Crypto in Crisis? Don’t Blame the Blockchain

Cryptocurrency and its underlying technology will survive the FTX debacle

Chaos reigns in the crypto markets.

But the problem isn’t with the underlying blockchain. The fault lies with the centralized crypto exchanges (CEXs) that take custody of their customers’ cryptocurrency.

Satoshi Nakamoto, the possibly fictitious inventor of Bitcoin, didn’t intend for institutions like FTX to arise and assume the trust-based role of brick-and-mortar banks.

After all, the paramount feature of blockchain technology is that it’s trustless. On-chain peer-to-peer consensus mechanisms assure, transparently, that a network is operating in the majority’s best interest.

The inorganic introduction of trust-based entities like FTX was bound to become problematic; the opacity of such institutions, in hindsight, made their collapse inevitable.

For FTX, the third-largest cryptocurrency exchange, the implosion came in November when it filed for Chapter 11 bankruptcy amid allegations of misusing customers’ funds.

So, what’s to become of blockchain and its beloved cryptocurrencies?

At its best, blockchain is a bull swinging its tail to swat away the CEX gadflies.

It will take time, but blockchain had to change direction to get back home. The FTX disaster, sadly, was what it took to tack the sails.

Let’s now explore what was left in the wake of the FTX shipwreck.

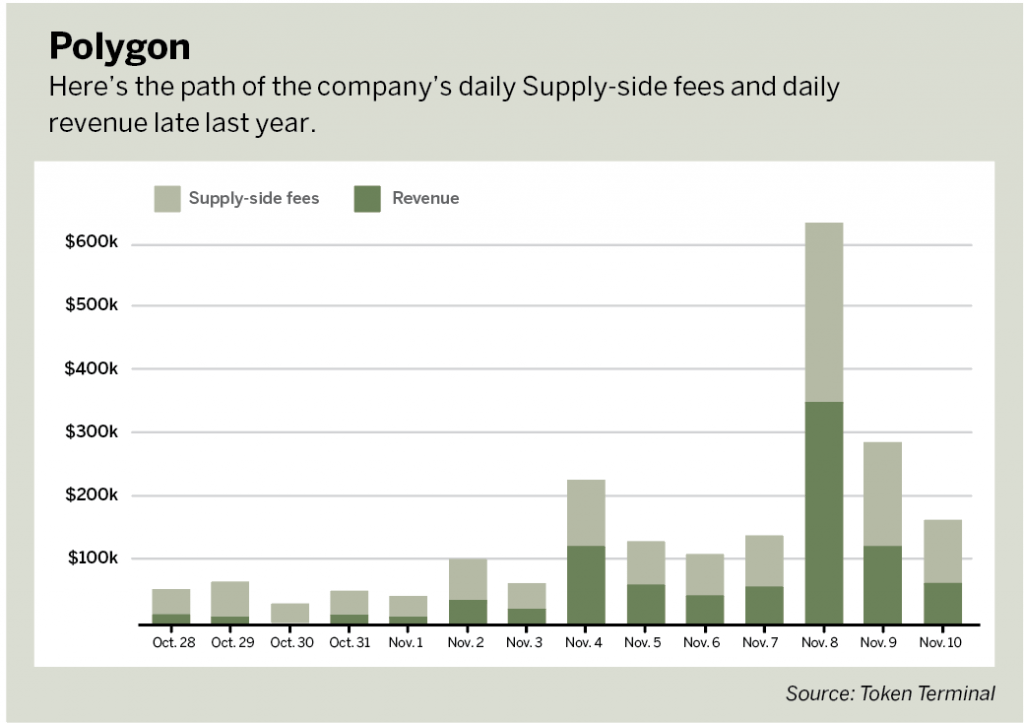

Polygon

Polygon and Solana have both been in the news frequently, but for very different reasons.

Polygon (and its MATIC token) appears to be the new darling network of the crypto world. Robinhood chose this Ethereum side-chain as the exclusive network when it launched its Web3 wallet in September.

Although the Polygon network offers low fees relative to Ethereum, the Ethereum mainnet still offers superior adoption and far greater liquidity. That’s why tastycrypto launched its wallet on Ethereum.

JPMorgan also chose the Polygon network for its first trade in decentralized finance (DeFi) last month.

Additionally, a fintech company called “Nubank” that’s backed by crypto-intolerant Warren Buffet, chose the Polygon network to launch its native Nucoin cryptocurrency.

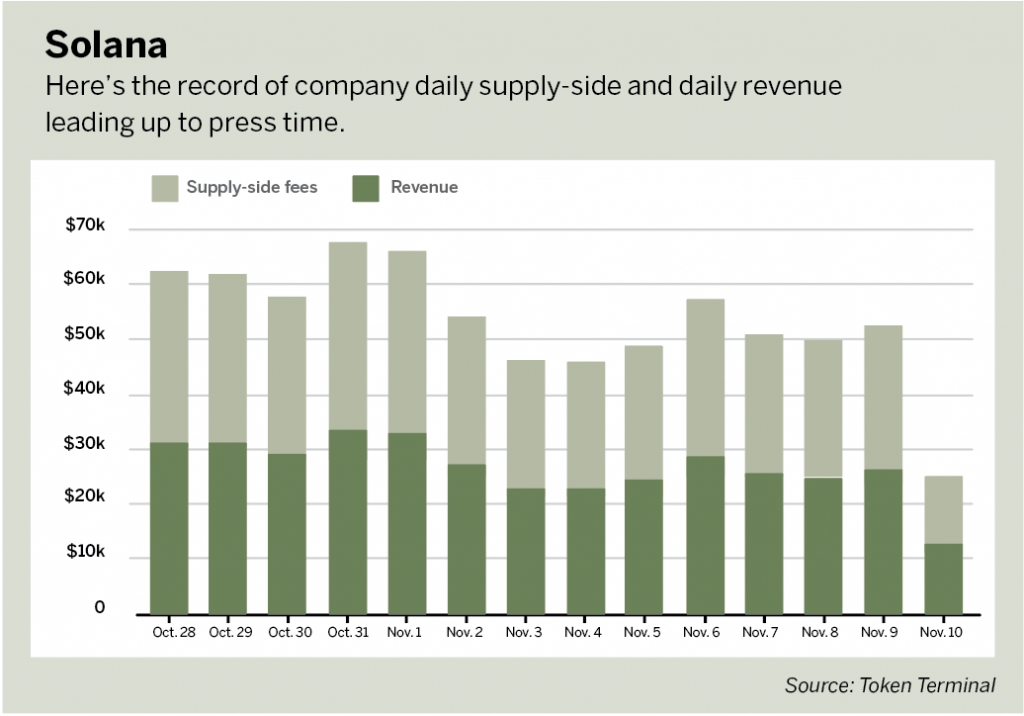

Solana sinks

Solana, on the other hand, has had a rough time. As Luckbox went to press, the coin was down about 70% in 30 days. Ouch.

Solana’s native currency, SOL, is now officially stigmatized as a “Sam coin.” Sam coins have exposure to Sam Bankman-Fried (SBF), the founder of FTX. SBF had a considerable vested interest in Solana and its projects.

Following the collapse of FTX, Polygon’s MATIC token replaced Solana’s SOL as the No. 10 most highly capitalized cryptocurrency.

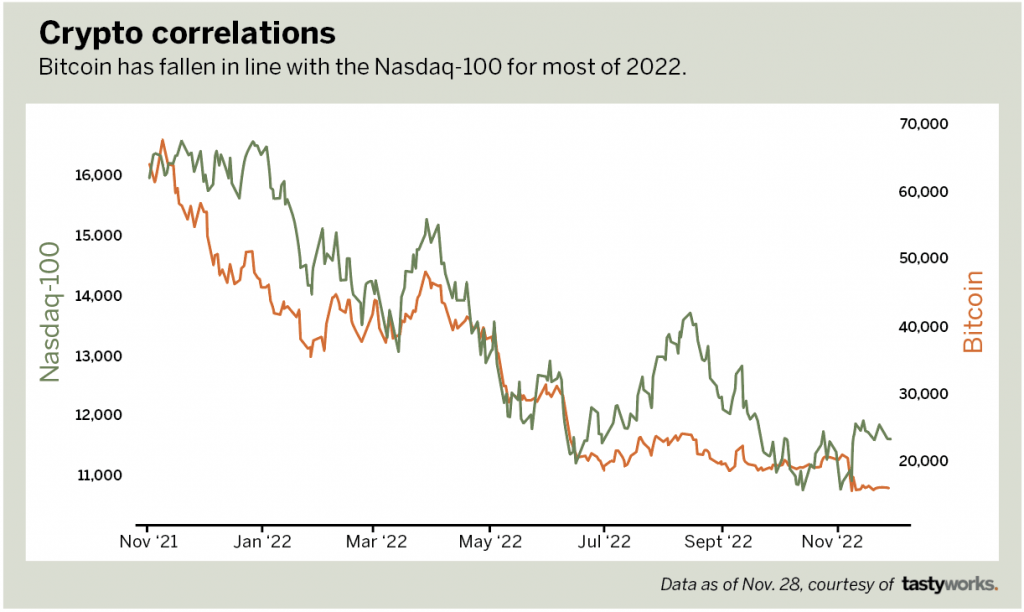

Bitcoin after SBF

For about a year, traders didn’t have to look at the price of bitcoin to get an idea of what it was doing. They had only to glance at the Nasdaq. The correlation was uncanny.

There was a sad sense of comfort in watching bitcoin change into yet another high-beta tech stock—like watching a cowboy break a wild mustang.

But that tether, for the time being, has been severed. Will Bitcoin return to its Nasdaq stable or free itself to run wild after the world economy rights itself?

Where is Bitcoin headed?

There’s a lot we don’t know about the future of bitcoin and crypto in general. The dominoes continue to fall, raising too much dust for us to see clearly. With Digital Currency Group’s Greyscale refusing to share proof-of-reserves, there’s a chance crypto’s most dramatic period is yet to come.

Everybody tries to predict the future price of bitcoin, and their forecasts range from $1 to $1 million. The truth is most assuredly somewhere in the middle, but that leaves an extensive range indeed.

Speculation aside, let’s review what we do know about bitcoin today:

Bitcoin pros:

•

The FTX collapse will hasten crypto regulation.

•

Most major centralized crypto exchanges are opening their books to the public via proof-of-reserves, promoting much-needed confidence in bitcoin.

•

The collapse of FTX is making non-custodial wallets more appealing; this transition will make the industry more transparent and secure.

• Inflation is beginning to wane.

Bitcoin cons:

•

Cryptocurrency exchanges are seeing large inflows of bitcoin, which often signals the desire to transfer the digital currency to cash.

•

Investors will need months, or even years, to regain confidence in crypto.

•

Bitcoin’s correlation to high-beta tech stocks is becoming stronger and may prompt institutional investors to favor regulated equities over cryptocurrency.

•

Instability in interest rates will continue to weigh on bitcoin (and all assets).

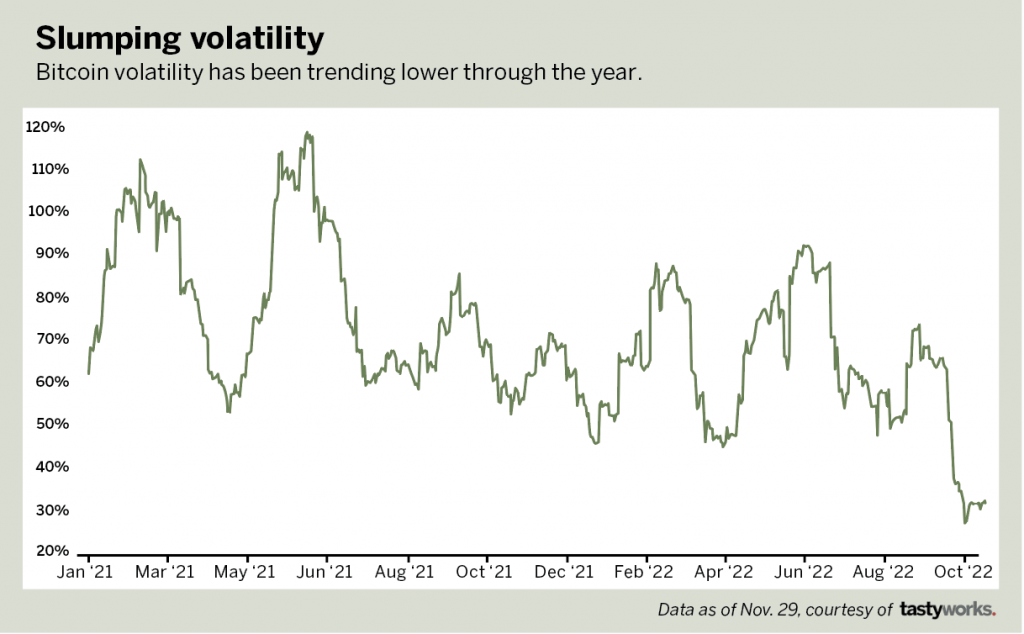

Bitcoin volatility plummets

Post-FTX, bitcoin has been a sleeping giant, reposed at around the 16k level.

Bitcoin historical volatility is eerily trading at its lowest levels of the year.

Given recent developments, it feels as though crypto is in the eye of the storm rather than past it. Too many questions are left unanswered for bitcoin to continue its consolidation at the 16k level.

Bitcoin, and all cryptos, have massive potential energy; once this loaded spring uncoils, be on the lookout for major kinetic breakouts.

At these deflated prices, long bitcoin volatility appears to be a reasonable trade in this market.

Michael Martin is head of content for tastycrypto.