Trading China’s Coronavirus (Part 6)

Backtesting Country ETFs vs. International ETFs

Key Coronavirus Updates:

- The World Health Organization (WHO) has put forward an official name for the new coronavirus: COVID-19

- The estimated number of global coronavirus infections has risen to more than 45,171 with at least 1,115 associated fatalities

- A record 103 new fatalities were reported on Feb. 11, the most for a single day since the outbreak began

- So far only two deaths linked to the new coronavirus have occurred outside mainland China (Hong Kong and the Philippines)

- A total of 12 coronavirus infections have been identified in the United States, with an additional 398 people currently under observation

- A team of experts from the World Health Organization was deployed to China to assist with containment efforts

- Fatality rates for COVID-19 continue to be pegged at 1-2%

- Human trials of Gilead’s (GILD) coronavirus drug, Remdesivir, were launched in China on Feb. 3

- The global auto and technology sectors are perceived to be the most at risk for supply chain disruption due to their heavy reliance on Chinese manufacturers

- It’s now believed the COVID-19 incubation period may be as long as 24-days, a time in which infected individuals may not be exhibiting visible symptoms, but still can potentially spread the virus

- A Holland American Line cruise ship was denied port of entry in Thailand on Tuesday, the fifth consecutive time the ship has been denied port (zero COVID-19 infections have been reported onboard)

Volatility traders follow the VIX closely as a signal for potential opportunities to purchase or sell options premium.

When the VIX rises above its historical average of about 18, short volatility traders get more serious about finding and deploying short premium, which they hope will produce positive profit/loss (P/L) based on the theory of mean reversion.

In the wake of the coronavirus outbreak, the VIX did briefly climb above 18, when it got as high as 19.37 on January 31. Since that time, the VIX has tailed back down to 15.

Because the VIX reports on implied volatility of U.S. equity markets, it doesn’t always capture the full “uncertainty” represented by events that impact companies and economies outside US borders. At present, heightened implied volatility related to the novel coronavirus appears to be following the above script.

In the last couple of weeks, China-exposed financial products have seen a larger uptick in implied volatility than the equities of companies based in the US or Europe, for example. Rationally, this makes sense, given that the great majority of coronavirus infections have been reported in mainland China.

In practice, that means when filtering for heightened implied volatility opportunities, short premium traders are likely currently finding a lot of China-biased symbols in their searches.

While those underlyings may fit the investment profile of some investors and traders, other market participants may be hesitant to get involved in so-called “country ETFs” like FXI because they haven’t traded them in the past, or aren’t familiar with their “usual” behavior.

Traders seeking to learn more about international ETFs (country-specific or otherwise) may want to tune into a previous installment of Market Measures on the tastytrade financial network, which provides valuable context on how these products are constructed, as well as the historical performance of short premium trading strategies deployed in them.

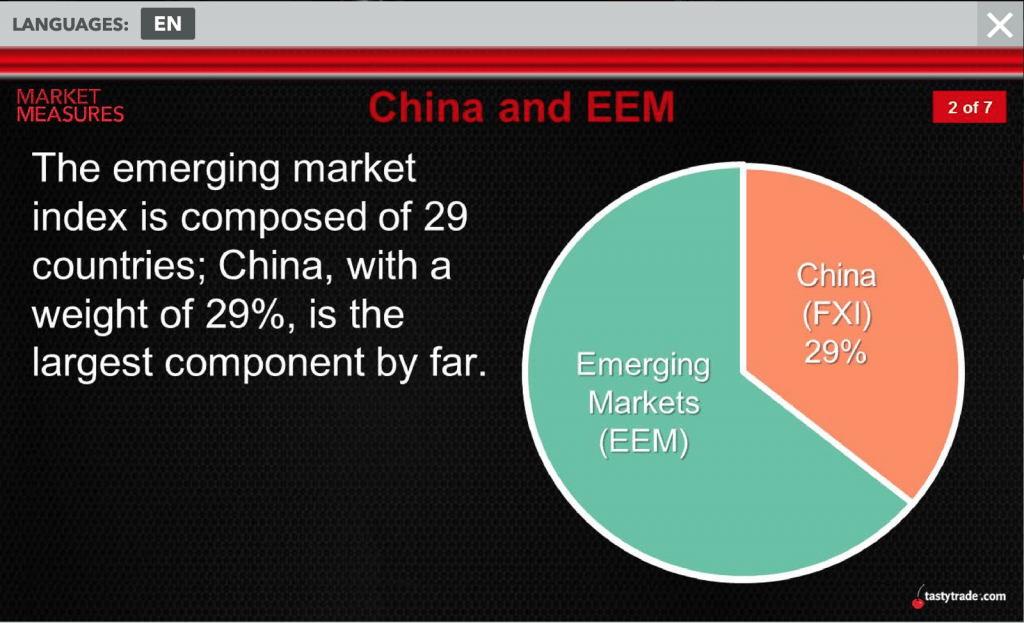

On this particular installment of the series, the hosts break down the differences between an ETF exposed exclusively to China such as FXI, as compared to a more diversified international ETF such as EEM (see below).

Beyond reviewing the components of each ETF, the show also includes a review of a tastytrade market study involving both FXI and EEM.

This research involves a series of backtests which analyzed the historical performance of selling premium in FXI as compared to selling premium in EEM. The backtests were conducted on FXI and EEM using historical trading data from 2011 to 2017.

The short volatility strategy backtested on both ETFs was a short strangle (16 delta) using options with on average 45 days-to-expiration (DTE). Additionally, a trade management filter was applied to each backtest which called for trade management (i.e. trade closure) when a position reached 50% of its maximum potential profit.

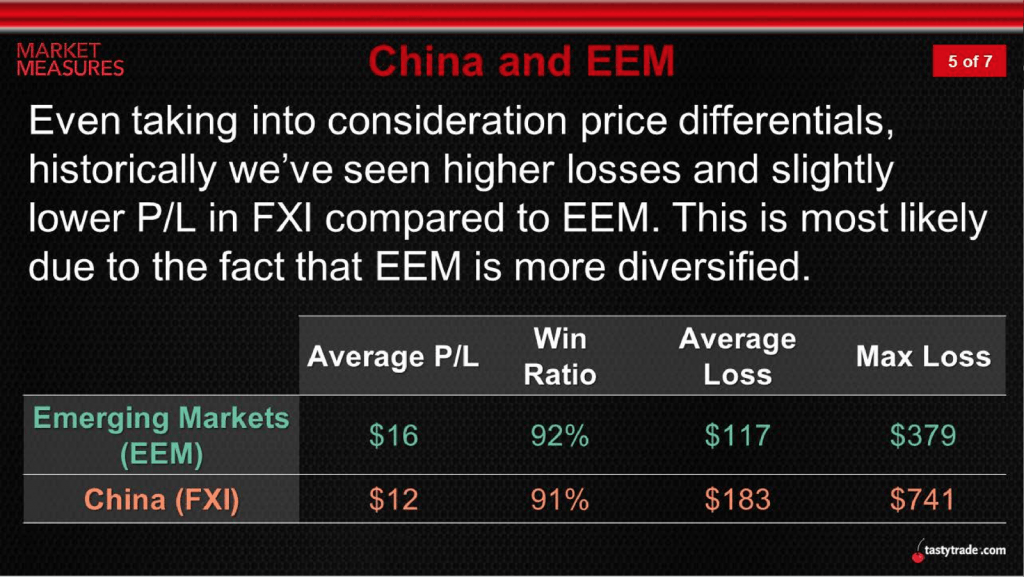

The results of these backtests are highlighted below:

As one can see in the above findings, a short strangle trading approach in both FXI and EEM has historically produced a positive P/L, as well as a win rate above 90%. In terms of potential “rewards,” this strategic approach appears to have historically produced attractive results.

However, when looking at the remainder of the data, which reports on the potential risks of such an approach, there appears to be a slight divergence between FXI and EEM. As one can see in the above graphic, both the “average loss” and “max loss” were higher for the short strangle approach in FXI as compared to EEM.

In order to provide more context on this trading tactic, the tastytrade researchers took the study one step further and executed a second series of backtests which called for trade deployment (short strangles in both symbols) only when Implied Volatility Rank in FXI was above 50.

Once again, the results illustrated that the potential rewards for both underlyings were roughly equivalent, while the potential risks were once again higher for FXI. The detailed results from this second series of backtests are presented on the show.

The above research appears to suggest that ETFs which focus on only one country or region may be riskier when compared to more diversified international ETFs, especially considering they don’t offer significantly higher win rates and average P/Ls (based on historical data). It also reveals that when implied volatility spikes in individual country ETFs, traders can consider more diversified international products such as EEM to deploy preferred exposures.

As the novel coronavirus story continues to develop, traders may want to keep the above information in mind, and trade accordingly.

Click here to read Trading China’s Coronavirus (Part 5).

A complete review of the Market Measures episode focusing on historical backtests in FXI and EEM is recommended when scheduling allows.

Market participants that want to learn more about the trading landscape in China can also review a past installment of Options Workshop on the tastytrade financial network at their leisure.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.