Trading the Rebound in Chinese Tech Shares

Shares in Chinese technology stocks have rebounded from 52-week lows, but the regulatory challenges that first catalyzed the selloff haven’t been resolved yet.

The sharp correction in U.S.-listed shares of Chinese companies—particularly in the technology sector—continues to be one of the biggest stories in the financial markets in 2021.

At this time, the group appears to be trading at a critical inflection point, as many Chinese ADRs have bounced off from 52-week lows in recent days.

Despite that rebound, most of the best-known companies from the Chinese technology sector are still trading deeply in the red, as it relates to 2021 year-to-date performance:

- Alibaba (BABA): -26%

- Baidu (BIDU): -26%

- JD.com (JD): -18%

- NetEase (NTES): -4%

- Tencent (TCEHY): -20%

Moreover, it should be noted that the above numbers don’t tell the full story because the correction looks a lot more severe when one considers the degree to which Chinese tech stocks have declined from recent 52-week highs. For example, BABA’s 52-week high is roughly $319/share, which means the current price of $167/share represents a decline of nearly 50%.

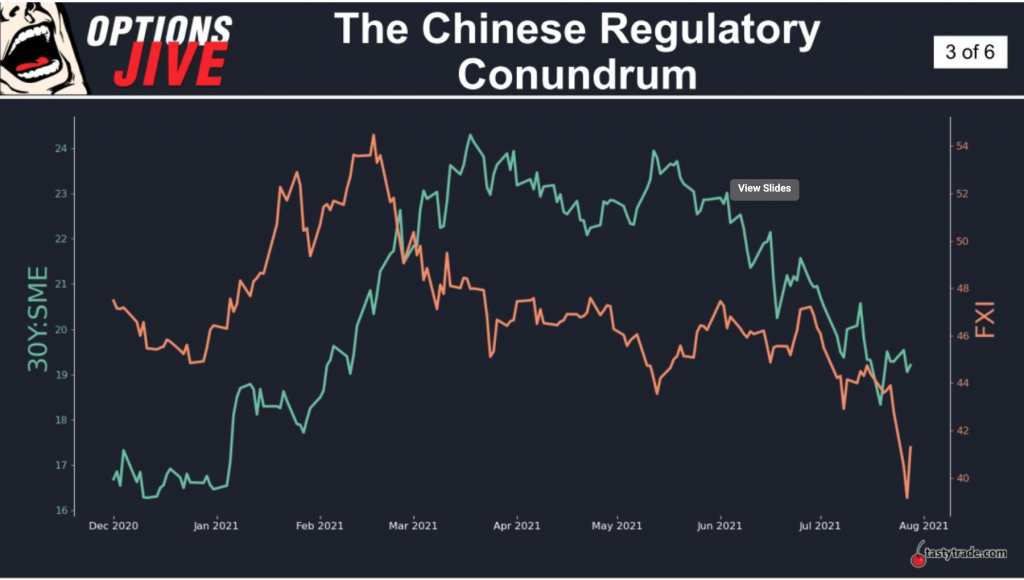

Considering those figures, it shouldn’t come as much of a surprise to hear that China-focused ETFs have also suffered significant corrections in 2021. To date, the iShares China Large-Cap ETF (FIX) and the KraneShares CSI China Internet ETF (KWEB) are both down 15% and 32%, respectively.

Big moves and heavy volatility tend to draw investors and traders like moths to a flame, so it’s no great surprise that activity in Chinese shares has also picked up. Along those lines, figures collected by the research group Vanda suggest that retail purchases of Chinese ADRs by American investors and traders are currently cresting at five-year highs.

Bargain hunters are clearly out in force.

However, final judgment on the relative value of Chinese shares at this time ultimately rests in the eye of the beholder. One can’t forget that while the potential rewards for buying beat-up stocks can be considerable, the risks can be equally great.

Chinese Regulatory Crackdown

One of the complicating factors in this particular case is that shares of Chinese stocks are moving down as a result of an intensifying regulatory environment in the Middle Kingdom. And because the Chinese government is anything but transparent, there’s simply no telling where and when the current regulatory crackdown will end.

As most are aware, the current regulatory crackdown appears to have started in the fall of 2020 when Chinese regulators stepped in at the last minute to block the initial public offering (IPO) of Ant Financial. Since that time, the regulatory net has continuously expanded—reeling in the education technology sector, the e-commerce sector and the online gaming sector, among others.

One of the primary concerns of Chinese regulators involves the security and usage of consumer data. However, they’ve also used this opportunity to crack down on other domestic issues, such as skyrocketing education costs, widespread addictive gaming behavior and excessive risk-taking in the financial industry.

Just this week, Chinese regulators vowed to crack down on mismanaged financial funds and weed out bad actors in an industry estimated to control over 60 trillion yuan ($9 trillion).

That comes on the heels of news last week that the beverage sector in China might be the latest domino to fall—a development that catalyzed weakness in Chinese liquor manufacturers, including those of Kweichow Moutai, the most valuable non-technology company in China.

Business in China is often conducted with copious amounts of alcohol, and after-hours meetings can sometimes involve binge-style drinking.

In an article posted last week in a state-run publication, the Central Commission for Discipline Inspection in China suggested that unspoken rules in the business community which fostered the overindulgence of alcoholic beverages could result in criminal prosecution.

As is often the case, that statement may have been more a “shot across the bow” to encourage a change in behavior as opposed to the beginning of a formal process for enforcing such rules.

Nevertheless, this development serves as an important reminder that the Chinese government holds the final word, and that virtually every activity in China must be approved by the State Council, explicitly or tacitly.

Where these regulatory crackdowns end is anyone’s guess, but the degree to which Chinese shares have pulled back has apparently reached the thresholds of many investors and traders who are now willing to bet on a rebound—as evidenced by those swelling numbers cited by Vanda.

That said, there’s still likely plenty of market participants still betting on additional downside in Chinese shares, meaning the ultimate winner of this tug-of-war—over the short-, middle- and long-terms—is still anyone’s guess.

Pinduoduo (PDD) Wrinkle

One technology company that’s experienced a considerable rebound in recent days is Pinduoduo (PDD). Last week, the company reported its first quarterly profit since going public. Curiously, the company also announced it would be donating their entire quarterly profit to rural development projects.

Clearly, this gesture was announced to placate regulators who appear to be acting on President Xi Jinping’s recent announcement that prosperity in the country must be a “common good.” In sum, that means that regulators’ actions of late appear to be at the behest of the president—and intended to help reverse or slow down the widening wealth gap in China.

Executive leadership at Pinduoduo apparently wanted to show that they heard those sentiments loud and clear, as the donation of the company’s entire quarterly profit clearly falls in line with the government’s current drive to redistribute wealth.

PDD stock rebounded considerably in the wake of that announcement and now sticks out as one of the names that has rebounded most sharply since the correction started.

That begs the question as to whether additional companies in China will be forced to donate their profits, and how that change in Chinese business culture would in turn impact investors. After all, corporate profits are traditionally reinvested for future growth or distributed to shareholders, not given to charity.

President Xi Jinping has previously spoken extensively on the topic of “socialism with Chinese characteristics,” and the current regulatory crackdown may represent the process by which the Chinese economy adjusts to allow for a more equitable distribution of prosperity.

The PDD wrinkle—donating its entire quarterly profit—certainly makes the coming weeks and months that much more intriguing.

To learn more about the recent activity in Chinese ADRs, readers may want to review this installment of Options Jive: The Chinese Regulatory Conundrum, which focuses on this topic.

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.