Trading Lessons From June’s Quadruple Witching

"Quadruple witching” refers to the third Friday of March, June, September and December, and represents the converging expiration of four different products.

Last Friday (June 18) was of particular interest in the financial markets because it represented one of the four “quadruple witching” events of the year. And with the averages making big moves, quadruple witching (aka “freaky Friday”) didn’t disappoint.

Quadruple witching is a term popularized within the investments industry and represents a unique quarterly occurrence involving the expiration of four different financial contracts on the same day.

Technically speaking, the “quadruple witching hour” is the last hour of trading (2 p.m.-3 p.m. Central Time) on the third Friday of every March, June, September and December. The conclusion of this hour represents the converging expiration of four different products: stock index options, stock index futures, single stock options and single stock futures.

The event has gained notoriety because several previous quadruple witching expirations have seen inflated volumes and some outsized moves.

While many traders try to close or roll positions prior to freaky Friday, the markets usually see a surge in activity at the end of quadruple witching days due to last-minute—or last-hour—adjustments.

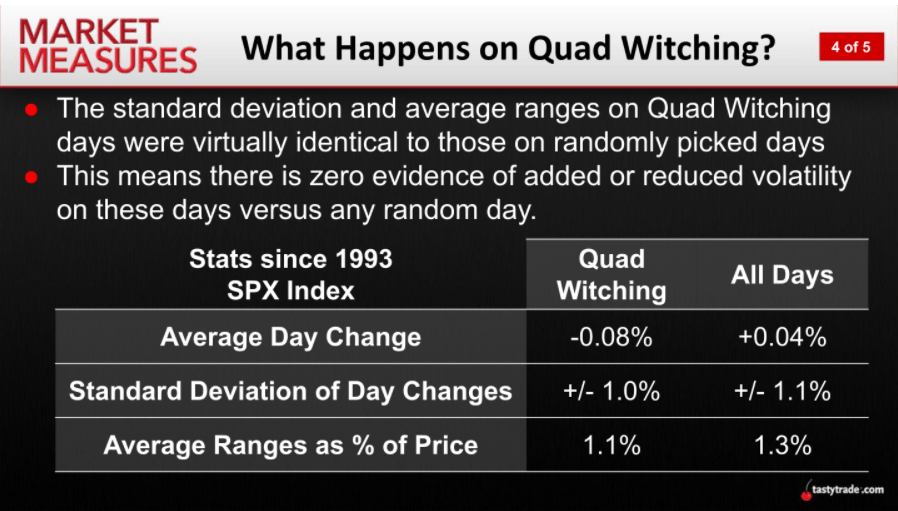

But despite its notoriety, data examined by tastytrade suggests that in many ways quadruple witching isn’t much different from any other day in the markets—with essentially the same probability of a big move as any other day on the trading calendar.

Along those lines, a new episode of Market Measures on the tastytrade financial network takes a closer look at the most recent quadruple witching and analyzes it in comparison to previous instances of quadruple witching.

In order to study market tendencies on quadruple witching, the tastytrade research team sought to answer a couple of pertinent questions:

- Are there discernible market trends leading up to, during and following the quadruple witching week?

- How does quadruple witching differ from a normal expiration week?

As one can see in the data below, tastytrade research revealed that the majority of key trading statistics from quadruple witching were mostly in line with an average historical trading day. In fact, the standard deviation and average ranges on quadruple witching were virtually identical to those on randomly picked days.

While the data above indicates that quadruple witching isn’t much different from any other trading day in terms of potential movement, the most recent freaky Friday did reveal some interesting trends when it comes to volume.

The most recent quadruple witching was notable because it saw the expiration of roughly $818 billion in equity options premium—close to the highest total on record. This was no doubt attributable to a broader volume trend which has seen equity and options volume skyrocket to new all-time highs in 2020 and 2021.

As an example, in calendar year 2019, volume in single-stock options averaged about 10 million contracts per day—a number that skyrocketed to 17 million in 2020, with the latter part of the year seeing some of the highest volumes in history.

December 2020 actually set the record for average daily volume in a single month with more than 23 million contracts per day.

Along those lines, the Options Clearing Corporation (OCC), which specializes in the clearing of derivatives contracts, estimates that 7.47 billion options contracts traded hands in 2020, up from roughly 4.9 billion in 2019—an increase of more than 52%.

The significant increases in trading volume could have been a factor in catalyzing a bigger-than-average move in the major indexes last Friday.

However, to ascertain whether this is a longer-term trend or just a blip on the radar, it will be necessary to monitor future quadruple witching expirations to see whether this trend is sustained.

Readers looking for more insight into quadruple witching can review the complete episode of Market Measures when scheduling allows.

For updates on everything moving the markets, readers may also want to tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time.

Get Luckbox! Subscribe to receive 10 issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.