Trimming Equity Exposure at All-time Highs

With major equity indices like the Dow Jones Industrial Average notching fresh all-time highs, investors and traders may want to consider trimming their exposure to equities

- The Dow Jones Industrial Average recently notched a fresh all-time high, climbing above 37,000 for the first time in history.

- Much like 52-week highs, all-time highs provide market participants with an attractive opportunity to reduce exposure.

- Building a cash reserve allows investors and traders to capitalize on opportunities during future corrections in the financial markets.

Often the case around this time of year, the Santa Claus rally has pushed the stock market higher during the last month of the year. The Dow Jones Industrial Average recently set a fresh all-time high, and the S&P 500 and Nasdaq aren’t far behind.

What does this all mean for 2024? That’s not easy to predict, but it does appear likely that 2024 will be a more volatile year for trading. A big reason for that is the 2024 U.S. presidential election, which is slated for Nov. 5, 2024.

Another big x-factor in 2024 is the economy. Thus far, the U.S. economy has avoided falling into recession, but there’s no guarantee the country will avoid a recession next year. The European economy is already flirting with recession, which isn’t necessarily a good omen for the U.S. economy.

Considering that backdrop, some investors and traders may want to consider reducing their long exposure to the stock market at some point in the coming weeks and months—by either putting that money into bonds, or simply holding extra cash.

All-time highs and positive drift

Back in early October, few would have predicted the Dow would set a fresh all-time high in December. Back then, the major market indices were struggling through a 10% correction. However, after bottoming on Oct. 27, the stock market has been on fire.

The recent positive momentum appears to stem from the Fed’s decision to tightening (for the time being), which has served to push down longer-term interest rates. On top of that, inflation continues to wane, and hiring remains strong.

Based on the current dynamic, it appears the Federal Reserve has successfully thread the needle—squashing record inflation without crashing the economy—for now.

As evidenced by the Dow Jones’ recent all-time high, a feeling of euphoria appears to have overtaken the markets. But it’s important to keep in mind that all-time highs aren’t uncommon, especially since the stock market tends to exhibit positive drift.

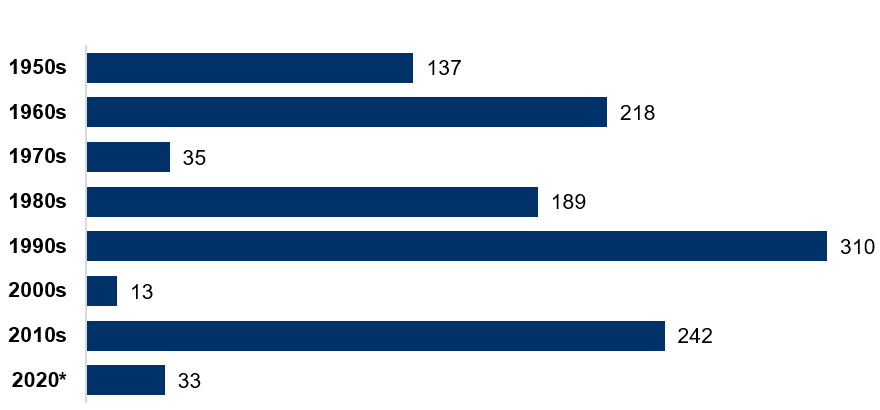

In the context of the stock market, positive drift refers to the historical tendency of stock prices to exhibit an upward trend over time. According to data compiled by RBC Global Asset Management, the S&P 500 notched a fresh all-time high 1,130 times between 1950 and 2020.

All time highs in the financial markets are fairly common, much like 10% corrections. In either case, active investors and traders are well-advised to have a plan in place for dealing with them.

Reducing long exposure at all-time highs

Despite the existence of positive drift in the financial markets, short-term corrections occur frequently. From 2002 through 2021, the S&P 500 corrected by 10% in half of those trading years—sometimes more than once.

According to research conducted by Charlie Bilello, director of research at Pension Partners, LLC, the frequency of 10% corrections only increases as you expand the sample size. From 1928 through the present, Bilello found that “a 10% intra-year drawdown has happened every 1.6 years on average.”

That reality puts the current all-time highs in fresh perspective. At some point down the road, investors and traders will be faced with a much different environment than the one observed this December. But for the time being, there’s reason to believe that the current all-time highs could beget additional all-time highs.

According to data compiled by the Wall Street Journal, the stock market has historically produced some of its strongest returns (on average) during the period between the last Fed rate hike and the first Fed rate cut.

Going back to 1990, stocks purchased at the start of the pause (the period after the last rate hike, but before the first rate cut) have produced an average return of 21%. That degree of outperformance may help explain why the markets have been euphoric in recent weeks.

According to Kristy Akullian, a senior investment strategist at Blackrock, markets could outperform during this “goldilocks” period. Akullian recently told the Wall Street Journal, “we’re even more confident now that we’re in [the pause period], and so there is more urgency to start acting before the Fed does start to cut rates.”

At this point, the market is expecting the Fed to cut rates at some point during Q2 2024, which means investors and traders could benefit from further upside in the stock market over the next several months.

But picking a top in the markets is never easy, and at some point the stock market will undoubtedly correct again. As a result, active investors and traders may want to consider trimming their long exposure to the stocks, especially those that are bumping up against all-time (or 52-week) highs.

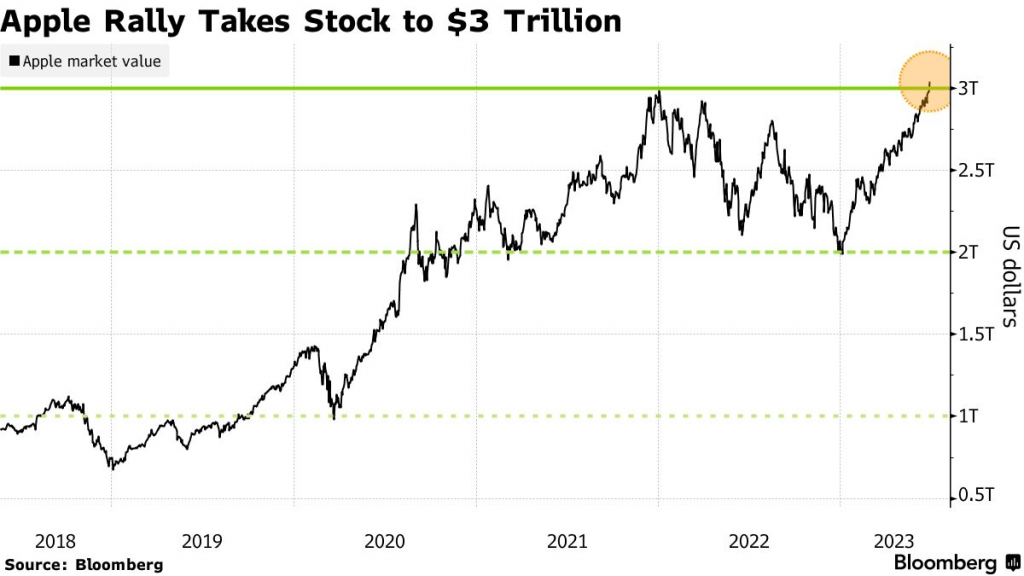

A quick review of performance in shares of Apple (AAPL) during the last couple of years helps illustrate the power of trimming a position at the top, and adding back amidst a correction.

Apple is one of the most valuable companies in the world, and one of the most recognized American brands on earth. Over the last five years, shares of Apple are up roughly 375%.

On Dec. 13—in conjunction with the all-time high in the Dow Jones Industrial Average—Apple shares also notched a fresh all-time high of roughly $198/share. The company now has a market capitalization of just over $3 trillion.

But as recently as 2022, Apple shares were moving in the opposite direction. In August 2022, shares of Apple peaked out at $172/share before retracing all the way back down to roughly $130/share in early January of this year. Since that time, shares of Apple are up more than 50%.

Apple shares have slumped previously and will undoubtedly slump again at some point in the future. For this reason, investors in Apple, and other stocks that are peaking toward 52-week or all-time highs, may want to consider shaving a portion of their positions.

Parting shots

By reducing long exposure to the stock market, investors and traders can build a cash reserve that allows them to capitalize on future corrections. Or, market participants might also consider sticking that extra capital into fixed income, considering that bond yields are trading at multi-year highs.

For some—especially the few that won’t ever need to tap their long-term investments—it might make sense to remain fully invested. After all, one could argue that shares of Apple will likey be more valuable five years from now than they are today.

For others, however, it may make sense to build up a larger reserve of cash with the major indices trending toward fresh record highs. That cash could be reinvested when the market finally pulls back, or it could be tapped as an emergency slush fund in the event of a job loss.

That’s not to say investors and traders need to divest at this moment. Historical data indicates that the stock market often produces attractive returns after the Fed stops raising interest rates. If the rally continues, the breadth of the current upswing will likely broaden, pulling along other large cap stocks and even smaller cap stocks.

Under that scenario, more stocks could trend toward 52-week highs (if not all-time highs), ultimately providing even more market participants with the opportunity to reduce their long exposure in the stock market.

As always, each and every market participant must decide for themselves what’s best for their own unique outlook, approach and risk profile. But in the financial markets, investors and traders usually don’t regret taking profits.

To follow everything moving the markets, including the options markets, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.