Sahm Wrote the Rule on Recessions. So What’s Her Forecast?

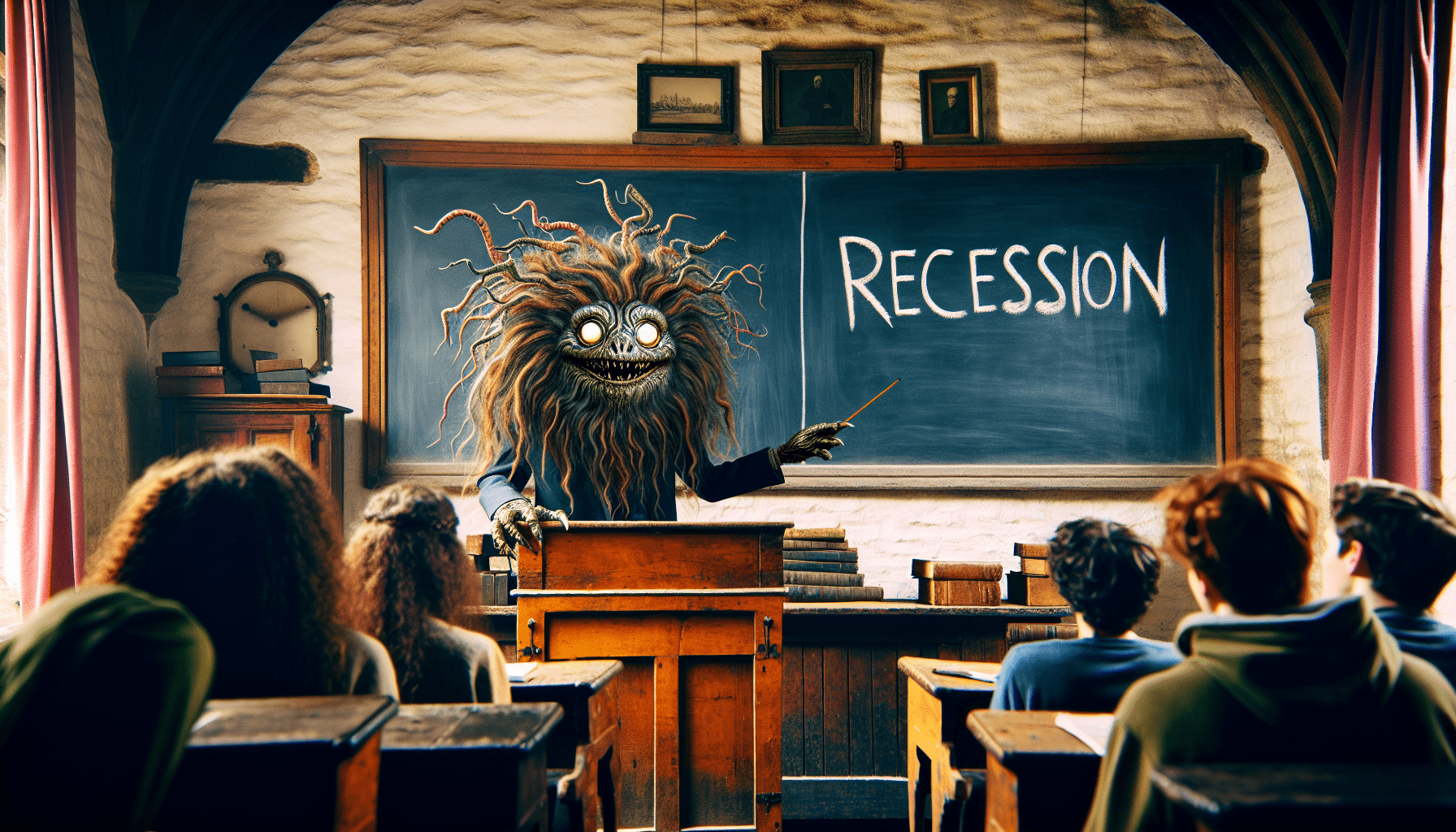

Spoiler Alert: She feels that she "created a monster"

A lot of people are citing the Sahm rule this week as an indication we’re headed for recession. But its author, Claudia Sahm, isn’t among them. In fact, she’s telling us she’s created a “monster.”

Let’s step back to the beginning to see what’s happening. Sahm made her name as a White House economist and former section chief at the Federal Reserve Board of Governors. She introduced the rule that bears her name in a policy proposal she wrote in 2019 for the Brookings Institution on using fiscal policy to stabilize the economy during recessions.

Simply stated, the rule says a recession is underway when the three-month average of the unemployment rate increases more than half a percentage point in a year.

A slightly more complicated way of stating it is that it’s a sign of recession if the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more, relative to its low during the previous 12 months.

The rule works remarkably well. Reviewing the historical record, we see it’s been right all the time since the early 1970s. It’s been off only by a few months twice since 1950. It’s well-regarded for both its accuracy and its simplicity.

So, what’s it saying now?

The current situation

The Sahm rule reading came in at 0.53% on Monday, the day the markets fell by more than 3% before the rebound. Some of the explainers among us blamed at least part of that sharp decline on the Sahm numbers. But they also cited weaker-than-expected job creation in July in the U.S. and the Bank of Japan’s recent machinations and its affect on the yen carry trade.

At any rate, the Sahm figures fell in recession territory. Just not by much.

Moreover, Sahm herself has been reminding the world for the past couple of days that the rule doesn’t predict recessions. That’s not what it does. Instead, it works as an early indication that a recession has already arrived.

Plus, the rule’s not perfect, Sahm maintained in an email to CNBC news.

“We are not in a recession now—contrary the historical signal from the Sahm rule—but the momentum is in that direction,” she wrote. “A recession is not inevitable and there is substantial scope to reduce interest rates.”

Besides reminding CNBC that the world is a bit more nuanced than many of us would like to believe, Sahm offered these words of wisdom: “… don’t rely on one tool.”

There’s a difference between a slowdown and a contraction, she went on to say, noting that consumer spending, household income and production data remain strong.

We might also note that today’s unemployment rate of 4.3% isn’t that bad by historical standards. Those of us who’ve reached a certain age recall “learning” in Econ 101 that 4% unemployed constitutes full employment because some of the workforce is moving between jobs.

Besides, it’s good to keep events in perspective, especially in regard to a market sell-off. As Sahm told Bloomberg, “Calm is important in a moment like this regardless of what data points you’re looking at. Fear does no good.”

She advised market participants against letting a slowdown shift the economy into reverse and praised the Federal Reserve for its slow, unemotional response to what some were calling panic.

But many active investors aren’t in the mood for that kind of level-headed equanimity.

The bigger picture

Last November, Sahm wrote an analysis of the economy and declared it to be in far better shape than critics stubbornly believe, according to an article in The New Statesman. She found every dataset—including income, wealth, real wages, jobs and household surveys—indicated Americans in every demographic group were better off than just a few years ago.

“The wealth of the median American household jumped by 37% in three years,” the article said Sahm had found.

Some were incensed by her findings. She reported blocking 200 abusive social media accounts and deleting death threats from her direct messages. At least one angry critic had tracked down her home address.

Her detractors on the right had a stake in promoting the idea that President Biden was mishandling the economy. On the left, they were convinced the Biden administration had done too little to help the homeless and had compromised too much with big business.

The political divide also affects interpretation of the Sahm rule. Some use it to say we’re not in recession and others use it to say we are.

“I created a monster,” Sahm has written in an online post. “Repeat after me: the Sahm rule is an empirical regularity. It’s not a proposition; it’s not a law of nature.”

Meanwhile, Sahm is holding onto her hope that the country will whip inflation without causing a recession—no matter how anyone applies the rule that bears her name.

Ed McKinley is Luckbox‘s Editor-in-Chief.