Bitcoin’s Fifth Comeback

The cryptocurrency has soared in value repeatedly and could pull it off again

Bitcoin imploded, but that doesn’t mean it can’t come roaring back with increased trading volume and much greater value.

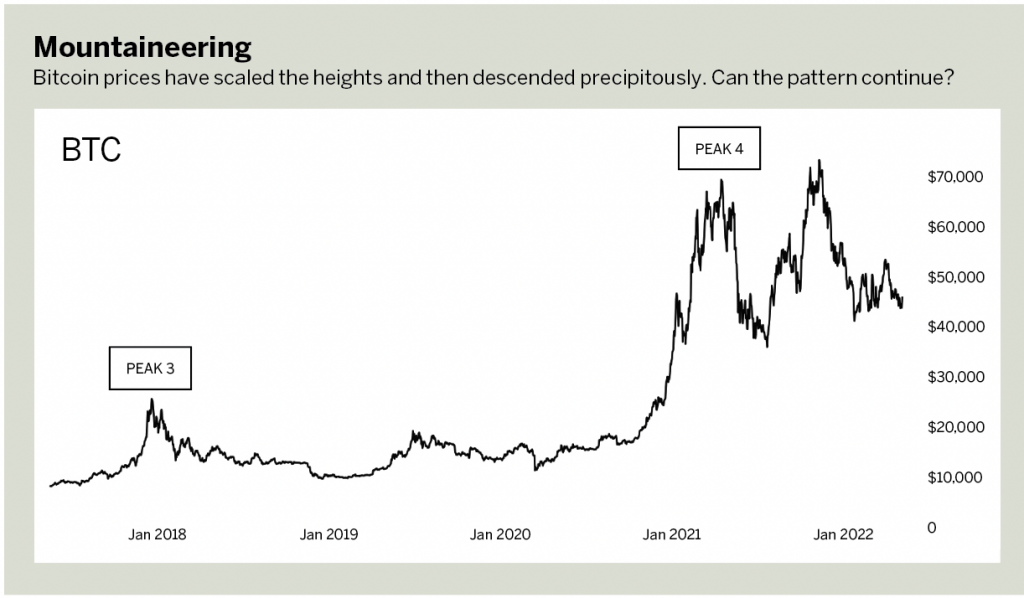

Let’s begin with recent history. After reaching an all-time high of $68,885 in November 2021, bitcoin lost more than half its value. That’s an extreme drop, even for an asset known for volatility.

Since May 2021, search volume has declined 80%, and the number of active users has dropped 27%. Looking only at the largest exchanges, weekly trading volume has fallen from 94,000 bitcoins to 10,000 bitcoins during the same period.

Thanks to the private nature of bitcoin transactions, stats aren’t available on how much of the cryptocurrency is bought and sold outside of the exchanges. But it’s safe to assume volume has decreased.

This is happening to an asset that rose from $0.06 to $32 in its first bull run, $2 to $1,200 in its second bull run, $166 to $20,000 in its third bull run and $3,160 to almost $69,000 in this most recent run.

Some say that’s the last time bitcoin’s price will ever go up. A 2,000% run? Never again. Can’t happen a fifth time.

Even the most ardent bitcoiner would have a hard time believing its price will reach $800,000 anytime soon, but a 500% upswing doesn’t seem outside the realm of possibility. That would put bitcoin’s market cap at roughly $4.5 trillion.

That’s crazy for any other market but a letdown for anybody who prospered in any of bitcoin’s previous bull markets.

So, some might ask what could possibly carry bitcoin’s price to such lofty heights. The fact that it’s happened before hardly seems compelling. That logic may work for gold or stocks, but those assets have centuries of history. Bitcoin’s only had 13 years.

Yet bitcoin has a lot going for it.

Technology. Last year, the Taproot upgrade made bitcoin’s network easier to scale. New payment technology, like Strike and Opennode, brought transaction time and fees almost to zero—less than conventional payment processors. While that doesn’t mean anything for bitcoin’s price, it adds utility and builds natural demand.

Millennials. Investopedia’s most recent financial literacy survey indicated that more millennials own cryptocurrency than stocks, a finding that matches many older studies. This generation is set to inherit at least $60 trillion in the coming years, assuming the economy cooperates, and it’s fair to wonder how much of that inheritance will go into bitcoin instead of legacy assets.

Generation Z. That same study showed that Gen Z owns less crypto but expects that cryptocurrency will deliver better returns than any other financial asset listed in the poll. Members of that generation are just getting their first “real” jobs and the disposable income that goes along with employment. It’s hard to think they won’t put some of that money into bitcoin.

Low- and middle-income countries. Faltering currencies and looming debt crises may drive

residents of some nations to put money into bitcoin to protect their wealth. With Western countries sometimes inclined to confiscate foreign assets, bitcoin could seem like a safe haven.

Network effects. While bitcoin’s price remains lower now than a year ago, the number of daily transactions is down only 10% and the size of the average transaction has tripled. The number of bitcoin wallets continues to rise, with clear accumulation among those with 10 or fewer bitcoins. Cost basis dropped substantially, suggesting this isn’t a market of HODL (hold on for dear life) investors who bought the peak and hope the market will recover. Instead, active buyers are gaining a larger share of the market as speculators sell at a loss.

“You should see the other guy.” Investors need an asset that’s already priced low but also carries a high upside. After all, bonds are getting smashed, gold is struggling to get above its 2020 high, stocks are sliding, U.S. mortgage applications are down 50% since last year, private equity is facing the end of the cheap money era, and commodity prices seem less predictable than ever (if they ever were).

Perhaps that’s not an endorsement of cryptocurrency as much as an indictment of the legacy financial system. Risky investments offer paltry returns, safe investments are guaranteed money-losers, and inflation has turned cash into a financial burden.

At least with bitcoin, investors might get ahead on their money.

Some may scoff. But as befits any asset that’s had upswings of 2,000% to 20,000% every few years, the cryptocurrency market needs time to recover.

How long? If only somebody knew.

As with other financial assets, momentum plays a big role. Once bitcoin’s price keeps increasing long enough to win the confidence of new buyers, everything else will take care of itself—just as it always has in the past.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto is Easy newsletter at cryptoiseasy.substack.com. He is the author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency.

@mkhelfman