:

- AES Corp (AES)

- Brookfield Renewable Partners (BEP)

- TerraForm Power (TERP)

- Enphase Energy (ENPH)

- Sunrun (RUN)

- JinkoSolar (JKS)

Of course, no industry is bulletproof, and there’s always the possibility that the solar sector suffers a pullback in 2020 or 2021.

Possible threats

One of the biggest threats to solar’s growth prospects at this time is the coronavirus pandemic. Globally, there have been several large-scale solar projects that have been trimmed back or canceled altogether due to declining economic activity.

An exacerbation of the pandemic could result in additional cutbacks.

Another impediment to growth appears to be a global shortage of the glass used in manufacturing solar panels. This has resulted in rising costs and delivery delays, both of which could pressure the solar sector’s ability to expand in the short term.

Investors and traders interested in tracking the Biden administration’s early agenda would be well-advised to monitor the solar sector closely in the coming weeks and months.

To follow all the action moving the markets in the aftermath of the U.S. presidential election, readers are also encouraged to tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. Central Time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.