3 Key Reasons to Rebalance Your Portfolio This December

At year’s end, most investors and traders reassess and rebalance their portfolios, but in December 2023, this review process is especially important

- With December underway, many investors and traders are poised to review and rebalance their portfolios ahead of the new trading year.

- A portfolio rebalancing is especially pertinent this December because of the recent market rally, elevated interest rates, and the potential for an economic pullback in 2024.

- A portfolio rebalancing provides the opportunity to reassess one’s strategic approach and financial goals.

The year 2024 is quickly approaching, and with the new year on the horizon, many market participants are preparing to review and rebalance their portfolios. Or they should at least analyze their existing portfolios, and decide whether any changes are needed.

Portfolio rebalancing refers to the practice of adjusting the composition of an investment portfolio to bring it back in line with its target asset allocation. This process involves buying or selling assets within the portfolio to maintain the desired balance of different asset classes, such as stocks, bonds, cash or alternative investments.

Investors and traders often rebalance their portfolios at the end of the year, but this December there are several additional reasons to do so.

One of the big reasons relates to the recent rally in the stock market. After dropping like a stone in September and October, the stock market has rebounded in sharp fashion. Since Oct. 27, the S&P 500 is up 11%, while the Nasdaq 100 is up 13%. It’s not unusual for investors and traders to rebalance their holdings after a big move in the markets.

Moreover, there’s a risk that the U.S. economy could fall into recession at some point during H1 2024. At present, some projections suggest that economic growth in the U.S. will weaken at some point in spring.

Historically, the stock market has underperformed during periods of economic weakness. Considering that outlook, some market participants may elect to rebalance their investment holdings to better prepare for a possible downturn in the economy.

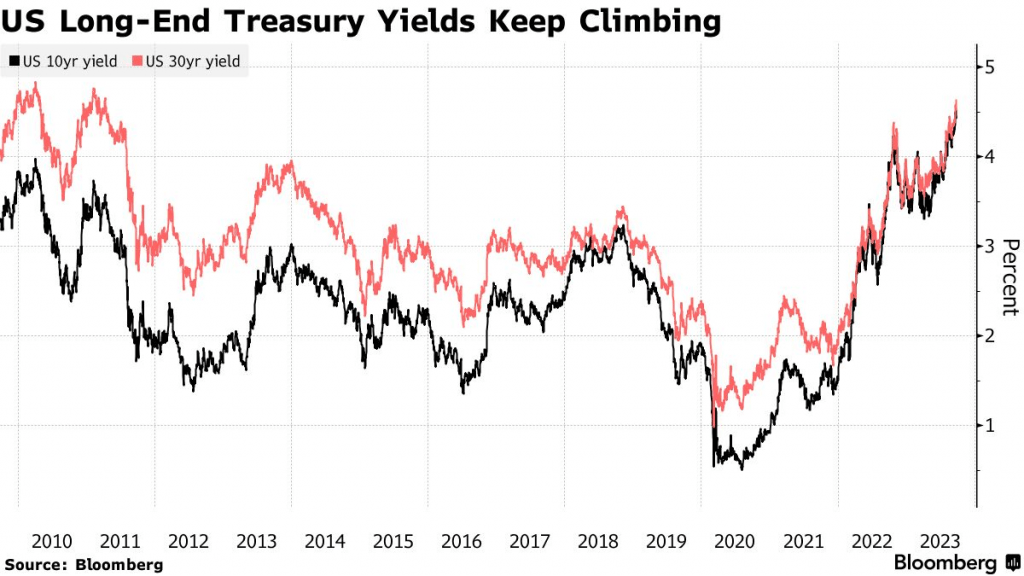

This is especially true in 2023, considering that benchmark interest rates in the United States are now hovering at multi-year highs. High interest rates aren’t great when it comes to mortgages and credit cards, but they are very attractive when it comes to fixed income returns.

When interest rates are high, newly issued bonds come with higher coupon rates. For example, the yield on the 10-year Treasury bond is currently around 4.30%, which is well above where it was at the start of 2022, when the yield was closer to 1.50%.

In terms of market context, the bond market hasn’t been great in the last couple of years. However, most projections suggest that the Federal Reserve is done raising rates, and that the next move by the Fed could be a rate cut.

As a reminder, interest rates and bond prices share a strong inverse correlation, so any cut in rates would be bullish for bond prices. Especially higher quality bonds such as U.S. government Treasuries and top-end corporate bonds.

With a recession potentially on the horizon, investors and traders have a unique opportunity to shift into bonds in favor of stocks, assuming that approach fits one’s outlook, strategic approach and risk profile. For others, sticking with what’s been working is also a completely viable course of action.

In sum, that means a portfolio rebalancing could be especially attractive at this time due to the recent rally in stocks, the potential for a 2024 recession and the current market environment for interest rates. But there are a couple other key reasons to rebalance one’s portfolio at year’s end, as detailed in the next section.

Two other key reasons to rebalance the portfolio at year’s end

In addition to the aforementioned considerations specific to calendar year 2023, there are a couple of additional reasons that investors and traders often elect to rebalance their portfolios at the end of the year.

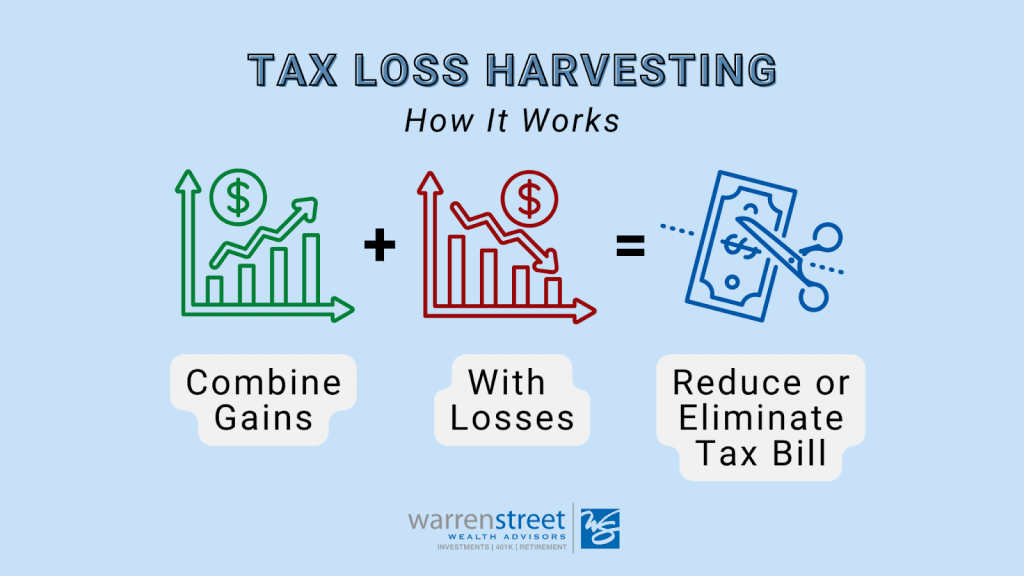

1. Strategic Tax Harvesting

As most market participants are well aware, capital gains taxes are levied upon realized investment and trading profits. However, this knife cuts both ways, as realized losses from investment and trading activity can be used to offset those gains, and reduce one’s overall tax liability.

A capital gain occurs when one sells a capital asset for a price higher than its original purchase price, or cost basis. On the other hand, a capital loss occurs when one sells a capital asset for a price lower than its original purchase price, or cost basis.

In that regard, the rebalancing of a portfolio at the end of the year can be helpful in managing capital gains and capital losses. By strategically closing winning/losing positions, investors and traders can potentially minimize the impact of taxes.

This approach—known as “tax harvesting”—should be executed in a manner that matches one’s strategic approach and overall risk management framework. For example, if one was bullish on a position that had lost money in a given year, he/she might not want to close that position for tax purposes.

In that regard, tax-related portfolio activity should match one’s overall strategy, outlook and risk profile. Ultimately, an end-of-year portfolio rebalancing should result in an optimized portfolio. But if opportunistic tax harvesting helps it get there, then the investor/trader basically accomplishes two goals at once.

One thing to keep in mind when selling positions at a loss is that investors/traders must wait at least 30 days before initiating a “substantially similar position,” otherwise the associated tax loss will be disallowed according to the “wash sale rule.”

2. Reassess Strategic Approach and Financial Goals

Looking beyond taxes, another key reason to assess one’s portfolio at the end of the year is to evaluate whether it’s necessary to tweak one’s strategic approach.

This may be due to a shift in the market environment, or this may be due to shift in the investor’s ultimate financial goals. An investor or trader may also decide to shift their investment/trading approach because their current strategy isn’t producing the desired results.

No matter the reason, this can be a productive endeavor in helping to optimize one’s portfolio for the new trading year.

Listed below are some general steps investors and traders can follow when rebalancing their portfolios, including some thinking around one’s overall investment philosophy:

- Review your investment goals and risk tolerance: Start by revisiting your investment goals, time horizon, and risk tolerance. Ensure that your investment strategy aligns with your current financial objectives.

- Assess your investment/trading philosophy: Consider whether your strategic approach, such as fundamental analysis or technical analysis, is still suitable for your financial goals and market conditions. Assess whether any changes in your financial circumstances or market dynamics necessitate an adjustment in your approach. This exercise provides an opportunity to fine-tune your strategy or explore alternative approaches, if warranted.

- Review your existing portfolio: Take a comprehensive look at your existing portfolio, including all your investments, such as stocks, bonds, mutual funds, ETFs, and any other assets. Note the current allocations of each asset class within your portfolio.

- Determine your target allocation: Define or reaffirm your target asset allocation. This allocation should reflect your long-term financial objectives and risk tolerance. For example, you may aim for a 60% allocation to stocks and a 40% allocation to bonds.

- Calculate the rebalancing need: Calculate the difference between your current portfolio allocation and your target allocation for each asset class. Determine whether you are overallocated or underallocated in specific asset classes.

- Prioritize asset classes: Prioritize which asset classes require rebalancing based on their deviations from the target allocation. Focus on the asset classes with the most significant deviations.

- Sell overweight asset classes: If you are overallocated in a particular asset class (e.g., stocks) compared to your target allocation, consider selling some of those assets to reduce the overweight position.

- Buy underweight asset classes: If you are underallocated in a specific asset class (e.g., bonds) compared to your target allocation, consider buying assets in that class to bring it up to the desired level. This involves purchasing assets that may be relatively undervalued.

- Consider tax implications: Be mindful of potential tax consequences when rebalancing. Sell assets in a tax-efficient manner, such as realizing losses to offset gains, if applicable.

- Review and adjust individual holdings: As you rebalance, take the opportunity to review and evaluate individual holdings. Consider whether specific investments continue to align with your strategy and financial goals. Make any necessary adjustments.

- Review dividends and interest: Ensure that any dividends, interest income, or capital gains distributions are allocated according to your rebalancing strategy. Reinvest these distributions in alignment with your target allocation.

- Automate the process: To maintain your target allocation throughout the year, consider automating contributions and rebalancing using a dollar-cost averaging approach. This can help you stay on track without frequent manual adjustments.

- Document and track changes: Keep records of your portfolio changes and monitor your portfolio regularly to ensure it stays aligned with your strategic approach.

Rebalancing one’s portfolio at the end of the year is an essential part of maintaining a disciplined investment approach and aligning one’s investments with one’s long-term financial goals.

Portfolio reviews may also be conducted during the trading year, especially after a big move in the market, or some other paradigm shift that calls for a reassessment of one’s approach or the overall market landscape.

For more insight into analyzing your existing portfolio, readers can check out this episode of Trade Managerson the tastylive financial network. And to follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.