Bet on Bitcoin in 2024

The crypto complex is looking up (again)

Bitcoin, the reigning king of speculative investments, appears likely to retain the crown in 2024.

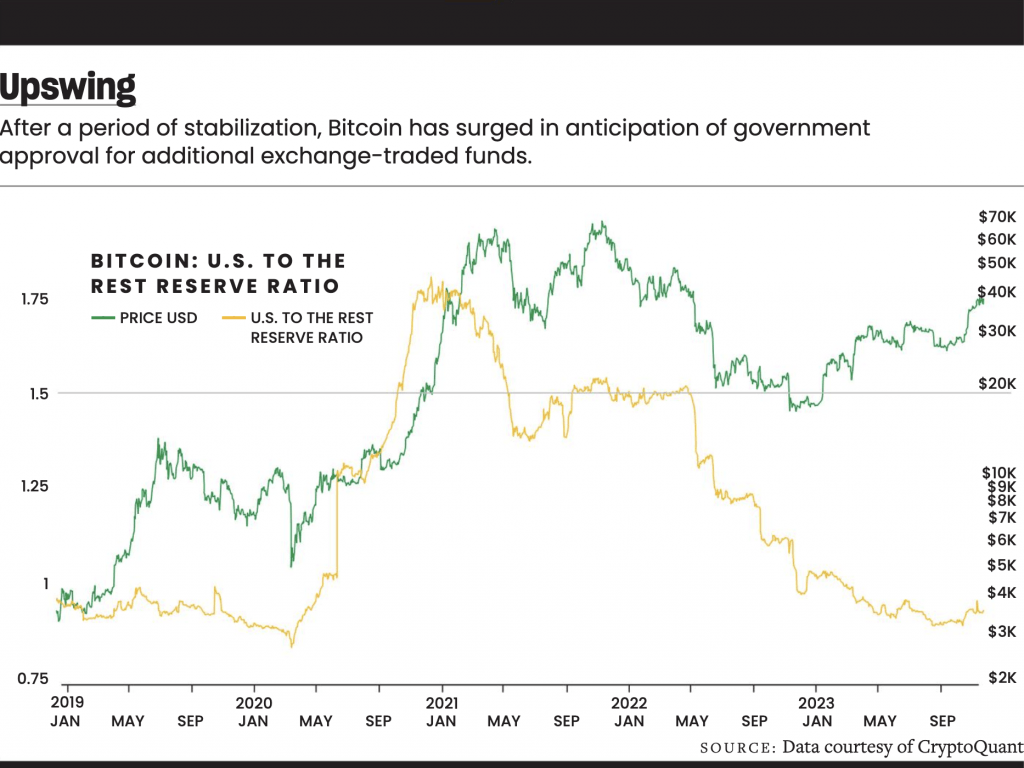

In the coming year, the world’s first and still-largest crypto may not beat its 2023 return of more than 150%, but will also go above $60,000—near its previous all-time high of $70,000.

Thanks to the transparency of Bitcoin’s blockchain, we can see strong holding, hoarding and accumulation patterns among investors since June 2022’s collapse of the crypto lending platforms.

Look what happened during that time.

Beneficial global financial conditions evaporated. The largest crypto market makers collapsed. The second-biggest crypto exchange imploded. Central banks hiked rates.

And people bought more Bitcoin.

The number of wallets with one or more bitcoins set record highs this year. More than half of Bitcoin’s market cap sits in the hands of investors who first bought the cryptocurrency more than two years ago.

Those who bought at the end of 2022 and the beginning of 2023 are sitting on gains of 100% or more and still aren’t selling. If anything, they’re buying more.

It’s the type of conviction that sets a strong foundation for any market.

Meanwhile, the cryptocurrency’s protocol will reduce the new supply coming into existence.

Fewer new coins

In April 2024, Bitcoin’s protocol is scheduled to begin creating half as many new bitcoins each year. The new bitcoins always go to miners. Those are the only people who sell them all the time in all market conditions to cover their costs and make money.

With 50% fewer bitcoins going straight to market, investors only need to continue holding and accumulating at the same pace they already do. Bitcoin’s price will have to go up.

Wall Street’s involvement

Expect a slew of U.S.-based spot bitcoin exchange-traded funds (ETFs), including some from established brands like Fidelity (FNF), Blackrock (BLK) and Franklin Templeton (BEN).

A U.S. court told regulators they can’t deny these ETFs, and a bipartisan group in Congress has demanded the Securities and Exchange Commission approve them.

But spot ETFs alone won’t bring money into Bitcoin. Many Bitcoin investment funds already exist, and they’re not having a big effect. They saw only $1 billion in net global inflows for the year, as of November, according to the Coinshares research firm.

What will bring more money in?

Wall Street incentives. With ETFs, they have a reason to sell broker-dealers, advisors and their clients a low-cost, easy way to gain exposure to bitcoin in a diversified investment portfolio.

Bitcoin’s connection to well-established legacy firms will enhance its image and make investment allocators feel more comfortable putting client funds into a product that must buy bitcoin from the spot market.

Immune to economic woe

Some worry about a U.S. recession.

That may matter for stocks and bonds, but most of the world’s population can’t buy or sell stocks and bonds. Either they don’t have a broker, or they live somewhere without access to U.S. financial markets.

But anybody can buy or sell bitcoins from anywhere.

That’s why the U.S. share of the market peaked in 2021 and has declined more than 50% with no signs of turning around.

The shift appears in other metrics, too—like a falling correlation with U.S. stocks and a declining percentage of reserves on U.S. exchanges.

As a result, Bitcoin is protected somewhat from a U.S. recession. If anything, Bitcoin will benefit from subsequent easing of financial conditions in response to U.S. economic distress.

At the same time, China is stimulating its economy and trying to bail out its troubled economic sectors. In June 2023, the Chinese government let Hong Kong open its doors to crypto.

Expect Chinese money to filter into bitcoin

Moreover, most of the world’s economies are growing. While those countries don’t have the financial potency of the U.S. or China, they now have a growing share of the crypto market.

According to flows of bitcoins and stablecoins, a type of cryptocurrency pegged to the U.S. dollar, almost $4 billion in new money came from Asian sources in November. Surely, more will come.

Shrinking supply and rising demand. Seems like a safe bet.

Mark Helfman, crypto analyst at Hacker Noon, publishes the Crypto Is Easy newsletter at cryptoiseasy.beehiiv.com and wrote Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency. @markhelfman