Why Market Volatility Could Calm Down During the Summer Trading Season

Historical market data illustrates that market volatility tends to trend lower during the summer months, as compared to other parts of the trading year.

After six months of turbulence in the financial markets, there’s some hope that volatility could soon dissipate—at least temporarily.

And that’s not due to a major shift in the geopolitical landscape, or some other momentous news development. Instead, it’s the fact that summer has arrived in the northern hemisphere.

Traditionally, market volatility has a tendency to trend lower during the summer months, as compared to other parts of the trading year.

Does that historical trend guarantee that the markets will calm down during the remainder of the summer? Absolutely not. But historical data indicates that market volatility is on average lower in the summer months, as compared to other parts of the year. Considering the chaotic trading environment observed during H1 2022, this would likely be a welcome development for many market participants—especially of the passive variety.

So without further ado, let’s dive into the associated research.

According to a comprehensive study conducted by the tastytrade research team, market volatility tends to be the least volatile on the calendar during the months of May, June, July and December. Looking at the other end of the volatility spectrum, September and October tend to be the most volatile on the calendar, as illustrated in the graphic below.

The above research, which was presented on a past installment of Market Measures, helps explain why May, June and July might at times feel like the “summer doldrums.” The fact that many investors and traders take extended vacations during this period of the year helps explain this phenomenon in part, too.

Recent trading activity in the CBOE Volatility Index (VIX) appears to confirm this historical trend. Since June 17, 2022, the VIX steadily trends lower—dropping from around 33, back down to 26. The long-term average in the VIX is roughly 19, which means the market’s infamous “fear gauge” is still trading above normal, but is starting to exhibit the traditional trend observed during previous summers.

Are Returns in the Market Also Seasonal?

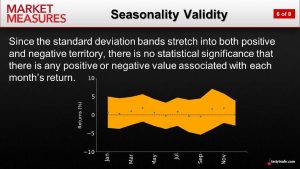

Looking beyond market volatility, investors and traders should also keep in mind that there’s no clear evidence that a given month on the calendar has produced more attractive historical returns as compared to the other eleven months of the year.

This data was also presented on Market Measures, and demonstrates that in terms of predicting returns (positive or negative), all calendar months are apparently created equal. One key to this portion of the study was that tastytrade analyzed not only the actual historical market returns, but also factored in the standard deviation of those returns.

As shown in the graphic below, there was no statistical significance revealed in the data (i.e. no discernible historical trend)—indicating that the calendar is unbiased when it comes to returns.

This means that while market volatility is traditionally lower during May, June and July, there’s no guarantee that the market won’t drop further during those months. Just as there’s no guarantee that the market will rally/rebound in conjunction with reduced volatility.

Looking Beyond the Summer Months

The fall months tend to be the most volatile on the calendar. That means that after the summer lull, it’s probable that market volatility could pick up once again.

As shown in the graphic below, the current market for VIX futures does indeed reflect an expectation for increased volatility in September and October—matching closely with the historical trend.

The market for VIX futures also reflects an expectation that volatility will dip come December. This also matches historical data, as December tends to be the least volatile month on the calendar (on average).

To learn more about the connection between the VIX and VIX futures (/VX), review a new installment of From Theory to Practice on the tastytrade financial network.

For more information about trading volatility-focused products, check out this episode of Options Trading Concepts Live. To follow everything moving the financial markets on a daily basis, tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.