You Can Make Money in a Sideways Gold Market

Gold prices have traded mostly sideways during 2021, and while that may not be ideal for long-only investors, that type of price action is traditionally well-suited for short volatility positions.

Gold has been trading sideways for most of the summer, and while that may not be great news for directional investors, that type of movement is just what the doctor ordered for short volatility traders.

Gold prices have oscillated around the $1,800/ounce mark for months now, and are currently sitting at about $1,817/ounce. Gold started the year trading about $1,950/ounce, which means it’s down about 7% on the year, overall.

Not surprisingly, gold prices enjoyed a very strong year in 2020, when economic uncertainty linked to the COVID-19 pandemic pushed prices from roughly $1,500/ounce to a record all-time high just north of $2,000/ounce. However, the strong bid observed in gold prices throughout last year hasn’t yet materialized in 2021.

Gold is traditionally viewed as a safe haven, so it’s maybe no great shock to see prices lose their footing alongside a strong rebound in the global economy.

The surprising aspect of the gold trade in 2021 has arguably been the metal’s extremely tight trading range, as well as a sharp decline in associated volatility. After spiking above 32 last March, the CBOE Gold ETF Volatility Index (GVZ) has steadily tracked lower this year—closing last week at roughly 15.

Beyond its safe-haven status, gold prices are also traditionally sensitive to moves in the U.S. dollar—the two share a semi-strong historical inverse correlation. That means when the U.S. dollar weakens in value, gold prices tend to strengthen, and vice versa.

In 2021, the U.S. dollar has rebounded slightly from an abysmal year in 2020. That development is assuredly serving as yet another headwind for gold prices.

Taken together, the aforementioned market dynamics suggest that investors and traders in the precious metals sector might have to get creative when it comes to deploying gold-related ideas in the market.

Conveniently, the sideways action in gold does lend itself well to some types of options positions—particularly those involving short volatility.

Typically, short premium options positions—such as short calls, short straddles/strangles, and short puts—perform most efficiently when movement in the underlying is subdued and/or sideways. And that behavior almost perfectly describes gold price action of late.

The only caveat is that short volatility traders also prefer to enter such positions when implied volatility is inflated. Considering that the GVZ is trading around 15, and well off its 52-week high, that means the second piece of the short volatility puzzle isn’t necessarily available at this time.

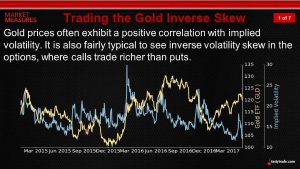

The one thing short volatility traders in the precious metals space have going for them is the fact that upside options in the gold sector traditionally trade at inflated levels when it comes to implied volatility. This phenomenon exists because of gold’s safe-haven status, and is sometimes referred to as reverse skew.

That means in the event of a sudden global crisis, or widespread stock market correction, gold could immediately catch a strong bid—meaning that upside gold calls trade a little bit like puts in a normal stock during an unexpected sell-off.

In sum, that means investors and traders looking for opportunities in the gold sector might currently be drawn to short upside call positions. Of course, one would only go down that path if he or she were relatively confident that sideways action in the gold market will continue. Or, at the very least, that no gap moves in gold prices were expected during the lifetime of the short option(s).

Market participants can remove some directional (i.e. gap) risk from a short options position by hedging them delta neutral, or by deploying covered calls/puts.

Essentially, the extra leg of the position (i.e. the stock hedge) provides the investor/trader with protection against an unexpected move in the underlying price—similar to how long stock works for a covered call option.

Readers seeking to learn more about trading short calls in the gold sector may want to review a previous installment of Market Measures on the tastytrade financial network, which outlines in detail the inverse skew phenomenon in gold-related options.

To learn more about trading “delta neutral,” readers may also want to review this previous episode of Options Jive.

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.