Volatility Spikes

So much for all the trade war “optimism.”

Optimism relating to the ongoing trade war between the United States and China was basically flushed down the toilet on Aug. 1 when President Donald Trump announced he was planning more tariffs on Chinese imports that were set to take effect on Sept. 1.

While that move may or may not be a part of Trump’s grand plan to strike “the deal of the century” with China, the immediate take by financial markets was one of definitive pessimism. And while the selloff has stabilized for now, the S&P 500 was down over 200 points from its recent all-time high in the immediate aftermath of trade war escalations.

As is usually the case when equity markets speed up to the downside, volatility also shifted into high gear. The VIX, which is a broadly followed measure of market volatility, posted its highest level since December of last year.

And the uptick in volatility wasn’t limited only to the equities side of the financial markets.

Crude oil has gotten absolutely smoked in the last week, dropping from roughly $58 per barrel on July 31 all the way down to $51/barrel on August 7. The OVX, which acts much like the VIX for the crude oil market, also spiked. The OVX is now trading at levels last seen in 2018.

Anyone sensing a pattern?

The thing is, if you think stocks and oil have been on a wild ride, look no further than the precious metals sector for even more craziness. Since the start of July, silver has jumped over 13%, going from roughly $15 per ounce to north of $17/ounce.

The rally in gold has been going on for an even longer period of time. Gold was as low as $1,250/ounce in June, and recently breached the $1,500 mark on August 7. As outlined previously by luckbox magazine, the Gold-silver Ratio also remains at historic highs.

With so many different niches of the market making big moves, and exhibiting significant volatility, many traders are likely wondering how they can pick the most suitable opportunities for their own portfolios.

Well, a recent episode of Futures Measures on the tastytrade financial network may be a great launching point. On the show, the hosts highlight not only where the biggest price moves are being made, but they also analyze current levels of implied volatility in many of these markets.

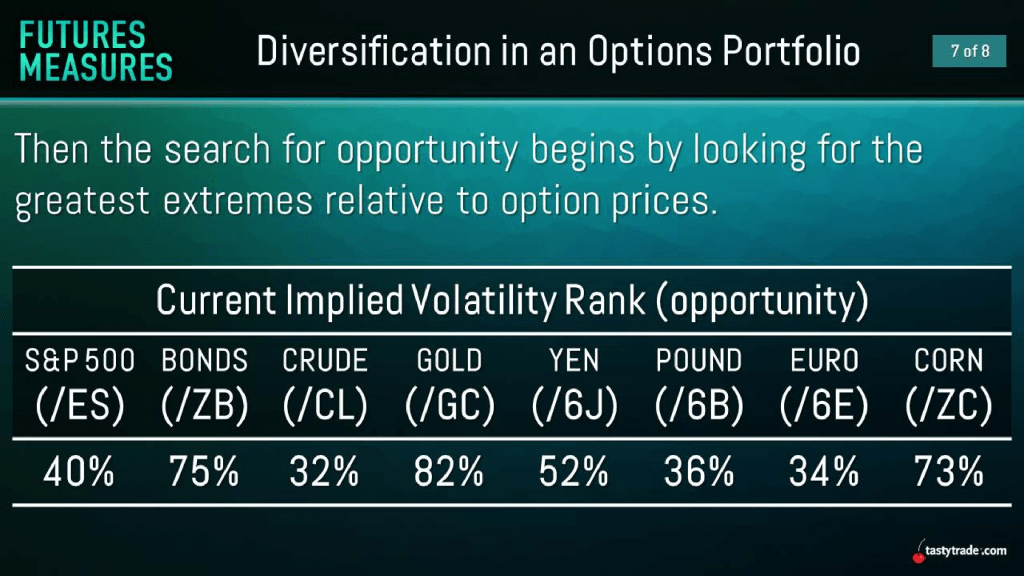

Even more importantly, this episode of Futures Measures also breaks down the current levels of Implied Volatility Rank for many of the highest volume (and best-known) futures markets. Implied Volatility Rank, also referred to as IV Rank, uses the last 52-weeks of data to help traders evaluate how current levels of implied volatility compare to recent history.

For example, if implied volatility in XYZ over the last 52 weeks has ranged between 20 and 40, then a current implied volatility of 40 would equate to an IV Rank of 100%. If implied volatility was trading for 30 in XYZ, then IV Rank would be 50%, and so on.

Options traders often use implied volatility, and metrics like IV Rank, to ascertain whether option prices are cheap, expensive, or fair. This approach can be applied to not only traditional equity and index options, but also futures options.

Below is a chart featured on the aforementioned episode of Futures Measures which highlights current IV Ranks in a wide range of futures markets:

As one can see in the image above, current data suggests that implied volatility in bonds (/ZB), gold (/GC), corn (/ZC) appear to be at some of the most extreme levels when compared to the last 52-weeks of data.

Traders searching for attractive short premium opportunities in the current environment of elevated volatility may want to review the complete episode of Futures Measures when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.

Additional information on Implied Volatility Rank (IVR) and futures options is also readily available in the tastytrade LEARN CENTER.