The Changing Tickers of Volatility

The late, lamented VXX—a volatility product that provided exposure to changes in the Cboe VIX Index through near-term VIX futures contracts—was one of the most actively traded exchange-traded notes (ETNs). Investors who thought market volatility might go up or down could buy or short shares of VXX—VXX RIP.

It was supposed to be simple. But the operative word is “was.” In January, the VXX portfolio was liquidated and the product delisted by its issuer, Barclays. Why? It was not due to lack of popularity, which is what kills most new trading products. It was a structural problem with the VXX itself.

To replicate the performance of the market’s volatility (i.e., the Cboe’s VIX Index), VXX held a portfolio of VIX futures (/VX). The reason is that it’s not possible to buy the VIX directly, and not practical to replicate the VIX Index with a portfolio of SPX options.

/VX futures are actively traded, so it made sense to buy them in the VXX portfolio. The problem with /VX futures, as far as the VXX was designed, is that they expire. For the VXX not to expire right along with the /VX futures, it had to roll them from one expiration to another. At any one time, then, the VXX was comprised of /VX futures in the front-month expiration and /VX futures in the second expiration.

For investors who think the new VXX will suffer the same fate as the old VXX, a consistent bearish strategy could be profitable

When the front-month /VX futures expired and the next /VX futures became the front month, the VXX portfolio was 100% in that new front-month future. Every day after, the VXX would roll about

4% of its front-month /VX futures to the next expiration.

For example, on the first day that the September /VX futures became the front month, the VXX would be 100% in the September /VX futures. The next day and every day after, VXX would sell some of its September /VX futures and buy an equivalent number of October /VX futures. By doing so, when the September /VX futures had expired, the VXX portfolio would be 100% in October /VX. That way, VXX always had /VX futures in its portfolio.

But here’s the problem: Most of the time, the second month /VX futures is in contango to (higher than) the front-month /VX futures. The September /VX futures might be 16.00, and the October /VX futures might be 16.75. When the VXX rolled its September /VX to October, it would lose that .75 difference. When the contango was steep, the VXX lost more money on each roll. Sometimes the /VX futures were in backwardation, with the front-month /VX trading over the nextmonth /VX. In that case, the VXX would make money from that roll. But the /VX futures were never in backwardation very often or for very long.

That loss from the daily roll when the /VX futures were in contango dragged on the VXX’s price. The VXX dropped so steadily over time that it had five 1:4 reverse splits in its life to keep its price from getting too low. But this decline in price was never going to end, and when the VXX’s actual charter expired 10 years after its creation in 2009, Barclays closed it down.

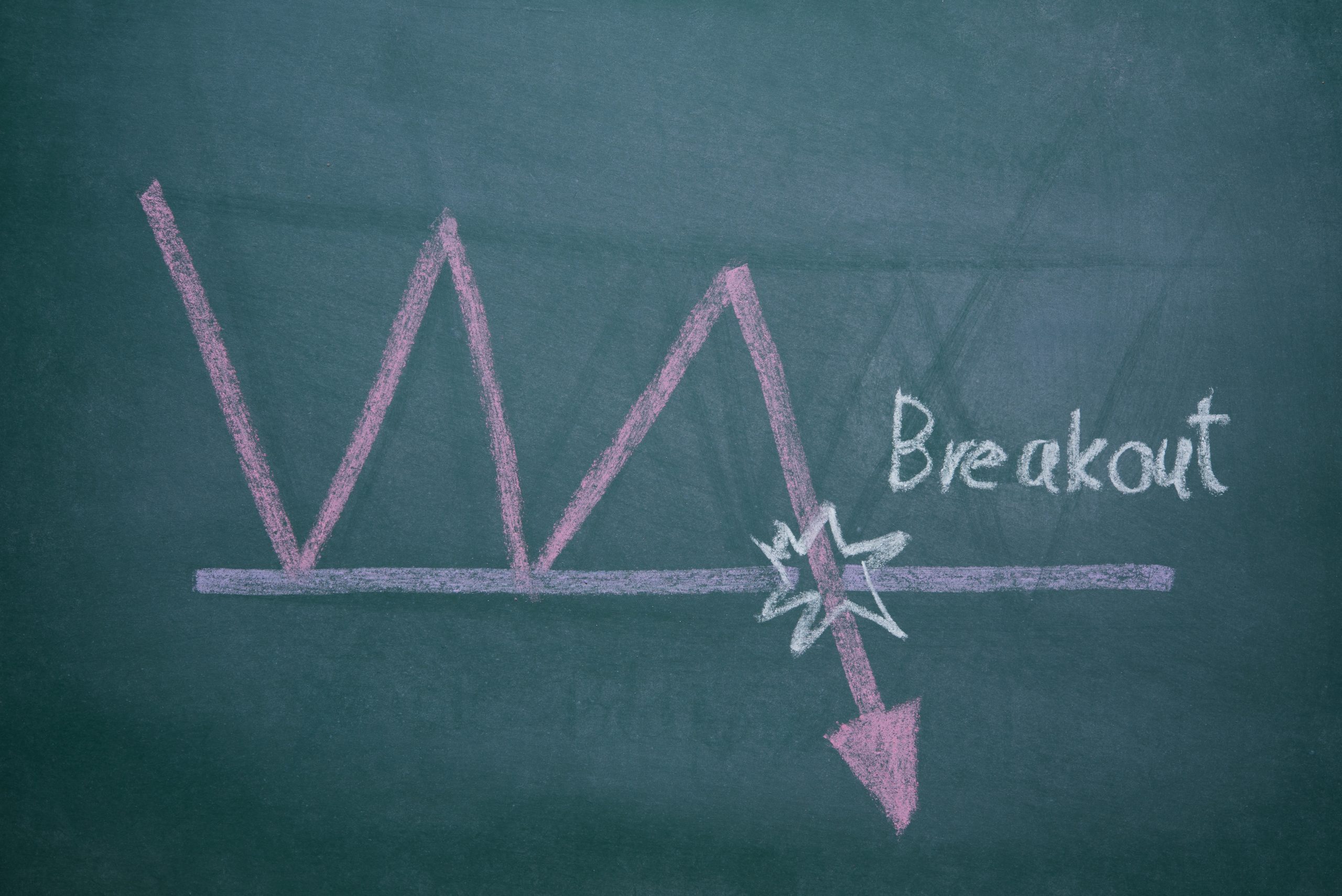

From a trading standpoint, the VXX was a great short because its price just kept sinking except for a few rare occasions when volatility spiked and took VXX with it. That’s why it was best to use defined risk bearish strategies in VXX as opposed to shorting its shares.

But shortly after VXX’s demise, Barclays created a new ETN, VXXB, to replace it. While it differs in a couple ways, the main difference is that VXXB matures in 30 years, not 10 years. However, its portfolio is still comprised of /VX futures, and it hasn’t escaped that drag from its rolling process. And if that weren’t enough, Barclays changed the name of the VXXB to VXX in May.

So, VXX is back, as are its options! And for traders who think the new VXX will suffer the same fate as the old VXX (and particularly if they understand why), a consistent bearish strategy could be profitable over time. Just keep the trade small and with defined risk.