Uncategorized

Where the Action Is

By Yesi D

Volatility is synonymous with the probability of movement. Consistently volatile sectors, such as oil services (OIH), oil and gas exploration (XOP) and gold miners (GDXJ), have a high probability of movement.

Other sectors, including consumerstaples (XLP), utilities (XLU) and healthcare (XLV), have a lower probability of movement, meaning they’re more stable and thus more appropriate for investors who shy away from risk.

Of the major market indexes, small caps (IWM) tend to be more volatile than the Nasdaq (QQQ) and the S&P 500 (SPY).

Check out the following graphics to see the volatility of sectors and exchange-traded funds, or ETFs.

How can investors play sectors and indexes once they know the volatility involved? Check out the Sector ETFs listed on the opposite page for answers.

Uncategorized

-

What You Need to Know About the Ponzi Scheme Affecting Rural China

|Thousands of banking customers in the rural Chinese province of Henan have purportedly fallen victim to a wide-ranging Ponzi scheme and haven’t been able to access their accounts since April—an… -

EV Rider

|Harley-Davidson is finally producing bikes that environmentally conscious younger riders could love. But is it too late for another comeback? Any list of prominent companies that have been around more… -

Sunshine Securities

By Tim Knight

|Only 0.014% of the solar energy reaching Earth is converted into usable power. That leaves plenty of room for improvement, and companies are rushing to meet the challenge. Let’s examine… -

Inflation, Hot Air & Wind

By Jeff Joseph

|Hype and ballooning both rely on hot air and some wind at your back. But in the case of ballooning, not too much wind. In each issue of Luckbox, the… -

High flying allbirds

By Mike Butler

|Celebs, consumers and investors are flocking to Allbirds, a footwear unicorn made from sheep Before Allbirds appeared on the Nasdaq, its shoes appeared on the feet of Paul McCartney, Matthew… -

No, It’s Not Stagflation

|Yes, prices are up and GDP is down compared with earlier this year, but the economy isn’t entering a ’70s-style malaise The economic woes of the 1970s, a decade marked… -

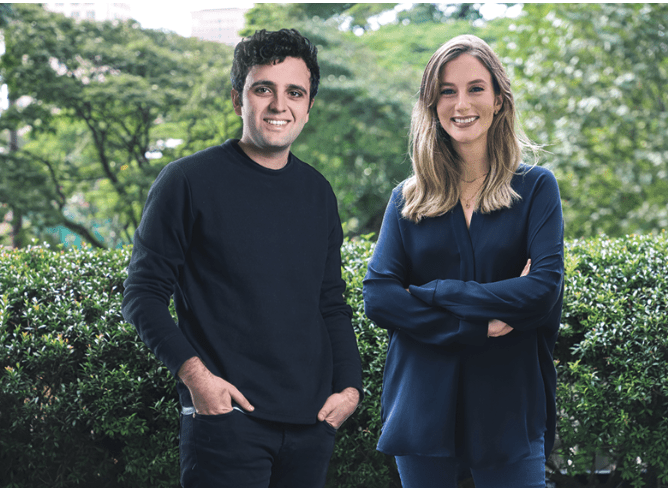

Kalshi: The Exchange for Everything

By Mike Reddy

|Investing in the outcome of events is nothing new, but this federally regulated events exchange is Longtime Luckbox readers are well aware of the educational and financial benefits of reliable… -

Aussie Dollar Not Finished Falling

By Ilya Spivak

|The U.S. dollar backtracked in July as the Federal Reserve tempered expectations for when it would begin to reduce stimulus. The markets had seemingly over-extrapolated after the Fed brought forward… -

Volatility Arbitrage

|When VIX hits an extreme, options traders often seek to pair cheap and expensive volatility against each other using a strategy known as “volatility arbitrage.” -

Luckbox Preview: Trading the Surge in Sports Gambling

|A landmark decision by the U.S. Supreme Court in 2018 established that states could regulate their own sports gambling activities, which in turn catalyzed a jaw-dropping surge in nationwide online… -

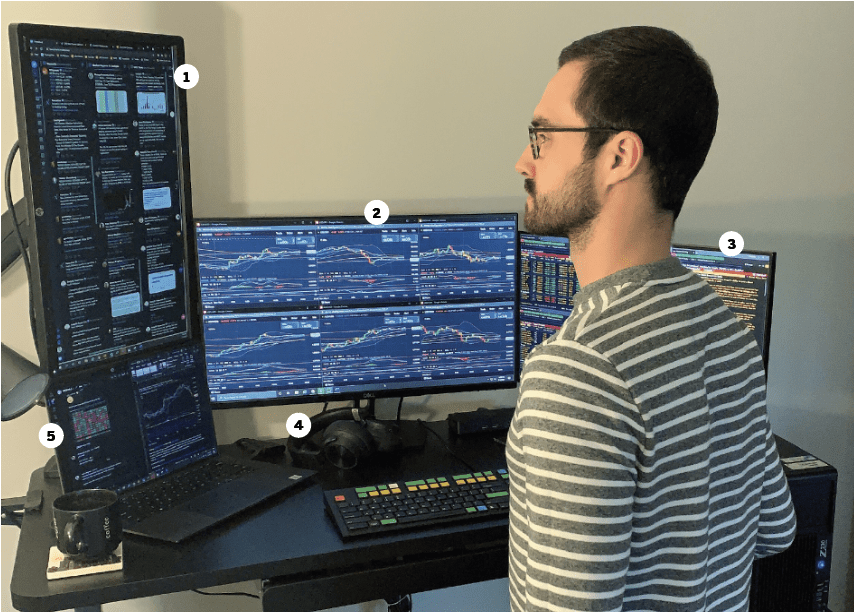

Meet Rich Dvorak

By Yesi D

|Rich Dvorak, IG Analyst @richdvorakfx Home/Office location Chicago Age 27 Years trading Nine How did you start trading? I opened a brokerage account on my 18th birthday. I discovered my… -

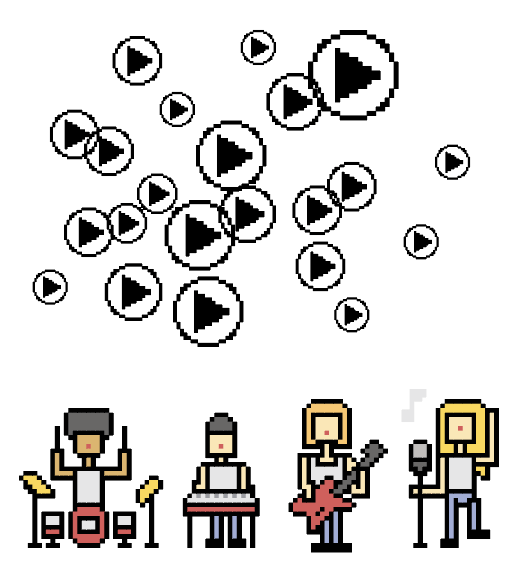

Making a Buck in the Band

|Music streaming gives artists exposure but not much else Music streaming gives relatively unknown artists a bigger microphone but a smaller paycheck. The mic’s larger in the sense that musicians… -

Scaramucci Forecasts Bitcoin Prices & NY Politics (#36)

By Luckbox

|Anthony Scaramucci returns to The Prediction Trade with a shocking prediction on the fate of NY Gov. Andrew Cuomo. Scaramucci shares his 2021 bitcoin price forecast as well as his… -

Cuomo Will Be Reelected, Scaramucci Says

By Luckbox

|Sexual misconduct allegations might not be enough to stop the New York governor from securing a fourth term. Despite numerous sexual misconduct allegations and a deluge of calls for his… -

Cuomo Will Be Reelected, Scaramucci Says

By Mike Reddy

|Sexual misconduct allegations might not be enough to stop the New York governor from securing a fourth term. Despite numerous sexual misconduct allegations and a deluge of calls for his… -

The Last Picture

By Luckbox

|Lucky Man No, this isn’t an aerial view of a frenzied futures trading pit. These men dressed in loincloths are preparng to snatch a wooden stick called a “shingi” after… -

Die Probability

|Tackling the dicey subject of calculating the probability of contagion, and the mortality of the coronavirus Americans are struggling to understand the risk of catching and transmitting Covid-19. Should they… -

Volatility Contraction Part 2: The VIX and Market Corrections

|The S&P 500 was down about 34% on the year at its worst moment (so far) in 2020. After a strong rally from that trough, the S&P 500 is now down… -

Tax Tips for Traders

By Robert Green

|Some active traders—including side hustlers—may want to qualify for Trader Tax Status Active investors can take advantage of “trader tax status” (TTS), an IRS designation that some accountants call “tax-loss… -

Gold-Silver ratio nearing 28-year highs…there is a trade for that

|Gold and silver prices have traditionally been so locked at the hip that if they were represented in a modern-day relationship, they’d undoubtedly be that couple that goes on holiday…