Crypto 2023: Reaffirming Legitimacy

Helfman foretold the crypto collapse of 2022. Here’s his take on 2023.

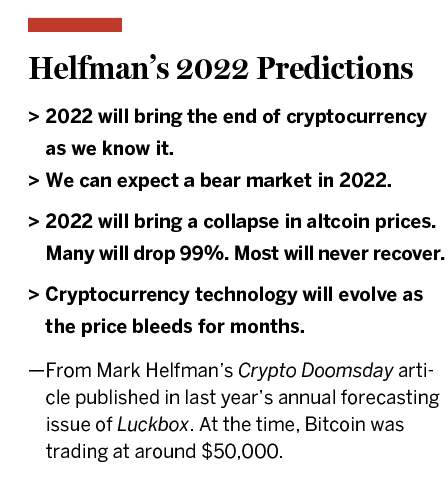

n my column for last year’s annual forecasting issue of Luckbox, I predicted 2022 would bring a big drop in crypto prices, a collapse of unbacked stablecoins, and a shift toward cryptocurrency regulation, litigation and legislation as the wider world recognized the crypto market is full of frauds and faulty technology.

Those conditions offered amazing opportunities for investors, and many will look back on 2022 as the last good time to get into crypto.

But what about next year? In 2023, the crypto market will emerge from the doldrums, but most people won’t notice until it’s too late to invest.

Bitcoin’s price will reach $50,000—no matter how the economy fares.

If the economy’s good, millennials and financial institutions will move more money into the market. But if the economy stumbles, cryptocurrency will still offer an attractive alternative to legacy assets.

Regulation and litigation

To date, the crypto market has been a haven for greed, grift and instant gratification—a monetary speakeasy for anyone flouting the dry laws of legacy finance.

But governments will shut down the more wayward crypto products in 2023, creating a cleaner, more trustworthy crypto market and attracting capital from legacy financial firms and institutional investors.

All major jurisdictions will pass laws for clear disclosures, place curbs on sensationalist advertising, and provide safeguards against fraud and conflicts of interest. Many will also include needlessly burdensome, potentially unworkable licensing and registration requirements.

The U.S. government will embrace stablecoins, but not unregulated, experimental projects like Terra Luna, a failed attempt to use Ponzi-like financial engineering to peg a cryptocurrency to the U.S. dollar.

This stablecoin’s failure caused a cascade of liquidations from positions collateralized against it and damaged the lending firms leveraging those trades, wiping a cumulative $1 trillion from the crypto market with hyper-Lehman speed from May to June 2022.

Congress will create a framework for private entities to take deposits of dollars in exchange for a natively digital token that users can redeem on demand for an equal number of U.S. dollars.

New regulations will mandate that all stablecoin providers comply with anti-money laundering rules, carry insurance for customer funds (perhaps through the Federal Deposit Insurance Corporation), register with the U.S. government and submit to regular audits of their reserves.

Crypto-native entities like Gemini, Binance, Circle and Tether already offer those tokens but without government protection or supervision. As soon as the legislative ink dries, they will register and some major banks will join them, either by creating their own stablecoins, forming partnerships with stablecoin providers or buying stablecoin issuers.

It’s a risk-free product: Put deposits into one-month T-bills and earn $2-$4 profit on every 100 tokens. Some may even program stablecoins to pay a little interest to their token holders as an incentive to attract users and take market share from the aforementioned entities.

At the same time, Congress will create a “safe harbor” for innovation and experimentation with stablecoin technology and other implementations of blockchain.

Today, most of those experiments violate U.S. securities laws, and field tests involve unethical or illegal market tampering and hacks. With a safe harbor program—perhaps a two-year experimentation grant or test period—projects will flock to this country.

Concurrently, U.S. regulators will settle or lose every lawsuit that involves cryptocurrency businesses. On top of the European Union’s MiCA (Markets in Crypto Assets) rules, global agreements and local standards for crypto, all of this activity will bring legal clarity and a safe space for financial innovation in cryptocurrency and blockchain technology.

Bitcoin comes of age

By the end of 2023, nearly every major investment company and brokerage firm will offer exposure to bitcoin, either through direct custody or through investment funds like Grayscale or NYDIG.

Google, Amazon and Twitter will either accept cryptocurrency payments or build their own crypto-based settlement platforms.

Some institutions will develop, buy or form partnerships with cryptocurrency wallet providers to offer customers access to crypto markets and “safe” ways to store crypto, even if it’s just stablecoins from their partners and subsidiaries.

NFTs will finally matter

What about the blockchain assets called non-fungible tokens, or NFTs? Today, they only prove ownership of an asset.

While the most visible applications of NFTs involve digital pictures, the technology has many applications. Once there’s global, immutable proof of ownership and the rights and privileges that go with it, it’s possible to remove layers of bureaucracy and record-keeping while also crafting automated protocols to transfer, fractionalize, securitize, amortize and distribute assets to anybody, anywhere, anytime—without human intervention.

As a result, governments should address many areas of concern. How do regulators regulate a digital record? It’s just an entry on a blockchain.

Is it a security because people can sell it or raise money with it? It is a commodity because people can exchange it with each other in equal amounts? Is it property because a digital record assigns ownership to a specific person or group of people?

Or is it more like a car—something built, used and discarded?

In 2023, governments will answer those questions, each in its own way.

That will set the table for Web3.0 platforms to embed NFTs for loyalty, membership, access, rewards and fundraising for creators.

For example, Web3.0 platforms like Soltype, Mirror, Writers Dorm and Sigle will get at least one major writer or columnist to publish on their platforms, with readers buying NFTs for access to their content.

It will be similar to today’s Patreon, Substack or OnlyFans, except creators will keep the proceeds and a cut of each NFT sale, while NFT owners collect rewards, special perks, and the right to sell and lease their access to their creators.

Bored Ape Yacht Club, a series of collectables on the Ethereum blockchain, will get a licensing deal, and at least one start-up will sell an NFT as a type of convertible note, except much cheaper and easier to deliver.

It will spark the next wave of speculative interest in NFTs, which will begin in 2024.

The fate of altcoins

From one peak to the next, no altcoin has outpaced bitcoin’s performance—not even Ethereum’s ether, which peaked against bitcoin in June 2017. Quant has a token price that has risen almost 300% since June but remains down against bitcoin year-over-year.

As such, bitcoin will remain the biggest, best-known cryptocurrency.

However, some altcoins will emerge from the bear market stronger than ever, with more upside potential than bitcoin.

For example, there’s the aforementioned Quant. Its Overledger technology connects all blockchains and already patches into Oracle and LACChain.

Or Cosmos, another project connecting blockchains, has a popular toolkit and a large, growing community of developers and users.

There’s also Polygon, a smart contract platform that uses the same technology as the better-known Ethereum but with a token that can run operations at a lower cost. And there’s Blockchain OS, a protocol that converts Linux, the ubiquitous computer language, into a format that works with blockchain technology.

These “picks and shovels” projects use their native tokens to incentivize vast networks of users and computing power to service their platforms. Their tokens will outperform the wider market.

Another big winner? Liquidity platforms, a type of protocol for asset pools that lenders, borrowers, investors and financial institutions can dip into for yield, collateral and asset swaps. Projects like Aave, Uniswap and THORChain will lead the pack with their well-differentiated technology, strong development teams and growing communities.

If 2022 was the end of crypto as we knew it, 2023 will mark the beginning of a new era of crypto utility.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto Is Easy newsletter at cryptoiseasy.substack.com. He is the author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency.

@mkhelfman