Trades

The Future of Crypto Staking

By Mike Martin

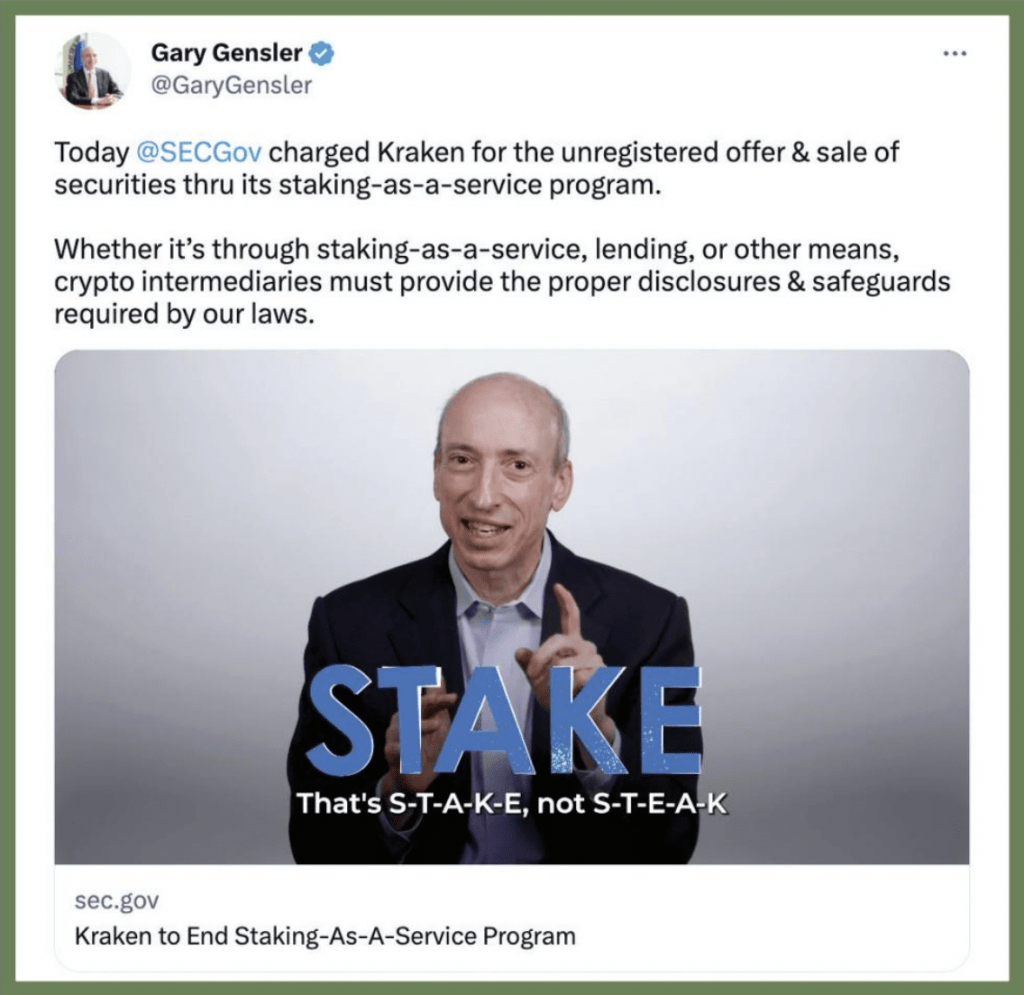

Decentralized finance may benefit from the SEC’s decision to shut down staking by cryptocurrency exchanges

The U.S. Securities and Exchange Commission has forced the Kraken cryptocurrency exchange to shut down its staking service and pay $30 million in fines.

It’s part of a crackdown on such staking services. Let’s examine the mechanics of staking and explore the reasons why shutting them down may benefit decentralized finance (DeFi).

Unlike Bitcoin, the Ethereum network is a “proof-of-stake” (PoS) blockchain that adds transactions through a process called validation.

Anybody can...

Crypto Currently

-

Bitcoin’s Perfect Storm of Good Fortune

By Mike Martin

|New exchanges could inundate the cryptocurrency with cash -

Tokens of Depreciation

By Mark Helfman

|Cryptocurrency exchanges issue tokens to reward loyalty—but the terms are subject to change Of the top 50 cryptocurrencies listed recently on CoinGecko, seven were exchange tokens, a type of loyalty… -

Crypto in Crisis? Don’t Blame the Blockchain

By Mike Martin

|Cryptocurrency and its underlying technology will survive the FTX debacle Chaos reigns in the crypto markets. But the problem isn’t with the underlying blockchain. The fault lies with the centralized… -

Crypto 2023: Reaffirming Legitimacy

By Mark Helfman

|Helfman foretold the crypto collapse of 2022. Here’s his take on 2023. n my column for last year’s annual forecasting issue of Luckbox, I predicted 2022 would bring a big drop… -

Proof-of-Work Purge The Merge

By Mike Martin

|Ethereum, the second-biggest cryptocurrency network, has sliced its energy use and is preparing for higher volume and lower prices In one of the most highly anticipated events in the history… -

Is Bitcoin at the Bottom?

By Mark Helfman

|Barring economic catastrophe, this analyst believes the price of bitcoin is unlikely to go lower Bitcoin may seem destined for lesser things. Why? Because the world is running out of… -

Crypto Curriculum

By Mike Martin

|These videos, websites and white papers provide the basics on cryptocurrency and blockchains Starting a cryptocurrency education can be daunting. A Google search for “cryptocurrency resources” yields more than 100… -

Crypto Consensus

By Jeff Joseph

|Blockchain networks come to agreement through either proof-of-work or proof-of-stake protocols By Ryan Grace Proponents of cryptocurrency tend to view blockchain technology as the future of the financial system because it… -

Bitcoin’s Fifth Comeback

By Mark Helfman

|The cryptocurrency has soared in value repeatedly and could pull it off again Bitcoin imploded, but that doesn’t mean it can’t come roaring back with increased trading volume and much… -

Crypto’s Collapse Devines Aussie Dollar’s Decline

By Ilya Spivak

|Keyword searches and risk-off sentiment in crypto suggest more movement to the short side for the Aussie Dollar Traders often default to a ticker-centric view of financial markets. “Which stock… -

The Blockchain: A New Paradigm for Data

By Mark Helfman

|A step closer to protecting individual privacy In April 2021, Russian hackers gained access to Colonial Pipeline’s computer network and shut it down. They demanded $4.4 million in bitcoin to… -

Cardano Rising

By JC Parets

|Is cardano the next ethereum? Smart people continue to point to the integration of their own smart contract development. Let’s look at the hype surrounding what they’ve built behind the… -

Bitcoin Bets & Game Theory

By Mark Helfman

|The best investors and gamblers have something in common. They share an emphasis on game theory—a rational way to quantify the expected gains from decisions and probabilities. While generally applied… -

Big Tech Banking

By Mark Helfman

|Politicians have long accused big tech of monopolistic business practices, invasions of privacy, abuse of data and suppression of free speech. Voters largely agree, at least in the United States,… -

Time to Short Bitcoin? Check These 3 Signals

By Mark Helfman

|Given bitcoin’s high volatility, how do investors know whether an upswing marks the peak of the market or just a “local top” before another leg up? Thanks to the transparency…