American Manufacturing is Back on the Rise

Employment data indicates the manufacturing sector in the United States has been steadily growing since the conclusion of the Great Recession—representing a critical reversal in the negative trend observed from roughly 1980 to 2010.

These days, most people think of Asia and Central/South America as the world’s top manufacturing regions.

But the fact is, the United States remains one of the world’s top manufacturers. In 2021, U.S. factories were responsible for roughly 17% of global manufacturing output—second only to China.

Diminished perceptions of the U.S. role in global manufacturing likely stem from the fact that the U.S. was far and away the most dominant manufacturer in the world for so many years.

From roughly 1885 to 2010, the United States was the undisputed manufacturing heavyweight of the world. A mantle that was passed to China roughly 12 years ago. The country of Japan also deserves honorable mention, as it has consistently been among the world’s top-3 manufacturers during the last 50 years.

But it’s America’s rich history of dominating the manufacturing industry that likely helps explain why the country’s current second-place ranking feels like such a disappointment.

Having peaked during the 1980s, most people think of American manufacturing as “on the decline.” And until recently, that would have been correct.

Amazingly, the U.S. now appears to be in the process of flipping the script, as manufacturing in America has actually been on the rebound during recent years—albeit a gradual one.

From January 2010 to January 2020, the U.S. went from having 11.5 million people employed in the manufacturing industry, to nearly 13 million. A trend that clearly illustrates how U.S. manufacturing has been on the rise since the conclusion of the Great Recession.

Of course, that’s hardly an eye-popping level of growth over a 10-year period, but the most important element of this data is that it represents a reversal of the previous trend. That’s because from 1980 to 2010, the U.S. experienced a steady decrease in manufacturing jobs, as American companies moved “offshore” to capitalize on cheaper labor costs (and other competitive advantages).

In 1980, there were over 19 million workers in the United States employed in the manufacturing sector. That figure steadily declined in the ensuing decades, all the way down to the aforementioned 11.5 million observed in 2010.

Considering that context, the fact that employment in the U.S. manufacturing sector experienced any growth at all in the last decade now seems fairly monumental. Moreover, had the COVID-19 pandemic not materialized, one could argue that momentum in the U.S. manufacturing sector might have gained even more steam.

The chart below highlights how employment in the U.S. manufacturing sector took an unexpected hit during the initial stages of the pandemic, but rebounded in rapid fashion during the second half of 2020 and 2021.

Changing Dynamics in the American Manufacturing Sector

The resurgence in American manufacturing can’t be attributed to a single factor, instead, there’s a wide variety of considerations that appear to be supporting this encouraging trend.

One of those factors relates to the country’s ongoing trade war with China, which has been fought primarily using tariffs on imported Chinese goods. Tariffs that basically make imports from China more expensive, and in turn increase the relative attractiveness of manufacturing goods domestically.

After the initiation of the trade war in 2018, exports from China to the U.S. dropped from roughly $480 billion in 2018, down to $420 billion in 2019.

And while the majority of those Chinese imports were replaced by products from other low-cost manufacturing hubs (i.e. Mexico and Vietnam), the tariffs undoubtedly forced some American companies to consider relocating their manufacturing operations back home (i.e. “reshoring”), or at least closer to the U.S. (i.e. “nearshoring”).

Reshoring is the practice of bringing manufacturing and services back to the United States from overseas. Nearshoring, on the other hand, involves relocating business activities and/or manufacturing operations in countries that are located in close proximity to the United States (i.e. Canada and Mexico).

Beyond the import tariffs, another big factor contributing to the resurgence in American manufacturing is rising transportation costs.

An estimated 80% of the world’s goods are transported via the ocean, and much of it inside 40-foot steel containers stacked on specialized container ships. And the cost to move those goods across vast oceans has risen sharply in the last couple years.

For example, it’s estimated that the spot price to ship a 40-foot container from Shanghai to Los Angeles increased by roughly 75% from December 2020 to December 2021.

That’s a huge increase, and a burden that bites directly into the bottom line of offshore companies attempting to leverage low cost labor hubs in faraway corners of the world. There’s a point at which the economics of rising shipping costs simply make this arrangement unfeasible.

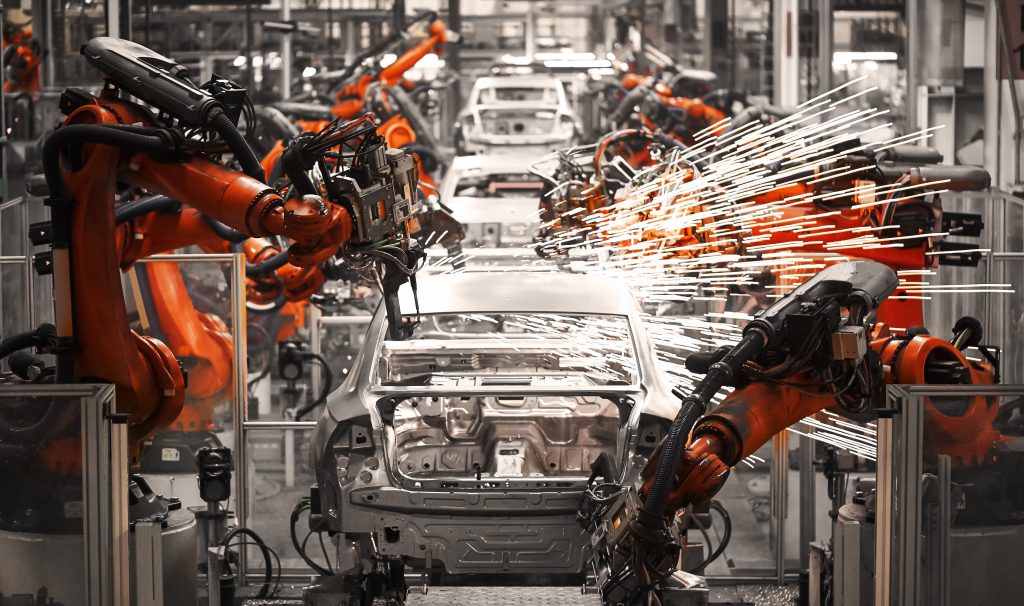

Aside from tariffs and transportation costs, one last factor to consider is the rise of automation within modern manufacturing operations.

Automation, in the context of manufacturing, is the use of equipment to automate systems or production processes. The end goal of this approach is to drive greater efficiency by either increasing production capacity or reducing costs—or preferably, both.

As a result of advancements in automation, it’s now possible to run a factory using only a handful of humans working in tandem with automated machines and robots. The rapid development of artificial intelligence (AI) capabilities will only serve to hasten this revolution.

Obviously, the ability to fully automate production minimizes the value of a low-cost labor pool. Especially when factoring in the potential for an astronomic rise in shipping costs.

Recent Developments in the U.S. Manufacturing Sector

Recent announcements from the manufacturing sector provide further perspective on the aforementioned factors driving growth in the U.S.

On March 29 of this year, a Vietnamese company named VinFast announced plans to build a new manufacturing plant in the United States. The new facility—in North Carolina—will house a battery production operation, as well as an assembly line for electric vehicles.

VinFast is expected to invest $2 billion into the facility during Phase I, and then grow the operations from there. The facility is expected to be operational by 2024, with the capability to assemble 150,000 vehicles per year, as noted in the tweet below from @nccommerce.

VinFast currently produces a wide variety of electric vehicles in its home country of Vietnam, including e-scooters, electric buses and electric cars, as well as charging station systems and other green energy solutions.

What’s most interesting about this development is that Vietnam has been ranked by many outlets as one of the least expensive places on earth to manufacture goods. In a recent report, U.S. News actually ranked Vietnam #1 in the world for low-cost manufacturing.

The fact that VinFast has elected to manufacture in the United States, as opposed to its own country, illustrates quite starkly the diminishing return of a low-cost labor pool. A U.S.-based manufacturing operation would also theoretically allow VinFast to circumvent any future tariffs that might be applied to Vietnamese imports.

VinFast isn’t alone, either.

Japan’s Panasonic Corp is reportedly looking for a new site in the United States to build a new generation of electric batteries. A long-time supplier for Tesla, Panasonic has said it plans to begin mass-producing this new type of lithium-ion battery by the end of 2024.

And on March 22, LG Energy Solution (headquartered in South Korea) announced it will be expanding its manufacturing operations in Michigan.

The South Korean company will invest an additional $1.7 billion in its existing facility, and plans to produce various components for the batteries used in electric vehicles. LG Energy Solutions is one of the world’s largest producers of lithium-ion batteries, and is a key supplier of Michigan-based companies such as Ford (F) and General Motors (GM).

Together, these examples help illustrate how international companies are now looking at the U.S. as an attractive location for manufacturing operations. And these recent announcements suggest that the rebound in manufacturing in the United States observed in recent years may represent a longer term trend.

To track and trade ongoing developments in the U.S. manufacturing sector, readers can add the following exchange-traded funds (ETFs) to their watchlists:

- First Trust RBA American Industrial RenaissanceTM ETF (AIRR)

- Industrial Select Sector SPDR Fund (XLI)

- Invesco DWA Industrials Momentum ETF (PRN)

- Invesco S&P 500 Equal Weight Industrials ETF (RGI)

- iShares U.S. Industrials ETF (IYJ)

- iShares Global Industrials ETF (EXI)

- Vanguard Industrials Index Fund (VIS)

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. CT, at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.