Trading China’s Coronavirus (Part 9)

Is the Coronavirus the Next Black Swan?

Coronavirus Updates:

- The estimated number of global coronavirus infections has risen to more than 75,685 with at least 2,236 associated fatalities

- At least ten deaths linked to the new coronavirus have now occurred outside of mainland China (France 1, Hong Kong 2, Iran 2, Japan 3, the Philippines 1 and Taiwan 1)

- Vietnam has quarantined a community of 10,000 people near the capital of Hanoi for precautionary purposes – the first large-scale quarantine area to be established outside of China

- At least 750 million people in China are now living under restrictions governing how often they can leave their city and/or home

- Updated COVID-19 data now indicates that the novel coronavirus has a mortality rate of approximately 2.5% (previous research suggested it was less than 2%)

- The World Health Organization (WHO) has documented about 100 person-to-person transmissions of COVID-19 outside of China, but stated there is little evidence of “sustained local transmission” as of now

- Global health experts have said it’s too early to determine whether the spread of the virus is slowing

- Russia has temporarily banned the entry of Chinese citizens into the country as a precautionary measure

- South Korea now has the second-highest number of infected patients (~200) after mainland China

- Car sales in China are believed to have slumped nearly 90% in the first half of February due to the outbreak

- Reduced global travel could cost the airline industry up to $30 billion in lost revenue during 2020

- Apple (AAPL) announced recently that it would miss its 2020 sales forecasts due to supply chain disruptions associated with the coronavirus outbreak in China

- Recent reports further suggest that Apple iPhone sales in China have plummeted 40-50% during February and March due to store closures and falling demand linked to the mass quarantines

- Adidas (ADDYY) announced that sales in China have slumped 85% as compared to the same period last year

- Half of all retail malls in China remain closed due to concerns over the virus

Black Swans and the Coronavirus

The 2007-2008 Financial Crisis and associated Great Recession brought a lot of attention to what otherwise might have been a relatively unknown book, The Black Swan: The Impact of the Highly Improbable by Nassim Taleb.

Had the financial markets maintained their normal upward bias through 2007 and 2008, it’s easy to see how The Black Swan may have been relegated to the dustiest corners of graduate business schools throughout the world, instead of most traders’ personal libraries.

Instead, the timing of the book’s release (2007) couldn’t have been planned more fortuitously, given that the focus of the book is the possibility for unforeseen financial calamities, and how the great majority of modern economic and financial models don’t seem to assign a high enough probability of occurrence to such events.

In short, Nassim Taleb described a “black swan” as an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight.

Publishing those thoughts immediately before the Financial Crisis, as was the case with Professor Taleb, effectively raised his soothsayer status to that of oracle/guru – or at minimum “a smart guy that should be listened to going forward.”

As it turned out in 2007-2008, financial and economic models had indeed failed to assign an appropriate level of risk to the possibility that Wall Street would mispackage high-risk real estate investments as low-risk products that were fit for investment by Main Street.

Look no further than the destruction wrought upon Bear Stearns, Lehman Brothers, and US stock market indices (40% pullback) as solid proof of how poorly that particular piece of financial engineering went over, and how the ensuing chaos cemented the relevance of the black swan theory to modern investing.

As of now, the current coronavirus epidemic still appears to resemble a flock of slightly unsettled white swans as compared to the type of cataclysmic events that characterized the Financial Crisis. However, nobody can guarantee with 100% certainty that there isn’t a black swan hiding somewhere within the current group.

And after Apple announced earlier this week that revenues may suffer in 2020 as a result of the coronavirus, it’s likely that investors and traders will start combing the news feeds a little more closely for potential red flags.

For those wishing to track the webbed footprints of a potential black swan, a new episode of Futures Measures on the tastytrade financial network is a great launching point.

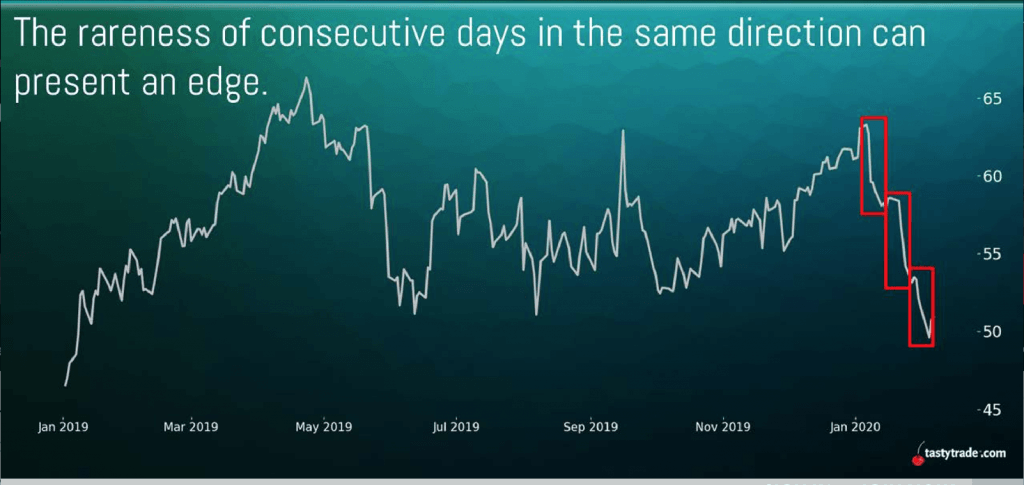

As one can see in the chart below, the value of the euro (relative to the dollar), dropped recently in 7 of 8 trading sessions:

The euro (relative to the dollar) often moves lower when uncertainty in the financial markets increases, especially because the dollar can be viewed as a “safe haven” during periods of global economic distress.

The crude oil market has been even more volatile than the euro, with WTI crude dropping in value by about 17% during the last five weeks (although it did rebound slightly, recently):

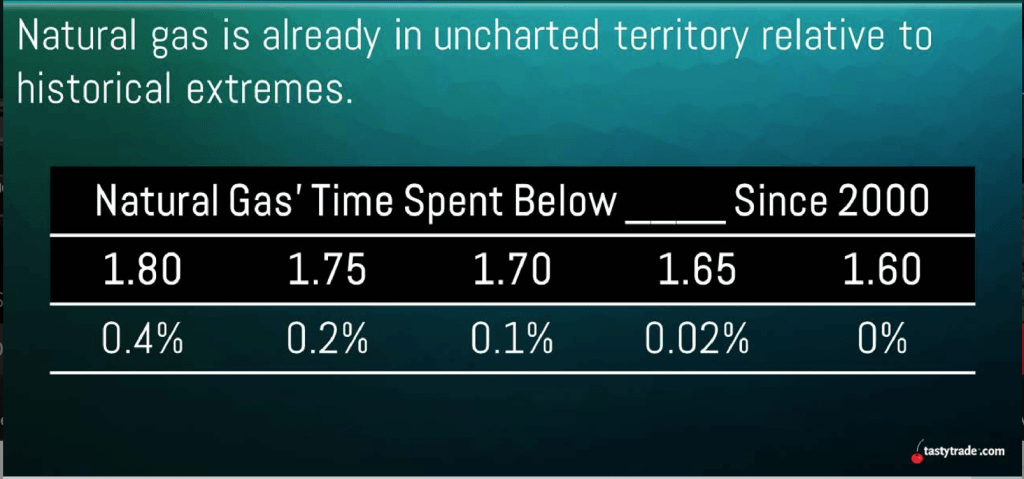

And if you thought crude oil got massacred, then natural gas has been obliterated, albeit over a longer period of time. Natural gas is currently trading at about $1.85/MMBtu, which is close to a four-year low.

While part of the downward price movement in natural gas can be chalked-up to a warmer than expected winter in the United States, the situation in China certainly isn’t helping the matter. As one can see in the image below, if natural gas prices drop any further, this particular energy commodity will be trading at prices rarely observed in the last two decades.

The chart below shows the percentage of time that natural gas spent trading below the indicated price since the year 2000:

One group that has yet to roll over is the broader stock market indices. As of the market close on February 19, the S&P 500 was trading just shy of its all-time record high.

However, one has to keep in mind that the modern stock market has frequently rallied based on widespread anticipation of dovish intervention by the U.S. Federal Reserve and other sovereign central banks. Case in point, China has acted swiftly to ease monetary policy in the face of the coronavirus outbreak, an action that could be boosting the confidence of many market participants.

Given the relative rarity of true black swans, global investors and traders might currently be banking on the fact that the two previous coronavirus epidemics observed in the 21st century were brought under control in relatively short order.

Over the coming days and weeks, each and every market participant will have to make their own determination about the likelihood of a black swan event being tied to the current coronavirus epidemic.

If the impact of the coronavirus does remain muted outside of China, then there will likely be plenty of money to be made on broad-based rallies in many of the underlyings highlighted in this post – particularly crude oil.

Traders seeking to review the new episode of Futures Measures focusing on potential black swan red flags can click this link.

Click here to read the previous installment: Trading China’s Coronavirus (Part 8).

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.