Proof-of-Work Purge The Merge

Ethereum, the second-biggest cryptocurrency network, has sliced its energy use and is preparing for higher volume and lower prices

In one of the most highly anticipated events in the history of cryptocurrency, the Ethereum network has successfully merged its execution layer with that of the Beacon chain.

This combination of execution layers, which took place in September, is known as the “Merge,” and it changed the Ethereum protocol’s consensus mechanism from proof-of-work to proof-of-stake.

Let’s look at three reasons why the Merge has excited the crypto universe.

- Ethereum now uses less energy

Proof-of-work networks, like Bitcoin, rely upon miners to validate transactions. This model involves thousands of miners racing to solve a cryptographic puzzle. The winner earns a reward.

The computational power Bitcoin miners use to work out one puzzle requires more energy than all of Argentina.

But proof-of-stake networks rely on “validators” instead of miners to authenticate transactions and add blocks to the blockchain. It’s based on a lottery called “staking.”

The more coins validators stake, the greater the odds the network will call upon them to validate a block. If they’re chosen, they’re rewarded in cryptocurrency.

Ethereum’s new proof-of-stake model operates with 99.95% greater energy efficiency than its previous iteration. Besides being better for the environment, the upgrade may help Ethereum comply with ESG, which stands for environmental, social and corporate governance standards. The ESG narrative could attract investors and help usher in much-needed regulation.

2. Ethereum offers two ways to stake

When investors stake coins in a proof-of-stake network, they can earn yield. That’s accomplished either by running their own “node” or delegating coins to a protocol that does the validating.

Today, they can earn ~5.13% in interest by staking ether coins on their own computers, or ~4.50% in interest by delegating coins to a protocol that stakes them on their behalf.

3. Ethereum will be deflationary

Since the Merge was completed on Sept. 15, the circulating supply of ether (ETH) has already begun to decrease. This is accomplished partly by moving away from the proof-of-work model, which required the network to pay miners in ether to validate blocks.

Before the Merge was complete, Ethereum was paying out ~5 million ether annually; the network in its present state will only be paying ~1 million. This reduction in rewards, combined with the network’s burning of transaction fees, will help to make ether a deflationary coin.

Many investors believe a lower supply of ether will be bullish for the coin long-term.

Buy the rumor, sell the news

The Ethereum Merge went exactly as planned. So why did ether sell off greater than relative cryptocurrencies post-upgrade?

This latest sell-off can most likely be attributed to the Wall Street adage, “buy the rumor, sell the news.”

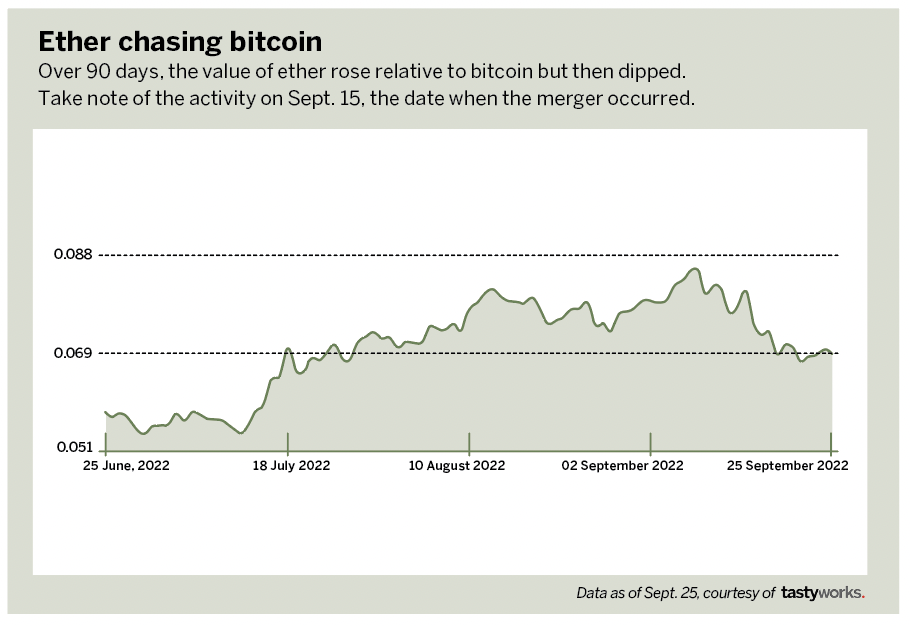

In the months leading up to the Merge, ether outperformed bitcoin, which has been in consolidation around the $20,000 for some time. The chart “Ether chasing bitcoin,” left, quoting bitcoin in ether, shows ether’s dominance through much of 2022.

Ethereum 2.0

Though the Merge introduced some immediate upgrades to the Ethereum network, none of the improvements were substantial.

Ethereum is already the second-biggest cryptocurrency, surpassed only by Bitcoin. But for Ethereum and its smart contracts to become truly scalable, two things need to happen: Transactions need to increase, and fees need to decrease.

The Merge opened the door to “sharding,” which will break up the Ethereum networks into smaller chains while maintaining unification. It’s poised to happen sometime in 2023.

After sharding is introduced, Ethereum will be able to process 100,000 transactions per second, according to Vitalik Buterin, the network’s founder. That’s a far cry from the current transaction rate of ~15 per second.

Ethereum has a long way to go before it becomes Ethereum 2.0. Besides the risk that will come with the adoption of sharding, Ethereum investors now have to worry about Gary Gensler, chair of the U.S. Securities and Exchange Commission, who could very well turn all proof-of-stake coins into securities.

For now, ether tokens are treated as commodities and thus aren’t subject to much regulation. But if the SEC begins to view them as securities, tighter regulatory control will follow.

Mike Martin is head of content for tastycrypto.