Why a Rebound in the Dollar May Have Slowed the Rally in Stocks

The U.S. dollar remains the world’s top reserve currency. As a result of that status, changes in the value of the dollar can reverberate to other parts of the global financial markets.

- Much like the VIX, the U.S. Dollar index can be an important indicator of sentiment in the financial markets, especially amidst a prolonged trend, a sudden shift in direction, or when reaching a historical extreme.

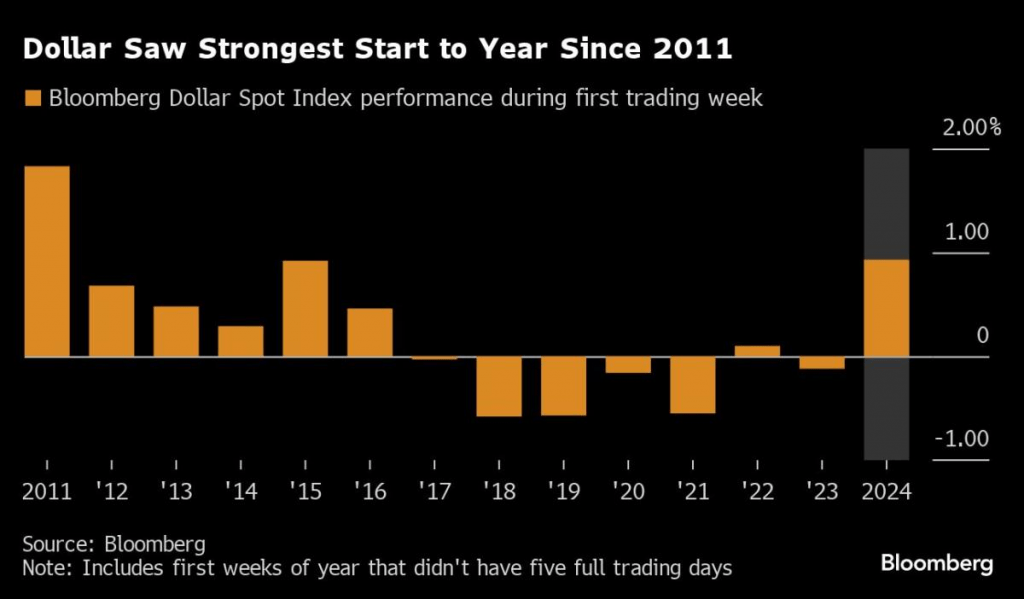

- In 2022, the U.S. Dollar index hit a 20-year high amidst a prolonged uptrend. However, the dollar reversed course in 2023, which may help explain why the stock market rallied last year.

- Importantly, the dollar pivoted once again at the start of 2024, and is up roughly 3.5% during the last 30 days, which may help explain why the stock market rally has slowed to start the year.

Many investors and traders follow the CBOE Volatility Index (VIX) for insight into market sentiment in the U.S. stock market. However, one could argue that the U.S. Dollar Index (DXY) is equally important when it comes to monitoring investor sentiment in the U.S. financial markets.

The dollar, after all, is the world’s top reserve currency and has been for nearly 80 years. These days, about 59% of the foreign reserves held by global central banks are denominated in USD. Moreover, roughly half of all international trade is invoiced in dollars.

As a result of the greenback’s key role in the global economy, the value of the dollar—as well as the narrative surrounding it—can heavily influence other areas of the financial markets. That’s especially true amids a major trend, a key shift in direction, or when the dollar hits a historical extreme.

The dollar’s story always starts in the currency markets. When the dollar increases in value, that means another currency (or basket of currencies) is depreciating in value against the dollar, and vice versa. To wit, the Dollar Index is calculated using the exchange rates of six major world currencies, including the euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound (GBP), Swedish krona (SEK) and Swiss franc (CHF).

In terms of trends, the U.S. dollar staged an epic rally against many of the world’s best-known currencies when it rallied from May of 2021 through October of 2022. During that period, the U.S Dollar Index rallied by about 25%, rising from 90 all the way to 113. Since that time, the DXY has retraced to about 104.

Looking beyond the scope of the foreign currency market, shifting trends in the dollar can also impact other parts of the financial markets. That’s because the dollar is not only the world’s reserve currency, but it’s also the sovereign currency of the United States, which happens to boast the largest economy in the world.

Like other sovereign currencies, that means the dollar reflects shifting conditions in the U.S. domestic economy. Over the last couple of years, one of the key themes in the U.S. economy has been tightening monetary policy, as observed through rising interest rates.

When monetary policy strengthens, the associated sovereign currency usually follows suit. That has been the case with the greenback, which moved higher for much of 2022 when the U.S. Federal Reserve was raising benchmark interest rates.

The dollar has pulled back recently, as expectations for an H1 2024 interest rate cut have strengthened. A weakening of the dollar serves as an important reminder that the fortunes of the U.S. corporate sector can also shift with the greenback, particularly export-focused enterprises. An estimated 40% of U.S. corporate earnings come from outside the country’s borders.

A decline in the value of the dollar can make U.S. exports relatively more attractive, boosting the potential revenues and earnings of export-focused companies. That’s one reason that shifts in the value of the dollar can reverberate well beyond the currency markets.

For example, when the DXY rallied to a 20-year high in 2022, U.S. exports became far less attractive to foreign buyers. Unfortunately, reduced sales typically translate to reduced earnings, which may help explain why the record strengthening in the dollar may have coincided with the 2022 pullback in the stock market.

Speaking to that dynamic, Tanner Ehmke, an economist for CoBank, recently told the Successful Farmer, “That’s a problem for our exports because our foreign buyers have to buy dollars first before they buy our products. They have to buy strong dollars, and so therefore they can’t buy as much.”

Considering that context, one can see how the 2023 reversal in the dollar—falling back from all-time highs—may have provided support for last year’s stock market rally. After peaking above 113 in late October 2022, the DXY fell all the way back to 99 during 2023.

Interestingly, the dollar recently staged another reversal at the start of 2024 and has risen by about 3.5% over the last 30 days. That may help explain why the rally in the stock market has slowed during the first month of the year. Because a stronger dollar once again makes U.S. exports relatively less attractive.

The S&P 500 was up about 14% during the last two months of 2023, but is only up about 3.5% year-to-date in 2024. If the dollar continues to climb, it may represent a continuing headwind for stock prices. Under that scenario, U.S. exports would undoubtedly lose some of their luster.

The good news is that the DXY probably isn’t headed back toward all-time highs. That’s because the U.S. Federal Reserve is currently poised to cut interest rates, which should take some of the wind out of the dollar’s sail.

All told, that means the Dollar Index could trend slightly higher in the coming weeks, but probably won’t break through its 52-week high of 107. Assuming the Fed cuts rates in H1 2024, the dollar could even reverse course and trend back toward 100. If that happens, it would represent an incremental positive for U.S. corporate earnings, providing another potential boost to the stock market.

No matter which direction it moves, the dollar will continue to exert influence over the global financial markets. For this reason, investors and traders should constantly track the dollar narrative, because it provides important insight into the broader financial markets, and therefore serves as a good complement to the VIX.

This is especially important in a presidential election year. As a reminder, the dollar often spikes in value when geopolitical uncertainty hits the global financial markets, which in itself provides a compelling reason to constantly monitor the DXY.

For more background on the U.S. dollar, as well as pertinent trading approaches in the currency markets, check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets in 2024, including the currency markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.